Key Takeaways

- Consistent net interest income growth from safer credit and reduced loan loss provisions strengthens earnings and profitability.

- Strategic investments in digital channels and improved loan processes enhance customer satisfaction, support revenue growth, and increase net income.

- Rising interest rates and economic uncertainty could hurt margins and earnings, while increased competition and acquisition challenges may strain revenue and profitability.

Catalysts

About Banco Bradesco- Provides various banking products and services to individuals, corporates, and businesses in Brazil and internationally.

- Banco Bradesco is experiencing consistent growth in net interest income (NII) due to a reduction in loan loss provision expenses and increased revenue from client NII. This trend is expected to continue as the bank focuses on safer credit modalities, leading to steady and reliable earnings growth in the future.

- The bank is leveraging productivity gains and controlled credit risk to maintain stable delinquency ratios and operating expenses. This strategic approach enhances net margins by balancing credit portfolio growth while managing risk, indicating potential for improved profitability.

- Investments in digital channels and restructuring of their loan granting processes promise operational efficiencies and a broader customer base, potentially increasing revenue and supporting net income growth through improved customer satisfaction and service delivery.

- The insurance group was noted for its significant return on average equity (ROAE) of almost 24%, with growing premium revenue. This sector's robust performance represents an opportunity for enhanced revenue streams and higher overall profitability for the bank.

- Bradesco's recent acquisition of a larger stake in Cielo is anticipated to expand its fee and commission income streams and add potential value through synergy realization. This strategic decision is expected to bolster revenue, especially as the consolidation impact stabilizes over time.

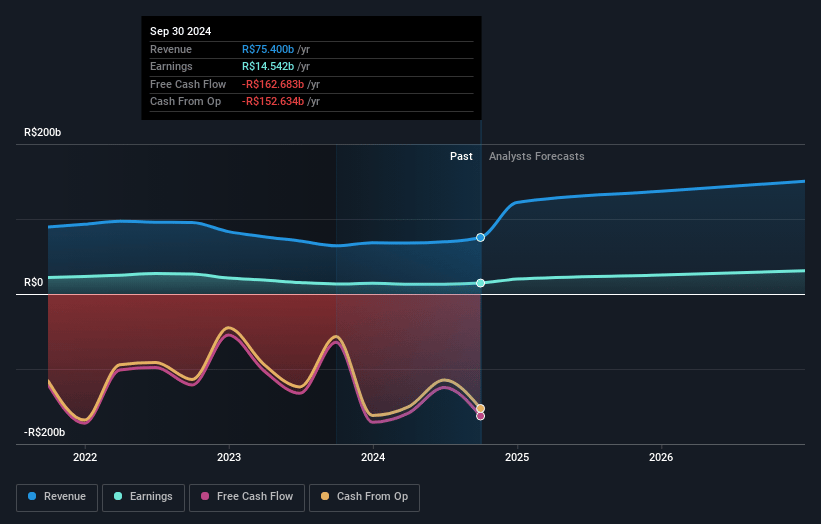

Banco Bradesco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Banco Bradesco's revenue will grow by 32.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.3% today to 19.8% in 3 years time.

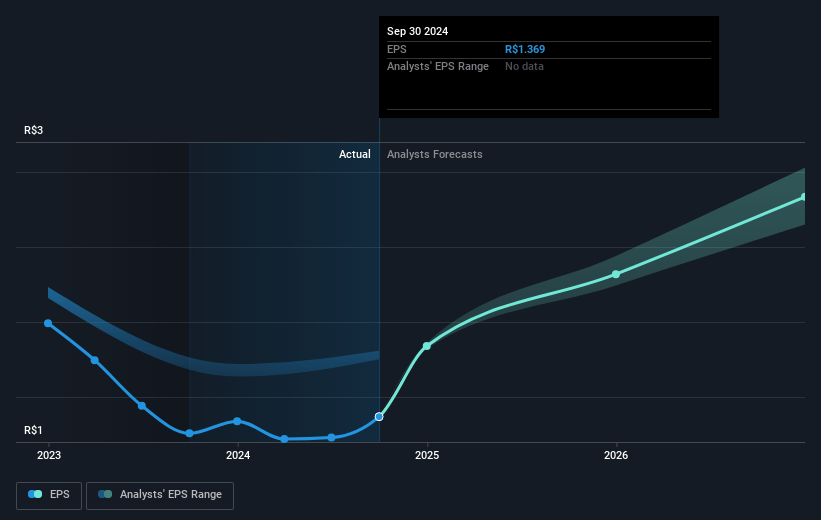

- Analysts expect earnings to reach R$35.1 billion (and earnings per share of R$3.15) by about January 2028, up from R$14.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as R$24.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, down from 8.5x today. This future PE is greater than the current PE for the US Banks industry at 5.9x.

- Analysts expect the number of shares outstanding to grow by 1.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.01%, as per the Simply Wall St company report.

Banco Bradesco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates could negatively impact borrowing costs and consumer spending, leading to slower loan growth and affecting net margins and earnings.

- Economic uncertainty, with potential increases in unemployment or inflation, might hurt credit quality and necessitate higher loan loss provisions, impacting net interest income (NII).

- Increased competition in the banking sector, especially from fintechs offering unsecured loans, may pressure market share and affect revenue growth.

- Challenges in certain segments, such as agribusiness and corporate lending, may hinder overall portfolio growth, affecting revenue and market share.

- Negative impacts from acquisitions, like Cielo, which have not yet yielded positive returns, could strain financial results and affect overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$15.4 for Banco Bradesco based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$19.0, and the most bearish reporting a price target of just R$12.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$176.7 billion, earnings will come to R$35.1 billion, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 19.0%.

- Given the current share price of R$11.63, the analyst's price target of R$15.4 is 24.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives