Catalysts

About Azzas 2154

Azzas 2154 is a leading Brazilian fashion and lifestyle platform that scales a portfolio of premium apparel, footwear and accessories brands through franchises, owned stores, multi-brand partners and e-commerce.

What are the underlying business or industry changes driving this perspective?

- Ongoing cultural and operational transformation at Hering, including a redesigned operating cycle that produces after sell-in rather than on speculative buys, is intended to materially reduce markdowns and inventory write downs, lifting gross margin and EBITDA over the next few collections.

- Acceleration of premium brands in womenswear and footwear, such as FARM, ANIMALE and Schutz, supported by strong performance in international markets and high productivity flagship stores, positions the group to capture structurally higher average ticket and mix, which may drive sustained revenue growth and expand net margins.

- Reinforced franchise and multi-brand ecosystems across Brazil, with healthier coverage levels, incentive realignment and 700 plus partner stores, is expected to convert brand strength into scalable sellout, supporting higher like for like sales and more efficient working capital, and in turn improving cash generation and earnings.

- Disciplined SG&A management, back office integration in Rio de Janeiro and a deliberately lean C level structure create operating leverage as volumes recover. Modest top line gains can therefore translate into disproportionately large improvements in EBITDA margin and net income.

- Strategic reorientation of brands like Vans and Hering toward more resilient lifestyle and casual wear demand, combined with higher share of DTC and e-commerce in the channel mix, is designed to enhance pricing power and reduce customer acquisition costs, supporting stronger revenue per client and higher net margins.

Assumptions

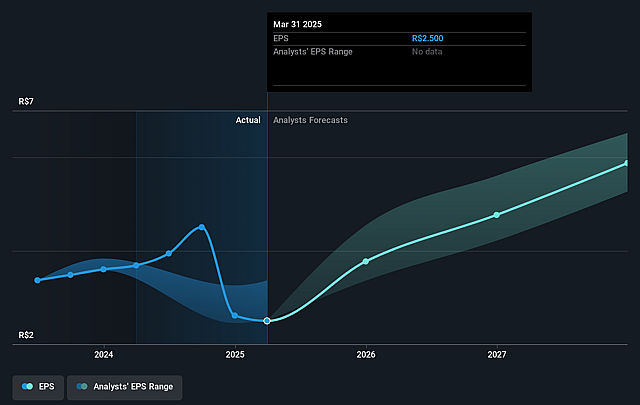

This narrative explores a more optimistic perspective on Azzas 2154 compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

- The bullish analysts are assuming Azzas 2154's revenue will grow by 11.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.3% today to 8.6% in 3 years time.

- The bullish analysts expect earnings to reach R$1.4 billion (and earnings per share of R$6.96) by about December 2028, up from R$753.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as R$1.1 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from 6.8x today. This future PE is greater than the current PE for the BR Luxury industry at 6.6x.

- The bullish analysts expect the number of shares outstanding to decline by 2.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 24.13%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The extensive cultural and operational transformation at Hering and in the shoes and bags unit may take longer than expected to stabilize, with the shift from buying before sell in to producing after sell in creating temporary stock outs in high potential products and excess inventory in weaker items, which could depress revenue growth and keep gross margins from recovering as planned.

- Structural dependence on a large franchise network in Brazil, alongside underpenetrated multi-brand channels that still require model revisions and incentive realignment, leaves execution risk around franchisee financial health and sellout quality. This could constrain like for like growth and weigh on net margins and cash generation.

- The repositioning of Vans away from skatewear toward broader casual wear, in a global context where running and other sneaker categories have gained share, may fail to restore brand momentum. This could limit the contribution of this business to group scale and pressure overall revenue and EBITDA if store productivity and brand relevance do not improve.

- Despite strong premium brands, the group has shown only modest consolidated top line growth and a heterogeneous performance across business units, while net financial expenses and an extended working capital cycle have risen. Any disappointment in the turnaround of weaker segments could therefore limit operating leverage and constrain earnings and free cash flow improvement.

- The strategy to unlock value by aggressively cleaning up legacy inventory and prioritizing cash generation and gross margin at Hering and in menswear could face consumer pushback or weaker brand perception if discounting and product transitions are not carefully managed. This would undermine brand equity over time and could negatively affect long term revenue growth and sustainable net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Azzas 2154 is R$60.0, which represents up to two standard deviations above the consensus price target of R$45.32. This valuation is based on what can be assumed as the expectations of Azzas 2154's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$60.0, and the most bearish reporting a price target of just R$31.5.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be R$16.4 billion, earnings will come to R$1.4 billion, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 24.1%.

- Given the current share price of R$25.37, the analyst price target of R$60.0 is 57.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Azzas 2154?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.