Key Takeaways

- Climate volatility, regulatory pressure, and rising costs present ongoing risks to yield stability, land expansion, and overall margins despite long-term demand tailwinds.

- Geographic and crop diversification offer resilience, but exposure to commodity price swings and limited financing options could suppress near-term profitability and project returns.

- Persistent high borrowing and input costs, unstable commodity prices, and stagnant land appreciation threaten profitability, limit expansion, and could constrain shareholder returns.

Catalysts

About BrasilAgro - Companhia Brasileira de Propriedades Agrícolas- Engages in the acquisition, development, exploration, and sale of agricultural activities in Brazil, Paraguay, and Bolivia.

- While BrasilAgro is well positioned to benefit from rising long-term global demand for food and Brazil's increasing strategic role in world agriculture-which should drive land and commodity price appreciation and support revenue growth-persistent climate volatility and extreme weather events, such as excessive rainfall and droughts observed in key producing regions, continue to threaten year-to-year crop yields and create downside risk to both revenue and margins.

- Although the company's active land acquisition and transformation in regions like Maranhao and Piaui could unlock significant value appreciation and capital gains over time, there is a real risk that higher regulatory pressures around land use, deforestation, and ESG compliance in Brazil could delay or restrict new land conversion, thereby limiting future returns and increasing operational costs, ultimately affecting net income.

- While diversification across crops (soybean, corn, sugarcane, cotton, and cattle) and geographies provides some resilience against commodity price cycles, BrazilAgro remains heavily exposed to fluctuations in key crop prices and input costs, as seen with recent fertilizer and capital costs, which can compress margins if unfavorable trends persist or worsen.

- Despite ongoing investments in technology and efficiency-including precision agriculture and irrigation-persistent high domestic interest rates and elevated costs of capital in Brazil strain both financing and working capital, potentially reducing returns on new projects, lengthening payback periods, and constraining near-term earnings growth.

- Even though improving logistics and infrastructure across Brazil should, in the long term, enhance export competitiveness and reduce costs, in the short-to-medium term, deficiencies in storage, transportation, and cost trade-offs due to rising funding rates may continue to cap the benefit to gross margin and delay realization of the full upside from secular export demand.

BrasilAgro - Companhia Brasileira de Propriedades Agrícolas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on BrasilAgro - Companhia Brasileira de Propriedades Agrícolas compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming BrasilAgro - Companhia Brasileira de Propriedades Agrícolas's revenue will grow by 3.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 25.2% today to 17.8% in 3 years time.

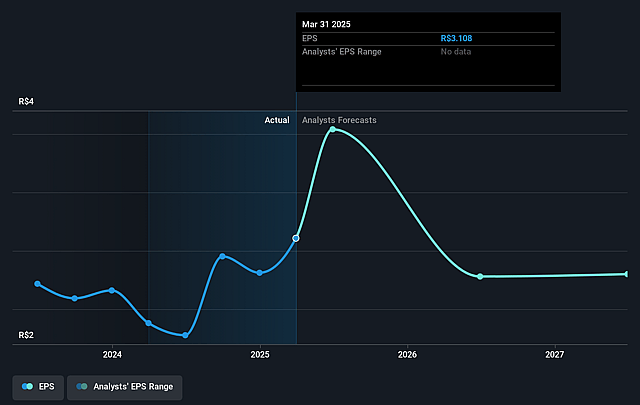

- The bearish analysts expect earnings to reach R$244.8 million (and earnings per share of R$2.47) by about July 2028, down from R$309.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, up from 6.6x today. This future PE is greater than the current PE for the US Food industry at 10.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.32%, as per the Simply Wall St company report.

BrasilAgro - Companhia Brasileira de Propriedades Agrícolas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces persistent high borrowing costs and elevated SELIC rates, substantially increasing its cost of capital and compressing net margins, which may limit profitability during expansion or periods of lower commodity prices.

- Land appreciation has slowed, with management not expecting new price peaks or significant reductions, exposing BrasilAgro to the risk that its reliance on land value growth for net income could be challenged if farmland values stagnate over the long term.

- Commodity price volatility, particularly for soy, corn, cotton, and sugarcane, driven by changing global supply and demand as well as climate risks like droughts or excessive rains in key producing regions, has resulted in lower yields and tight contribution margins; continued weather volatility could negatively impact both revenue and earnings stability.

- Rising input costs, especially for fertilizers and defensives with no expectation of further meaningful price declines, along with a high cost of working capital, threaten to erode operating margins and may limit the company's ability to capitalize on expansion and crop diversification efforts.

- The company's future cash flows and dividends may be constrained by the need to prioritize cash preservation and debt servicing amidst high interest rates, potentially reducing shareholder returns through lower dividend payouts and affecting long-term total returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for BrasilAgro - Companhia Brasileira de Propriedades Agrícolas is R$22.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of BrasilAgro - Companhia Brasileira de Propriedades Agrícolas's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$34.0, and the most bearish reporting a price target of just R$22.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$1.4 billion, earnings will come to R$244.8 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 17.3%.

- Given the current share price of R$20.43, the bearish analyst price target of R$22.0 is 7.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.