Key Takeaways

- Imminent regulatory shifts, operational upgrades, and favorable global health trends position the company for significant, sustainable margin expansion and premium pricing power.

- Strategic diversification into bioproducts and automation strengthens resilience, attracts ESG investment, and enhances long-term profitability and competitiveness within the sector.

- Heavy reliance on sugar and ethanol, climate risks, and high capital requirements threaten margins and earnings amid growing regulatory, market, and geographic vulnerabilities.

Catalysts

About Jalles Machado S/A- Produces, markets, and exports sugar, ethanol, and other by-products from sugarcane.

- While analyst consensus expects higher ethanol prices due to a lower supply, this may underestimate the potential impact of the imminent E30 (30% anhydrous ethanol blend) approval, which could trigger a step change in demand and pricing for ethanol, resulting in both immediate and sustained revenue and margin expansion well above current forecasts.

- Analysts broadly agree that operating efficiency improvements, particularly at Santa Vitoria, will aid margins, but this outlook does not fully capture the magnitude of normalized weather and recently completed capacity upgrades that could propel Santa Vitoria's crushing volume to 2.7 million tons and overall throughput to 9 million tons by 2027, driving a dramatic profit and cash flow inflection.

- Jalles Machado's leading position in organic sugar, combined with growing health and wellness trends globally, is set to unlock above-market pricing power once freight bottlenecks ease, enabling the company to capture heightened export demand and premium margins in an expanding global organic segment.

- The company's diversification into bioproducts-such as biomethane production and bioplastics-not only broadens revenue streams but also capitalizes on the global decarbonization and renewable energy agenda, positioning Jalles Machado to capture outsized market share, attract ESG-focused capital, and secure lower funding costs in the years ahead, materially enhancing long-term profitability.

- The full ramp-up of process automation, agritech, and modernization initiatives across all units places Jalles Machado among the most productive and sustainable operators in the sector, which should support sustained margin expansion, lower earnings volatility, and support higher valuation multiples as the industry continues to consolidate around the most efficient players.

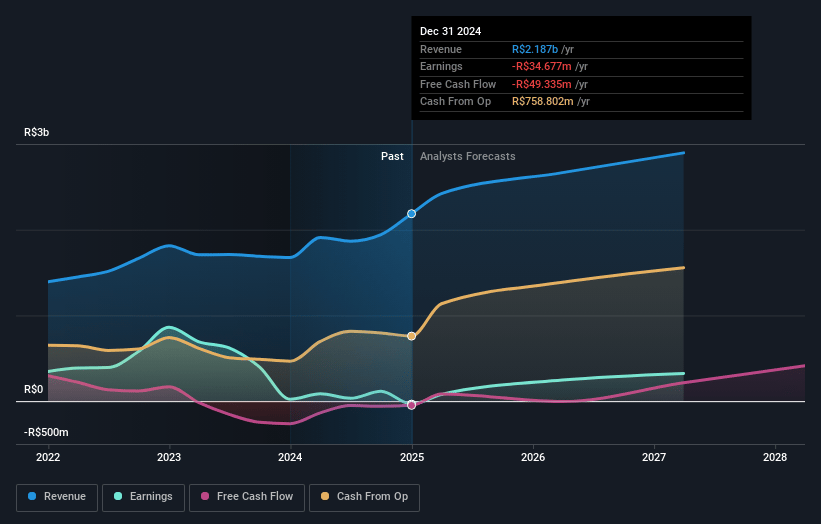

Jalles Machado S/A Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Jalles Machado S/A compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Jalles Machado S/A's revenue will grow by 8.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -2.4% today to 6.7% in 3 years time.

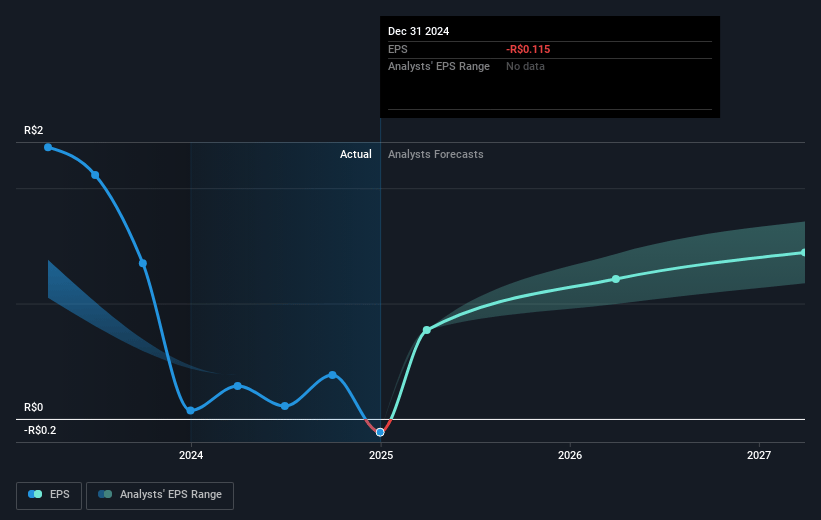

- The bullish analysts expect earnings to reach R$202.6 million (and earnings per share of R$2.58) by about July 2028, up from R$-56.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.2x on those 2028 earnings, up from -18.9x today. This future PE is greater than the current PE for the BR Food industry at 10.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 22.18%, as per the Simply Wall St company report.

Jalles Machado S/A Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent climate volatility, as evidenced by the severe drought at Santa Vitoria and the company's limited ability to manage irrigation outside a relatively small area, exposes Jalles Machado to input cost spikes and production shortfalls, which can suppress future revenues and compress net margins over time.

- Continued heavy capital requirements for mill upgrades, land expansion, and recurring improvement CapEx-even after the current investment cycle-highlight the high operational leverage and risk of subpar returns on invested capital, limiting potential increases in net earnings.

- There are signs that sugar and ethanol price improvements may prove temporary, as secular shifts such as global health trends curbing sugar demand and the longer-term global pivot toward decarbonization threaten to erode both topline revenue growth and pricing power for Jalles Machado's main products.

- The company's geographic and revenue concentration in Brazil leaves it highly exposed to local macroeconomic volatility, including inflation, workforce cost inflation, interest rate fluctuations, FX swings, and regulatory shifts, all of which could drive unpredictable swings in EBITDA and net income.

- Jalles Machado's limited diversification outside sugar and ethanol, combined with rising compliance costs from global ESG and environmental standards-as well as the growing market power of food and agribusiness buyers-could lead to margin compression and increased volatility in earnings, particularly if new product development remains slow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Jalles Machado S/A is R$11.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Jalles Machado S/A's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$11.5, and the most bearish reporting a price target of just R$6.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$3.0 billion, earnings will come to R$202.6 million, and it would be trading on a PE ratio of 31.2x, assuming you use a discount rate of 22.2%.

- Given the current share price of R$3.5, the bullish analyst price target of R$11.5 is 69.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives