Last Update 18 Nov 25

Fair value Decreased 5.52%SLCE3: Improved Revenue Forecasts Are Expected To Support Future Upside

Analysts have lowered their price target for SLC Agrícola from R$21.41 to R$20.23. This change is primarily due to expectations of higher discount rates and lower profit margins, which are anticipated to outweigh improved revenue forecasts.

Valuation Changes

- The Fair Value Estimate has declined from R$21.41 to R$20.23.

- The Discount Rate has risen slightly, increasing from 18.1% to 18.7%.

- The Revenue Growth forecast has improved, moving up from 3.3% to 6.1%.

- The Net Profit Margin projection has fallen significantly, dropping from 13.1% to 10.3%.

- The Future P/E Ratio is expected to increase from 13.94x to 14.75x.

Key Takeaways

- Strategic land expansion, investments in technology, and strong export relationships position the company for long-term revenue growth and improved operational efficiency.

- Diversification across crops, risk mitigation measures, and enhanced ESG credentials support greater earnings stability and access to better financing terms.

- Elevated leverage, cost pressures, and exposure to unpredictable commodity prices, weather, and global trade risks threaten profitability, cash flows, and future growth flexibility.

Catalysts

About SLC Agrícola- Produces and sells agricultural products in Brazil and internationally.

- Accelerating expansion of owned and operated land (notably the 12.9% projected increase in planted acreage for 2025/26 driven by recent acquisitions) is likely to boost production volumes and establish a higher long-term revenue base.

- Sustained global demand for agricultural commodities-especially from rising markets in Asia-and SLC's strong export relations with China are expected to underpin stable or growing export volumes and improve pricing power, supporting long-term topline growth.

- Continued investments in yield-enhancing technologies (irrigation, precision farming, and seed genetics) and targeting record productivity per hectare should drive operational efficiencies and higher yields, supporting improved net margins over time.

- The company's proactive hedging and exposure to multiple crops (soybeans, corn, cotton, seeds, and livestock) coupled with expanding irrigation to mitigate weather risks are expected to enhance earnings stability and reduce margin volatility in future crop cycles.

- Growing international emphasis on food security positions SLC as a preferred large-scale, reliable exporter; this may lead to expanded long-term contracting opportunities and potentially lower cost of debt via improved ESG and supply chain credentials, supporting net income and reducing financing costs.

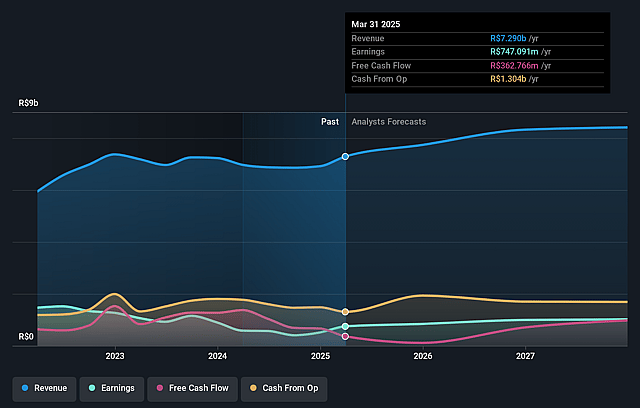

SLC Agrícola Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SLC Agrícola's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.5% today to 13.1% in 3 years time.

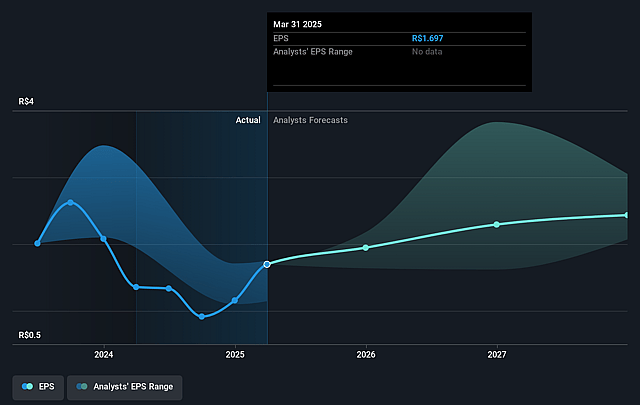

- Analysts expect earnings to reach R$1.1 billion (and earnings per share of R$2.26) by about September 2028, up from R$588.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting R$1.3 billion in earnings, and the most bearish expecting R$803 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, up from 12.7x today. This future PE is greater than the current PE for the BR Food industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.11%, as per the Simply Wall St company report.

SLC Agrícola Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased leverage from recent land and strategic acquisitions has pushed SLC Agrícola's net debt/EBITDA ratio to 2.3x, with further CapEx and investment needs indicating elevated interest expenses and compressed net margins, especially if interest rates remain high or decline slower than anticipated.

- Persistent soft commodity price pressures in soybeans, cotton, and corn-driven by record production volumes both in Brazil and the U.S.-increase the risk of margin compression and lower earnings if global demand does not outpace expanding supply.

- Geopolitical risks around trade policies, tariffs (especially U.S.-China/Brazil disputes), and fertilizer supply disruptions from Russia create uncertainty in both input costs and export market access, introducing volatility to revenues, margins, and potentially increasing costs for key inputs.

- SLC Agrícola's significant reliance on commodity sales and variable weather conditions leaves it exposed to yield volatility (as highlighted by the unusual rainfall-driven corn productivity spike in 2025), such that yields may revert to trend or below in subsequent years, reducing production volumes and profitability.

- High ongoing requirements for maintenance and expansion CapEx (including irrigation projects and farm upgrades) could further suppress free cash flow and restrict the company's ability to increase shareholder returns or fund future growth, especially if commodity pricing or yields underperform expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$21.409 for SLC Agrícola based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$25.0, and the most bearish reporting a price target of just R$18.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$8.6 billion, earnings will come to R$1.1 billion, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 18.1%.

- Given the current share price of R$17.0, the analyst price target of R$21.41 is 20.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.