Last Update 12 Dec 25

Fair value Decreased 2.31%GMAT3: Higher Future Multiple Will Support Confidence Despite Margin Headwinds

Analysts have trimmed their price target on Grupo Mateus slightly, from 8.65 to 8.45, as modestly higher discount rates and slightly lower forecast profit margins more than offset small upgrades to expected revenue growth and future valuation multiples.

Valuation Changes

- Fair Value: Trimmed slightly from R$8.65 to R$8.45 per share, reflecting a modestly more conservative outlook.

- Discount Rate: Risen marginally from 19.36 percent to 19.40 percent, increasing the required return applied in the valuation.

- Revenue Growth: Edged up from 16.57 percent to 16.77 percent, indicating slightly stronger top line expectations.

- Net Profit Margin: Reduced from 4.10 percent to 3.83 percent, signaling a more cautious view on profitability.

- Future P/E: Increased moderately from 13.83x to 14.39x, implying a somewhat higher valuation multiple on forecast earnings.

Key Takeaways

- Expansion into new markets, mergers, and supply chain optimization drive revenue growth, cost efficiency, and stronger margins.

- Multi-channel strategies and private label development enhance resilience, boost earnings quality, and capture evolving consumer trends.

- High regional concentration, aggressive expansion, consumer shifts, and execution risks expose Grupo Mateus to profitability pressure, operational challenges, and limited long-term earnings resilience.

Catalysts

About Grupo Mateus- Operates a supermarket chain in Brazil.

- The continued aggressive store expansion and entry into new, underpenetrated cities (especially in Brazil's North and Northeast) position Grupo Mateus to capture rising demand from a growing middle class and ongoing urbanization, supporting sustained top-line revenue growth.

- The strategic merger with Novo Atacarejo is expected to deliver significant operational synergies across logistics, procurement, HR, and loss prevention-driving efficiency, improving SG&A leverage, and expanding EBITDA and net margins as integration matures.

- Focused investments in supply chain optimization, logistics, and working capital efficiency-combined with the closure of underperforming eletro stores-will free up capital, improve cash conversion cycle, and enhance both net margins and cash flow generation going forward.

- Multi-channel and digital strategies (including intensified efforts in wholesale, distribution, and e-commerce integration) allow Grupo Mateus to better tap into changing consumer preferences and accelerate omnichannel revenue growth, providing resilience against competitive and macro headwinds.

- Ongoing rollout and maturation of higher margin private label products, coupled with deepening local market share, are set to boost gross margin and earnings quality, leveraging consolidation trends in Brazilian food retail and formalization of modern trade.

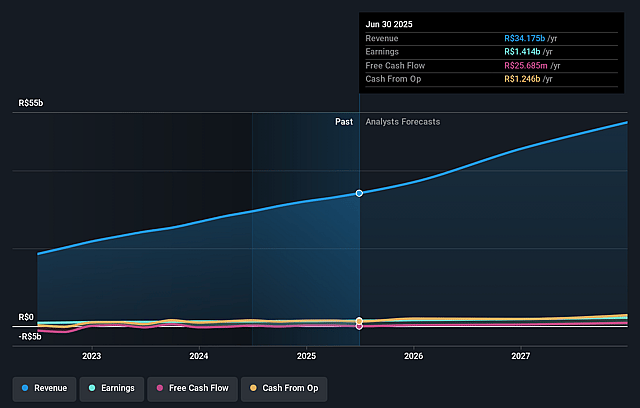

Grupo Mateus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Grupo Mateus's revenue will grow by 18.0% annually over the next 3 years.

- Analysts are assuming Grupo Mateus's profit margins will remain the same at 4.1% over the next 3 years.

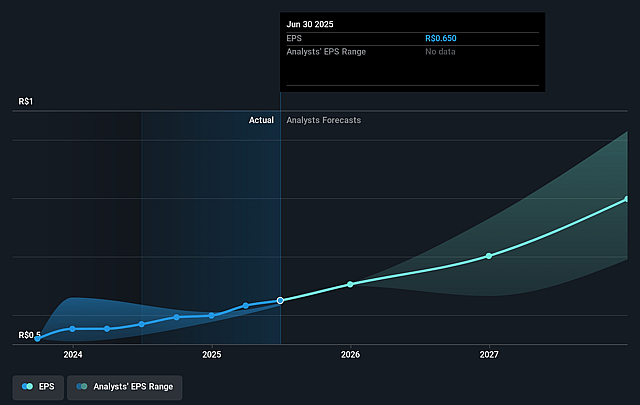

- Analysts expect earnings to reach R$2.3 billion (and earnings per share of R$0.96) by about September 2028, up from R$1.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting R$2.8 billion in earnings, and the most bearish expecting R$1.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 11.2x today. This future PE is greater than the current PE for the BR Consumer Retailing industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 1.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.46%, as per the Simply Wall St company report.

Grupo Mateus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent concentration in Brazil's North and Northeast leaves Grupo Mateus highly exposed to regional economic weakness, inflationary volatility, and slower demographic growth compared to the Southeast, which may constrain revenue growth and reduce long-term earnings resiliency.

- The company's aggressive expansion and store rollout strategy, including multiple stores under construction and acquisition of Novo, requires substantial capital investment and increases leverage, raising the risk of thinner net margins and potential balance sheet stress if market conditions worsen.

- Closure of underperforming 'eletro' (electronics) stores and references to transforming or divesting unprofitable formats highlight execution risks and the potential for asset write-downs, restructuring costs, and declining returns from legacy business segments-impacting future profitability.

- The evolving Brazilian consumer-increasingly rational and focused on lower-priced brands amid persistent inflation-could erode the effectiveness of Grupo Mateus's value-added or premium offerings, pressuring gross margins and limiting growth in average basket size.

- Ongoing margin and cash generation improvements rely heavily on supplier negotiations, tax credits, and integration synergies with Novo; heightened competition from both local and international omni-channel players, plus regulatory/tax changes, could erode these advantages, increase operational costs, and compress EBITDA/net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$9.4 for Grupo Mateus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$10.4, and the most bearish reporting a price target of just R$9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$56.2 billion, earnings will come to R$2.3 billion, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 18.5%.

- Given the current share price of R$7.03, the analyst price target of R$9.4 is 25.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Grupo Mateus?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.