Key Takeaways

- Sustained demand, urbanization, and supportive government programs position Cury for stronger revenue growth and a more resilient, higher-quality customer base.

- Operational efficiency, innovation, and focus on higher-income segments could drive margin outperformance and sizeable gains in earnings power beyond market expectations.

- Heavy dependence on government incentives and regional markets, along with labor, credit, and regulatory risks, threatens growth, profitability, and expansion capabilities.

Catalysts

About Cury Construtora e Incorporadora- Operates in real estate businesses.

- Analyst consensus expects sales growth to outpace historic levels, but this may be underestimated as Cury's intensified land acquisition strategy and the expansion of Minha Casa Minha Vida coverage to Bracket 4 should unlock multiyear double-digit volume growth, supporting structurally higher revenues.

- While the market anticipates stable or slightly rising margins, Cury's relentless focus on operational efficiency, cost controls, and premiumization of its sales mix through targeting higher-income brackets within affordable housing could result in outsized net margin expansion and a step-change in earnings power beyond consensus forecasts.

- Cury is set to disproportionately benefit from Brazil's persistent urbanization and the structural housing deficit in major cities, ensuring a sustained, long-term demand tailwind that could support both sales velocity and higher unit pricing, leading to durable revenue growth.

- Rapid adoption of digital and modular construction technologies-combined with Cury's track record of reinvesting in process automation-should further accelerate cost reductions, allowing not just margin preservation but margin outperformance versus peers over time.

- The strengthening of government-backed housing programs, increasing mortgage credit accessibility, and recurrent funding for Minha Casa Minha Vida indicate an expanding, more creditworthy customer base for Cury, underpinning future top-line growth and improved receivables quality, both of which bolster bottom-line performance.

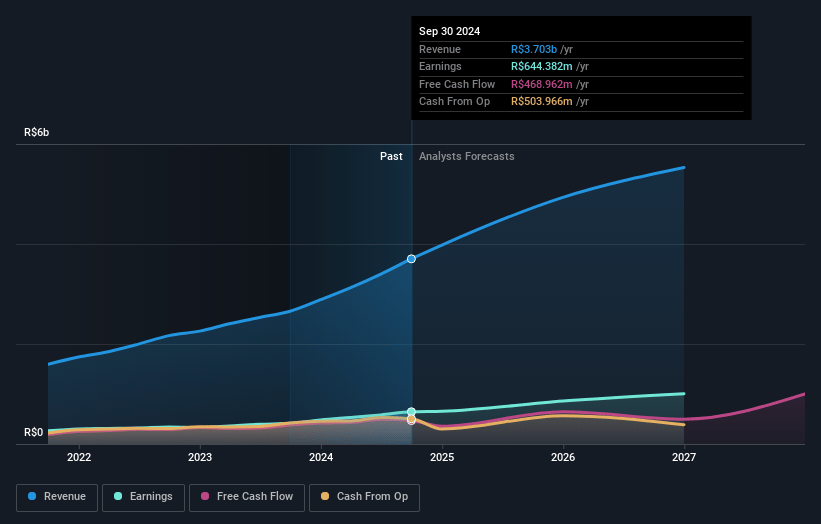

Cury Construtora e Incorporadora Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cury Construtora e Incorporadora compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cury Construtora e Incorporadora's revenue will grow by 29.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.8% today to 17.8% in 3 years time.

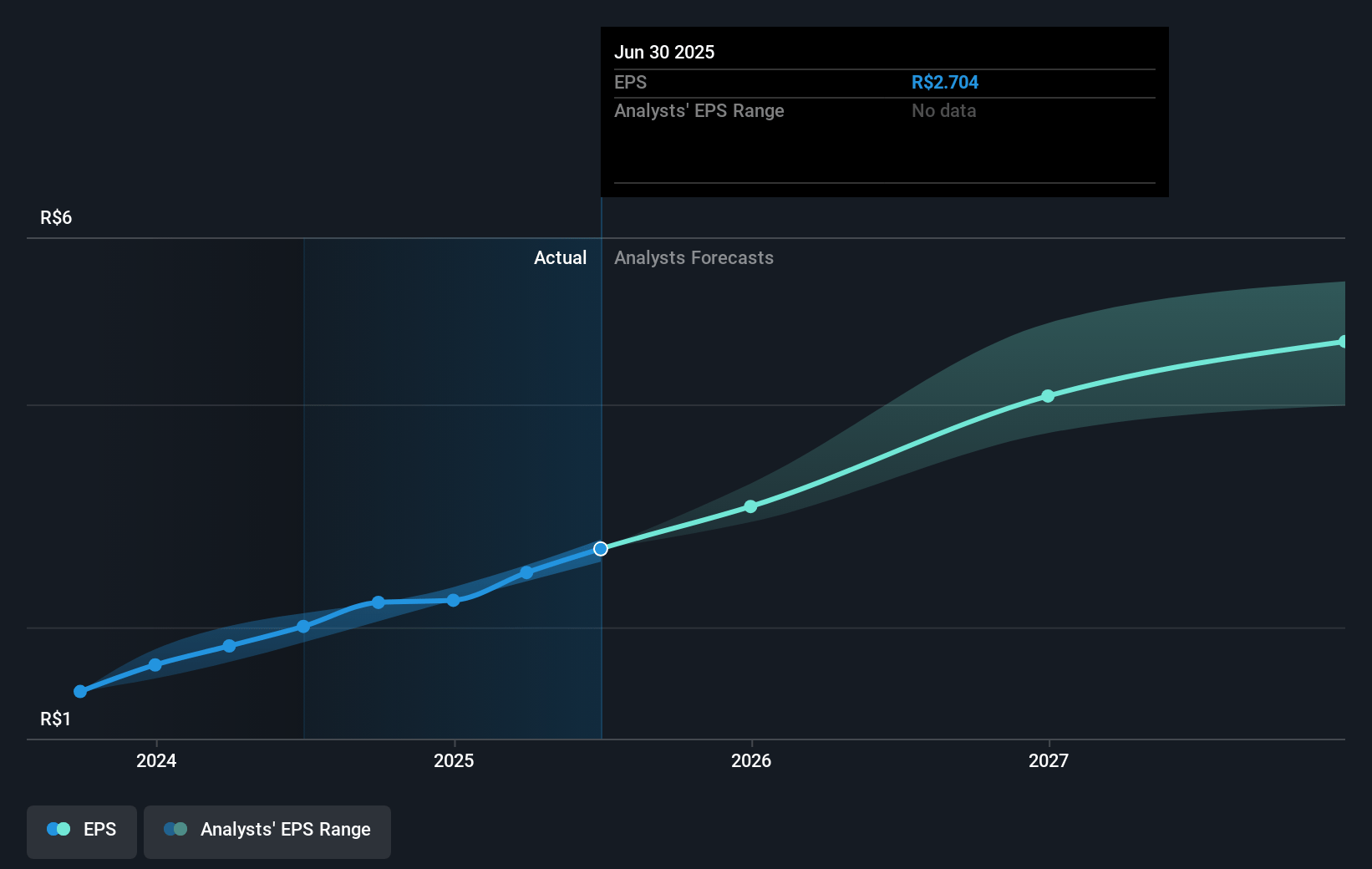

- The bullish analysts expect earnings to reach R$1.6 billion (and earnings per share of R$5.68) by about July 2028, up from R$722.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 11.6x today. This future PE is greater than the current PE for the BR Consumer Durables industry at 10.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.99%, as per the Simply Wall St company report.

Cury Construtora e Incorporadora Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cury is heavily concentrated in the São Paulo and Rio de Janeiro regions, which exposes it to regional economic downturns that could sharply reduce both its revenue base and future market share.

- The company's reliance on the Minha Casa Minha Vida government incentive program-now covering approximately 95 percent of its portfolio-means that any regulatory changes, funding cutbacks, or caps on social housing programs could threaten predictable sales volumes and earnings growth.

- Persistent challenges with labor shortages and potential increases in labor costs, as acknowledged by management, combined with ongoing supply chain disruptions, may erode Cury's gross margins and pressure its net profitability over time.

- Rising interest rates or tightening credit conditions for mortgages, as well as inflationary pressures on construction inputs, could undermine affordability for Cury's target low

- and middle-income buyers, risking future declines in sales volumes and operational cash flow generation.

- Intensifying regulatory scrutiny-especially on ESG compliance for land development-may increase project approval delays, compliance costs, and competition for viable landbank acquisitions, negatively impacting both gross margins and the company's ability to expand its top-line revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cury Construtora e Incorporadora is R$42.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cury Construtora e Incorporadora's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$42.0, and the most bearish reporting a price target of just R$21.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$9.3 billion, earnings will come to R$1.6 billion, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 20.0%.

- Given the current share price of R$28.8, the bullish analyst price target of R$42.0 is 31.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.