Key Takeaways

- Accelerated vehicle electrification and green mobility initiatives in Latin America position MAHLE Metal Leve for strong, above-market revenue and earnings growth driven by demand tailwinds.

- Rapid synergy realization from acquisitions, cost discipline, and a diversified, resilient aftermarket business are set to boost margins, stabilize earnings, and enhance valuation quality.

- Heavy reliance on combustion engine parts and slow diversification increase vulnerability to EV transition, regulatory changes, rising competition, and worsening profitability due to margin pressures.

Catalysts

About MAHLE Metal Leve- An automotive parts company, manufactures and sells components for internal combustion engines and automotive filters in South America, Europe, Central and North America, Africa, and internationally.

- While analyst consensus expects revenue growth from e-mobility and thermal management, current order momentum and successful major acquisitions suggest MAHLE Metal Leve could outperform expectations as vehicle electrification accelerates in Latin America and beyond, powering above-market revenue growth.

- Analysts broadly agree that operational restructuring will boost margins, but the rapid synergy realization from recent acquisitions and aggressive cost discipline, already outpacing initial valuations, could drive a step change in net margin expansion and overall EBITDA well beyond market forecasts.

- Sustained vehicle production growth in Brazil and Argentina, underpinned by rising middle-class vehicle ownership and newly launched green mobility government programs, could create multi-year demand tailwinds for MAHLE Metal Leve's core and hybrid component segments, resulting in consistent topline and earnings growth.

- The company's entrenched leadership in advanced engine systems and durable components, enhanced by investment in innovation and government-backed localization funding, positions it to win outsized share as emission standards and product life-cycle regulations intensify, lifting product mix and net margin quality over time.

- Expansion of a resilient aftermarket business, coupled with market share gains and a diversified product offering spanning agri-business, buses, and heavy-duty vehicles, creates a recurring, high-margin revenue base that is poised to stabilize earnings through cycles and support premium valuation multiples.

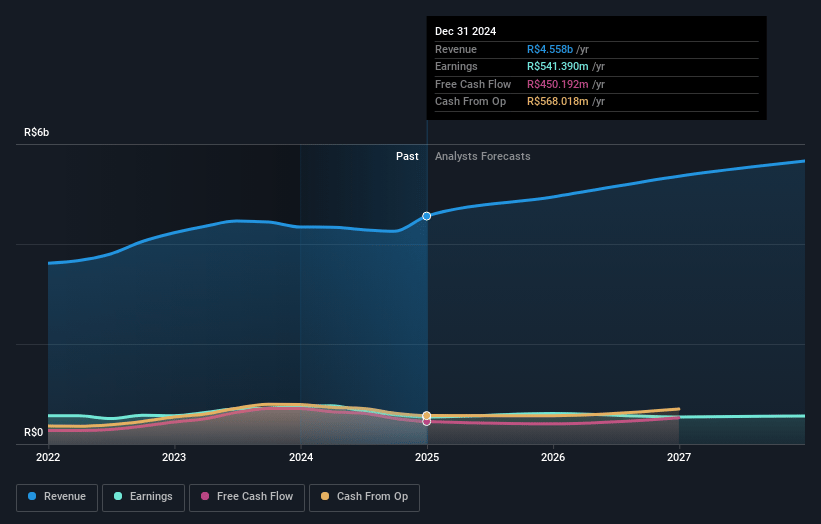

MAHLE Metal Leve Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on MAHLE Metal Leve compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming MAHLE Metal Leve's revenue will grow by 7.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.4% today to 11.4% in 3 years time.

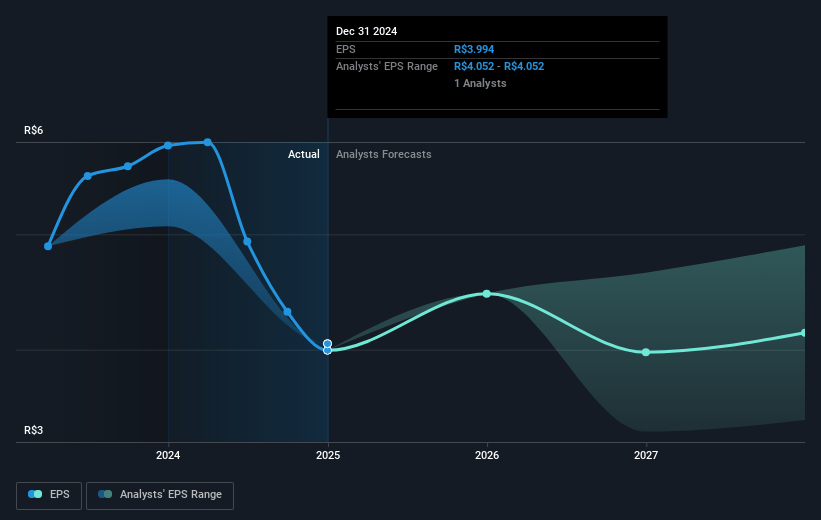

- The bullish analysts expect earnings to reach R$685.6 million (and earnings per share of R$4.98) by about July 2028, up from R$499.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 7.6x today. This future PE is greater than the current PE for the BR Auto Components industry at 8.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.48%, as per the Simply Wall St company report.

MAHLE Metal Leve Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MAHLE Metal Leve remains heavily dependent on the sale of traditional engine and transmission components such as pistons, rings, and liners, making the company highly vulnerable to the long-term decline in demand for internal combustion engine vehicles as electrification accelerates; this structural risk threatens future revenues as the addressable market shrinks.

- Despite recent forays into battery thermal management and cooling modules for electric vehicles, the scale of diversification remains limited, and the company's product mix continues to skew toward lower-growth segments, leaving margins at risk as high-value legacy products lose pricing power and earnings growth stagnates.

- Heightened global regulatory pressure, including green mobility programs in core markets and increasing emissions standards, will accelerate OEMs' transition away from combustion engines, forcing suppliers like MAHLE Metal Leve to invest heavily in R&D and capex for new technologies, which may suppress free cash flow and reduce profitability for several years before any payback from new segments materializes.

- Intensifying competition, both from established global suppliers and low-cost Chinese imports in the aftermarket and original equipment channels, is putting significant pressure on product pricing and market share, especially as the Argentinian and Brazilian markets experience increased openness and new entrants, leading to likely margin compression and reduced earnings quality.

- The company's recent financial results reveal declining gross and EBITDA margins-attributable to acquisitions in lower margin business lines and the core business shift-while persistent macroeconomic volatility in key export markets like Argentina and exposure to raw material and logistics cost inflation further elevate risks to net margins and overall earnings stability going forward.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for MAHLE Metal Leve is R$39.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MAHLE Metal Leve's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$39.0, and the most bearish reporting a price target of just R$26.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$6.0 billion, earnings will come to R$685.6 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 19.5%.

- Given the current share price of R$28.18, the bullish analyst price target of R$39.0 is 27.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.