Last Update01 May 25Fair value Decreased 1.32%

Key Takeaways

- Expansion efforts and redevelopment at key locations are poised to boost future rental income and overall revenue growth.

- Rising tenant sales and occupancy reflect retail stability, likely enhancing rental revenue and net margins.

- Inflation, macroeconomic pressures, and environmental factors threaten revenue growth and margin stability for Multiplan, with challenges in real estate and office space occupancy.

Catalysts

About Multiplan Empreendimentos Imobiliários- Multiplan Empreendimentos Imobiliários S.A.

- Expansion and redevelopment efforts at key locations such as ParkShoppingBarigui, Diamond Mall, and ParkShopping in Brasilia are projected to enhance future rental income and revenue streams, contributing to overall revenue growth.

- The significant increase in tenant sales and rising occupancy rates, reaching 96.3%, reflect stronger retail stability and demand, likely boosting rental revenue and enhancing net margins.

- The sharing of future CapEx investments suggests reduced capital allocation due to near completion of revitalization projects, which could lead to improved cash flow and contribute to higher earnings.

- The development of new projects like Lake Victoria and the second phase of Lake Eyre, along with strong sales performance, indicate potential revenue growth in the real estate segment.

- The continued consumer engagement via the multi-app and digital innovation initiatives are expected to support stronger customer relationships and increased sales, positively impacting future revenue streams.

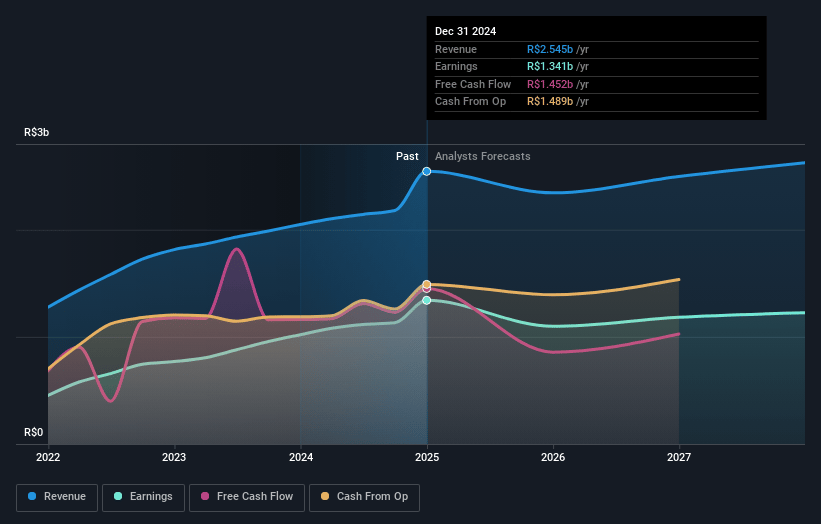

Multiplan Empreendimentos Imobiliários Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Multiplan Empreendimentos Imobiliários's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 51.4% today to 42.3% in 3 years time.

- Analysts expect earnings to reach R$1.1 billion (and earnings per share of R$2.27) by about May 2028, down from R$1.3 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as R$1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, up from 9.5x today. This future PE is greater than the current PE for the BR Real Estate industry at 7.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.54%, as per the Simply Wall St company report.

Multiplan Empreendimentos Imobiliários Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's rental revenue is starting to be impacted by inflation, which could affect revenue growth if inflationary pressures increase costs for tenants or reduce consumer spending power.

- Heavy rains and flooding in Rio Grande do Sul have led to increased costs and delays on the Lake Victoria real estate project, potentially impacting future project margins and related real estate earnings.

- The broader macroeconomic scenario, including high interest rates in Brazil, could impact consumer spending and tenant performance in shopping malls, potentially affecting revenue and net margins.

- Occupancy in office spaces, such as Morumbi Corporate, is experiencing challenges due to global trends in remote work, which may reduce leasing revenue from office properties if demand continues to decrease.

- While retail stability is improving, there are concerns about maintaining low non-payment rates and recovering lost credit from tenants, which could impact net margins if recovery efforts are less successful.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$30.669 for Multiplan Empreendimentos Imobiliários based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$36.5, and the most bearish reporting a price target of just R$28.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$2.6 billion, earnings will come to R$1.1 billion, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 20.5%.

- Given the current share price of R$25.46, the analyst price target of R$30.67 is 17.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.