Key Takeaways

- Expansion in premium medical education and scalable Semi On-campus programs is set to significantly boost recurring revenues, margins, and pricing power beyond current forecasts.

- Strong digital capabilities, demographic trends, and cash flow optimization position Yduqs for sustained operational outperformance and new premium revenue streams.

- Market challenges from shrinking demographics, digital disruption, financing uncertainties, and rising competition threaten enrollment growth, pricing power, and long-term profitability for Yduqs.

Catalysts

About Yduqs Participações- Provides higher education services in Brazil.

- Analyst consensus recognizes the upside from Yduqs's Medical Education segment expansion, but this view likely understates the longer-term compounding effect of medical seat additions; with student intake already exceeding expectations and demand outstripping supply, this high-margin, premium segment can power a multi-year step-change in recurring revenues and margin expansion well beyond current models.

- While analysts broadly agree on the transformative value of Semi On-campus programs and the migration of digital students, they may be overlooking Yduqs's unique scalability and first-mover potential; as Semi On-campus rapidly anchors pricing power across 2,500+ partner hubs with minimal incremental cost, the lift to both average ticket and EBITDA could be substantially greater and prove highly durable as student preferences evolve.

- As digital transformation accelerates in education, Yduqs's advanced digital platform positions the company to capture significant share from legacy and informal providers, reducing customer acquisition costs and enabling higher operating leverage, which should drive superior net income growth in coming years.

- Brazil's demographic and economic tailwinds-particularly the rise of the middle class and demand for lifelong upskilling-will not only expand the total addressable market for Yduqs, but also lift demand for postgraduate and specialized courses, supporting new premium-priced revenue streams and higher cash flow conversion.

- Yduqs's recurring free cash flow generation and aggressive cost of capital improvements-including renegotiated long-term debt, streamlined receivables, and ongoing portfolio optimization-create a foundation for sustained dividend growth and substantial earnings per share (EPS) upside, positioning the company to outperform consensus expectations on both capital returns and operational efficiency.

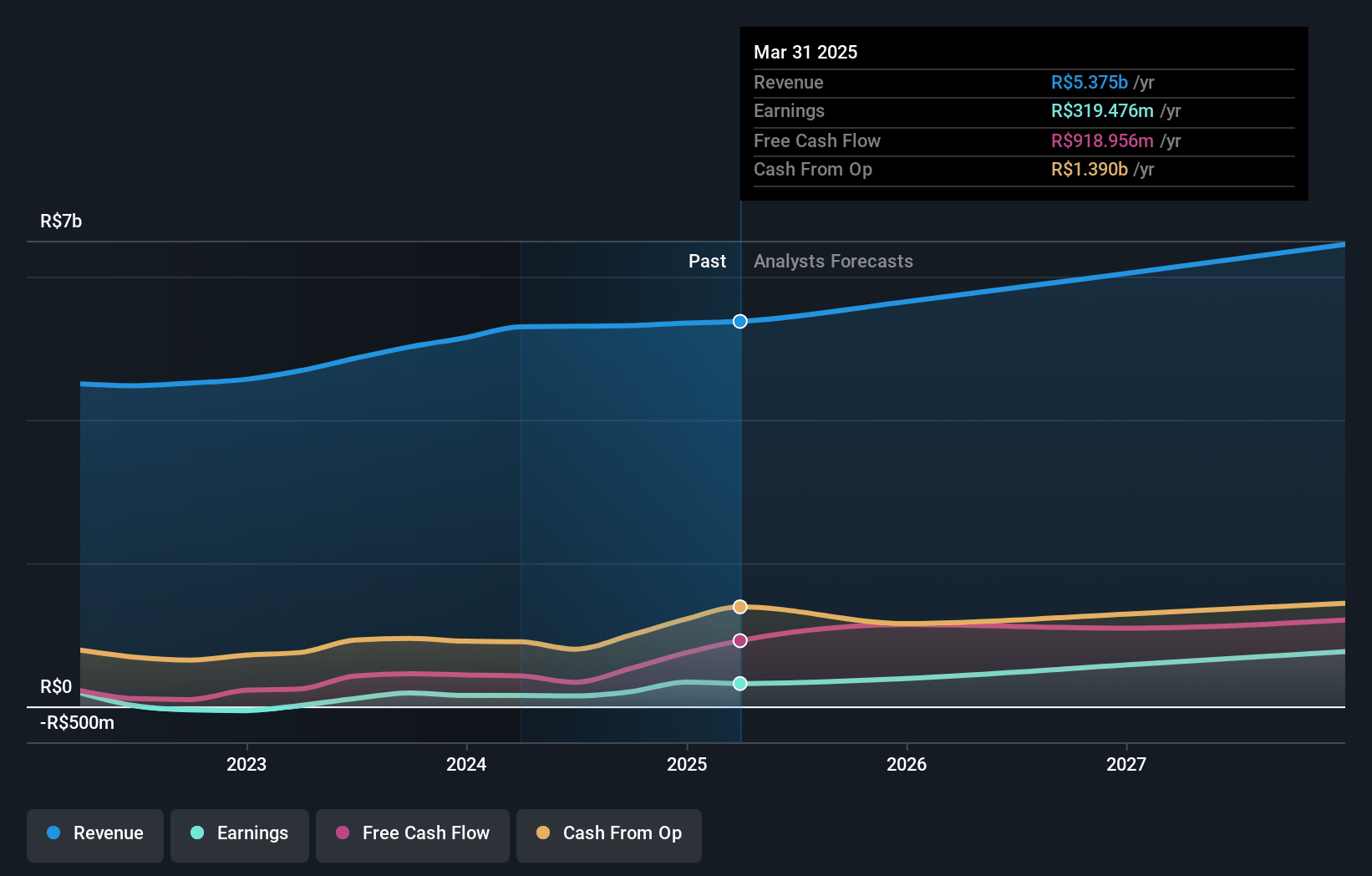

Yduqs Participações Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Yduqs Participações compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Yduqs Participações's revenue will grow by 9.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.9% today to 15.5% in 3 years time.

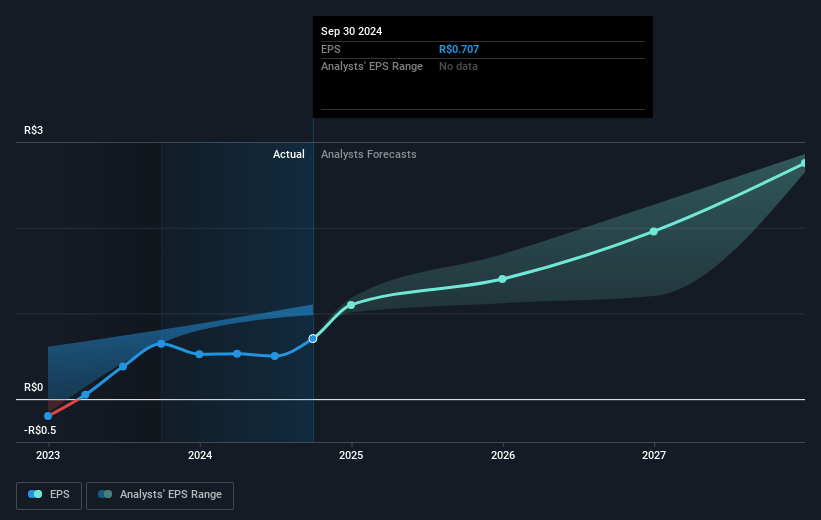

- The bullish analysts expect earnings to reach R$1.1 billion (and earnings per share of R$4.28) by about July 2028, up from R$319.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.6x on those 2028 earnings, down from 10.6x today. This future PE is lower than the current PE for the BR Consumer Services industry at 11.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.87%, as per the Simply Wall St company report.

Yduqs Participações Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Demographic shifts in Brazil, such as the slowing population growth and a declining college-age cohort, will likely shrink the addressable market for Yduqs over the coming years, capping potential enrollment growth and limiting sustained top line revenue expansion.

- The increasing preference for online, low-cost, or free educational alternatives may erode demand for Yduqs' core offerings, putting downward pressure on tuition pricing and ultimately compressing net margins and earnings.

- Yduqs faces persistent high student dropout and delinquency rates, with management indicating continuing attrition and provisions for non-engaged students, which directly impacts revenue quality and operating margins.

- Overreliance on government-sponsored student financing (FIES) and continued uncertainty regarding public funding creates vulnerabilities, since any further reduction or stricter eligibility could lower new enrollments and reduce recurring revenue streams.

- Sector consolidation and the entrance of global and local EdTech competitors may intensify pricing pressure and increase customer acquisition costs, threatening Yduqs' ability to maintain or grow profitably and potentially leading to margin deterioration over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Yduqs Participações is R$27.81, which represents two standard deviations above the consensus price target of R$19.13. This valuation is based on what can be assumed as the expectations of Yduqs Participações's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$29.7, and the most bearish reporting a price target of just R$11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$7.1 billion, earnings will come to R$1.1 billion, and it would be trading on a PE ratio of 9.6x, assuming you use a discount rate of 21.9%.

- Given the current share price of R$12.96, the bullish analyst price target of R$27.81 is 53.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.