Key Takeaways

- Long-term profitability is threatened by declining auto insurance demand, intensifying digital competition, and exposure to sector downturns as mobility trends evolve.

- Operational inefficiencies from outdated IT systems and economic headwinds in Brazil pressure margins, loss ratios, and overall earnings stability.

- Diversification, operational efficiency, strong cash generation, and customer focus position Porto Seguro for sustained profitability and growth across multiple business lines.

Catalysts

About Porto Seguro- Provides a range of insurance products and services in Brazil and Uruguay.

- Rapid technological shifts in mobility, such as the adoption of electric vehicles and evolving mobility-as-a-service models, are likely to structurally dampen the need for personal auto insurance-still a core revenue source for Porto Seguro-threatening long-term topline growth and leading to a stagnation or eventual decline in insurance premium revenue.

- The accelerating pace of digitalization and rise of nimble, digital-first insurtechs is expected to erode Porto Seguro's market share in key segments, intensifying pricing pressures and putting sustained upward pressure on customer acquisition costs, which in turn compresses net margins.

- Persistent economic uncertainty and inflation in Brazil may increase claims frequency and severity while simultaneously reducing disposable income levels, resulting in higher loss ratios and muted willingness of consumers to purchase insurance, directly impacting future earnings stability.

- Porto Seguro's legacy IT infrastructure and slower pivot to fully automated digital operating models, relative to emerging competitors, is likely to drive continued operational inefficiencies-manifested in elevated expense ratios-which will eat into improvements in net margin and reduce long-term return on equity.

- The company's significant reliance on auto insurance-even after some diversification-leaves it exposed to sector-specific downturns as car ownership rates potentially decline and insurance penetration fails to keep pace with changing transportation trends, threatening both revenue and long-term profitability across the group.

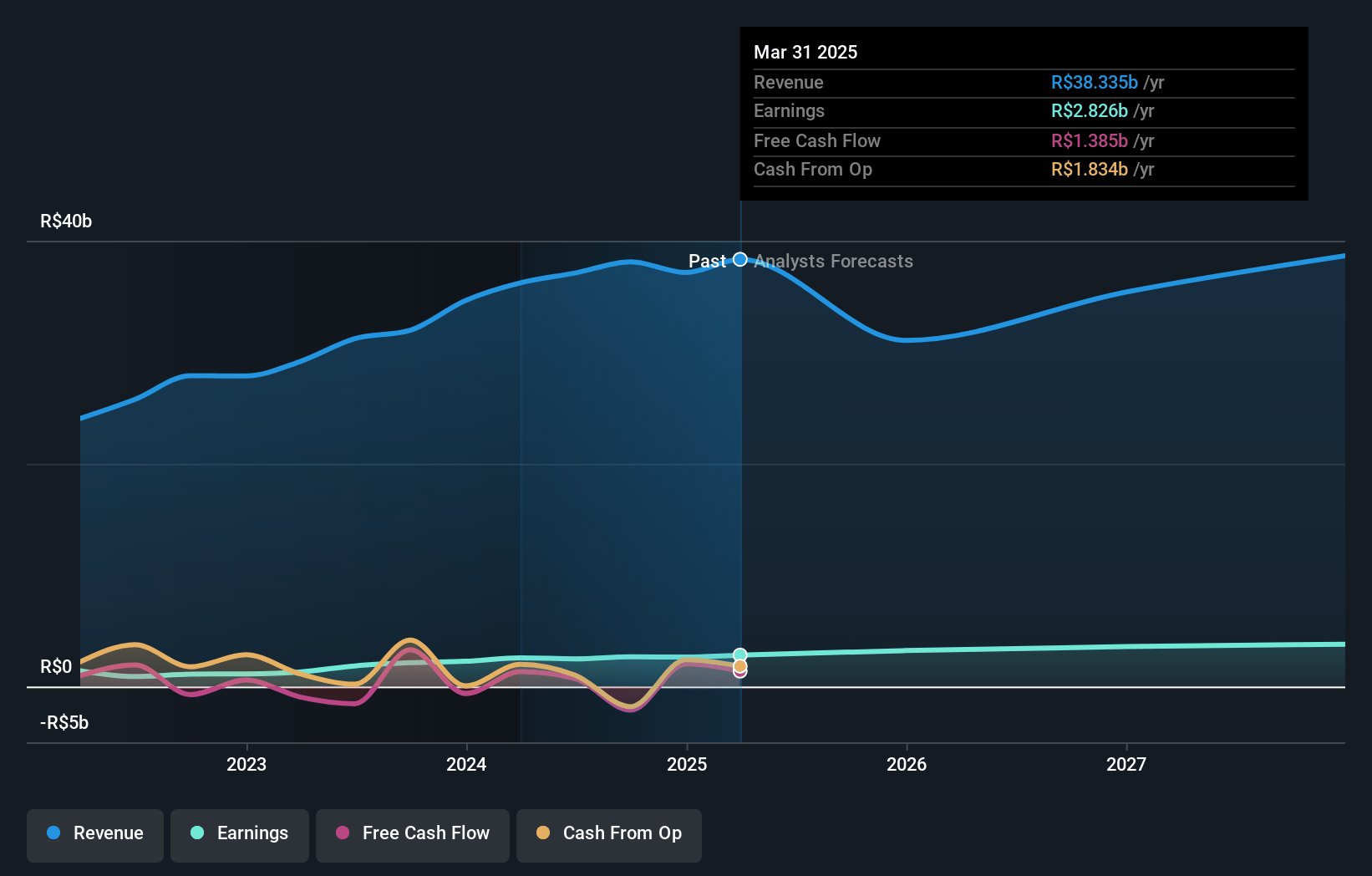

Porto Seguro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Porto Seguro compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Porto Seguro's revenue will decrease by 2.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.4% today to 10.2% in 3 years time.

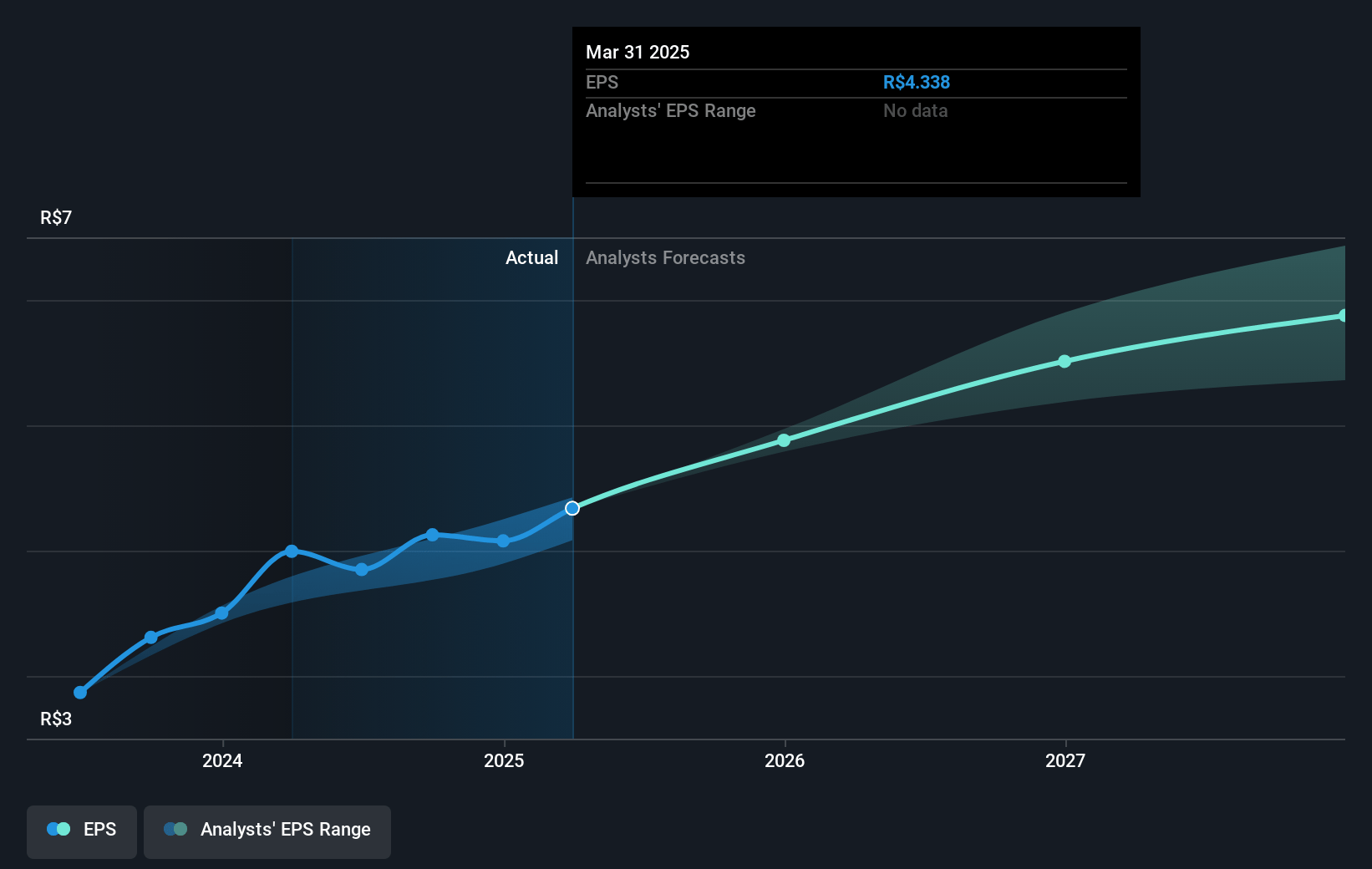

- The bearish analysts expect earnings to reach R$3.7 billion (and earnings per share of R$5.64) by about July 2028, up from R$2.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from 11.7x today. This future PE is greater than the current PE for the BR Insurance industry at 7.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.32%, as per the Simply Wall St company report.

Porto Seguro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Porto Seguro's successful diversification across insurance, banking, health, and services is reducing reliance on any single business line, increasing revenue stability and generating consistent earnings growth as seen from the strong multi-vertical performance and dilution of fixed costs.

- Sustained improvements in operational efficiency, digital transformation, and cost control are lowering SG&A and expense ratios, which supports higher net margins and overall profitability into future quarters.

- Strong cash generation and a conservative approach to excess capital provide ample resources for continued investment in growth, M&A, and technology, all of which can reinforce long-term earnings power and cushion against macro volatility.

- High and rising customer satisfaction (with record NPS and a growing customer base) alongside increased cross-sell, especially in health and banking, support better customer retention and recurring premium revenue, further strengthening long-term revenue streams.

- Robust guidance, consistent over-performance versus sector averages, and proactive management of portfolio risk suggest that Porto Seguro is well positioned to benefit from Brazil's growing middle class, underpenetrated insurance market, and rising demand for financial products, all pointing toward healthy revenue and earnings prospects over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Porto Seguro is R$42.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Porto Seguro's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$65.0, and the most bearish reporting a price target of just R$42.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$36.0 billion, earnings will come to R$3.7 billion, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 17.3%.

- Given the current share price of R$51.6, the bearish analyst price target of R$42.0 is 22.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives