Key Takeaways

- Rapid global expansion and premium brand repositioning are expected to drive revenue growth and boost profit margins.

- Enhanced digital performance, operational efficiencies, and improved inventory management support stronger cash flow and higher quality earnings.

- Continued operational challenges, restructuring risks, and reliance on legacy brands and brick-and-mortar expansion threaten growth, margins, and long-term relevance amidst shifting consumer trends.

Catalysts

About Azzas 2154- Designs, develops, manufactures, markets, and sells shoes, handbags, clothing, and accessories for women and men.

- Strong acceleration in international expansion, particularly Farm Rio's entry and rapid brick-and-mortar/e-commerce growth in the UK, Europe and soon Asia, is set to significantly expand Azzas 2154's addressable market and drive robust top-line revenue growth, leveraging the global rise in wealth and demand for luxury goods.

- Ongoing premiumization and repositioning efforts-evidenced by Schutz's improved traction in premium mall locations and Animale's outsized growth-should enable higher average selling prices and enhanced gross margins, supporting operating profit growth.

- The company's accelerating digital channel performance (notably Farm Rio e-commerce achieving R$1 million in hours, plus consistent double-digit online growth) signals increased reach and customer engagement, which, when combined with supply chain optimization, is likely to improve both revenue and net margins.

- Operational integration, organizational streamlining (including recent leadership changes and the merger's expense synergies), and cost discipline projects are already yielding SG&A efficiencies, forecasting further gains in EBITDA and net margin over the next several quarters.

- Sustained focus on inventory management and franchisee health (faster inventory turnover, improved working capital cycles, and balanced franchisee support) should minimize financial risk, maximize free cash flow, and support higher earnings quality going forward.

Azzas 2154 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Azzas 2154's revenue will grow by 9.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.9% today to 7.7% in 3 years time.

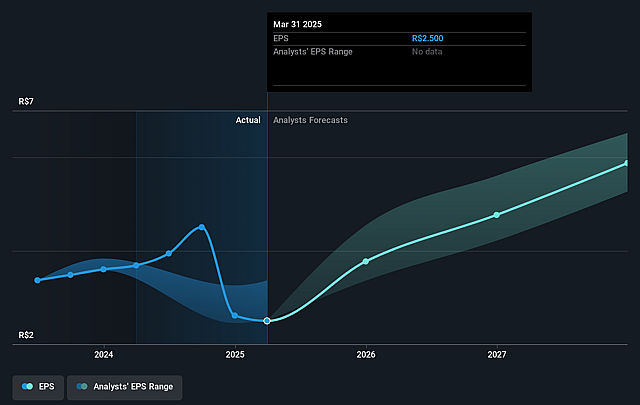

- Analysts expect earnings to reach R$1.2 billion (and earnings per share of R$5.73) by about September 2028, up from R$794.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as R$1.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, up from 8.7x today. This future PE is greater than the current PE for the BR Luxury industry at 7.2x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 22.73%, as per the Simply Wall St company report.

Azzas 2154 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company acknowledged underperformance in its original business vertical (shoes and bags), including negative same-store sales and flat growth for established brands like Schutz, coupled with management changes and ongoing efforts in process optimization and restructuring, signaling operational execution risk and potential for continued margin compression and revenue stagnation in its core segment.

- The integration of the recent large-scale merger and ongoing restructuring are still in early stages, with leadership turnover and consulting projects in progress; this exposes the company to risks of internal disruption, cultural misalignment, and delayed synergies, which could increase one-off costs, negatively impact operating margins, and hinder long-term scalability.

- The group's strategy relies heavily on expanding its brick-and-mortar and franchise channels, and further internationalization; a shift in consumer preferences toward e-commerce and digital-first experiences, or failure to maintain relevance with younger, value-driven consumer cohorts, could cap long-term top-line growth and erode future profitability.

- Flat or negligible growth prospects for legacy brands (such as Vans having reached saturation and Schutz with limited scale-up potential in the premium segment) suggest the risk of brand obsolescence or market share loss to new entrants and niche players, threatening both future revenues and sustainable net earnings growth.

- Exposure to challenging inventory dynamics and the need for regular returns from franchisees signal persistent supply/demand mismatches and working capital inefficiencies; this, combined with ongoing external disruptions (such as trade tariffs, inflation in input costs, and potential regulatory/tax changes), could weigh on gross margins and future cash flow generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$51.214 for Azzas 2154 based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$60.0, and the most bearish reporting a price target of just R$39.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$15.3 billion, earnings will come to R$1.2 billion, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 22.7%.

- Given the current share price of R$33.6, the analyst price target of R$51.21 is 34.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.