Key Takeaways

- Accelerating adoption of electric and autonomous vehicles reduces demand for Fras-le's legacy products, threatening revenues and aftermarket dominance.

- Regulatory changes and industry consolidation pressure Fras-le to invest heavily in new technologies, risking lower margins and diminished bargaining power.

- Diversified growth, global expansion, and operational efficiencies have strengthened Fras-le's resilience and margin potential while reducing dependence on legacy products and single regions.

Catalysts

About Fras-le- Provides friction materials for braking systems and other products in Brazil, England, Argentina, the United States, China, India, Uruguay, the Netherlands, and internationally.

- Rapid global adoption of electric vehicles and hybrids threatens to significantly erode Fras-le's core aftermarket revenue stream, as demand for traditional brake friction materials and related components structurally declines, limiting long-term sales growth prospects and pressuring revenue.

- Shifting regulatory and consumer preferences toward sustainability could hasten obsolescence for Fras-le's legacy products, forcing substantial investment into environmentally friendly materials and new technologies that may not yield timely ROI, placing downward pressure on net margins.

- As mobility solutions like autonomous vehicles, shared fleets, and advanced driver-assistance systems become more prevalent, the frequency and value of replacement parts sales are poised to fall, undermining Fras-le's aftermarket dominance and curtailing future earnings.

- Persistent reliance on traditional friction materials, despite incremental diversification efforts, leaves Fras-le vulnerable to cyclical and secular contractions in its primary markets, raising the risk of stagnant or even declining EBITDA and overall profitability.

- Ongoing industry consolidation among major OEMs and Tier 1 suppliers is likely to intensify pricing pressure and contract size requirements, reducing Fras-le's bargaining power and potentially causing sustained gross margin compression as the company struggles to remain relevant in an evolving supply chain landscape.

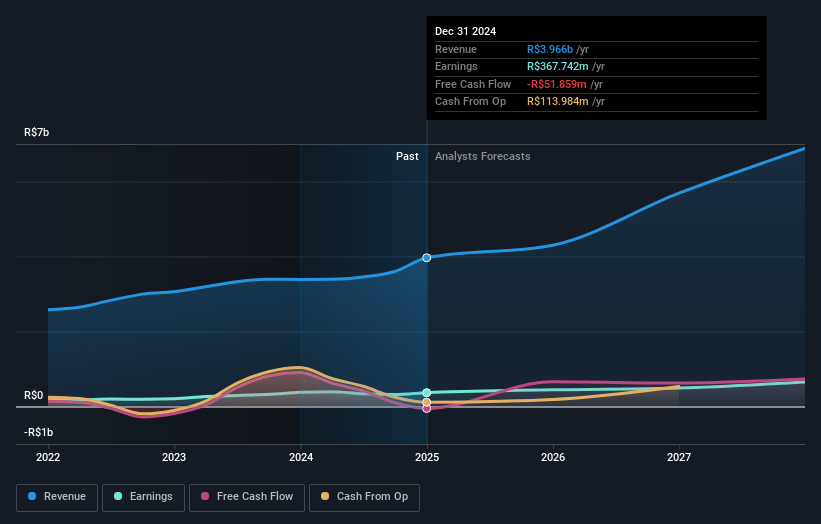

Fras-le Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Fras-le compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Fras-le's revenue will grow by 16.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.4% today to 8.8% in 3 years time.

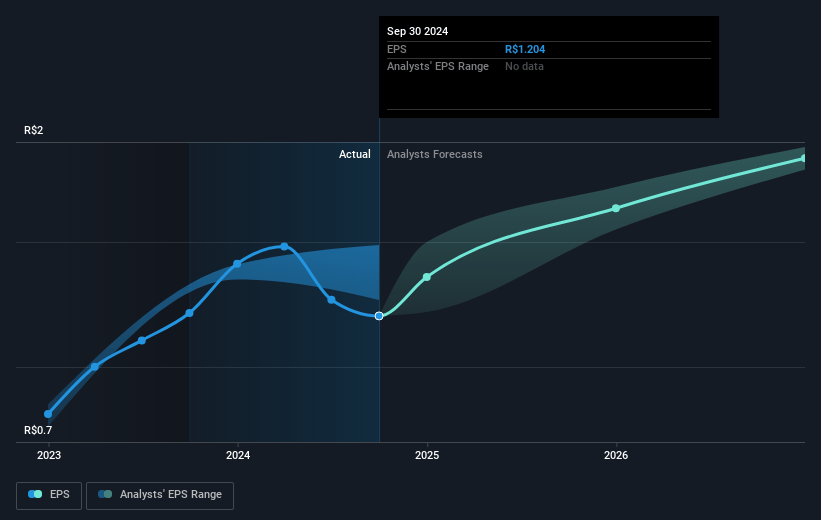

- The bearish analysts expect earnings to reach R$619.1 million (and earnings per share of R$2.4) by about July 2028, up from R$327.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, down from 20.3x today. This future PE is greater than the current PE for the BR Auto Components industry at 8.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.05%, as per the Simply Wall St company report.

Fras-le Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fras-le is experiencing robust organic growth, having increased market share in core Latin American geographies, gained new OEM customers in India, and relaunched product lines in Argentina, which together underpin the potential for sustained double-digit revenue growth over the coming years.

- Through the acquisition of Dacomsa, Fras-le has diversified its revenue base with Mexico now contributing approximately 25 percent of total revenue, unlocking significant operational and commercial synergies that should support higher consolidated EBITDA margins and future earnings.

- Strategic investments in manufacturing capacity (such as in Fremax and new advanced engineering hubs) and supply chain optimization are driving both improved production efficiency and the ability to capture cost-saving synergies, which can positively impact net profits and margins long term.

- The company's success in developing and integrating a more diverse product mix beyond traditional friction materials-including light line and motor spare parts, which now comprise over 50 percent of revenue-reduces reliance on legacy products, enhancing resilience to industry shifts and supporting sustained revenue growth.

- Fras-le's established global footprint, with factories and distribution operations in North America, Latin America, Europe, and Asia, together with the ability to localize production and re-balance supply chains in response to tariffs or trade policy changes, positions the company to manage regional disruptions effectively and maintain revenue and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Fras-le is R$23.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fras-le's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$34.1, and the most bearish reporting a price target of just R$23.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$7.0 billion, earnings will come to R$619.1 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 20.0%.

- Given the current share price of R$23.99, the bearish analyst price target of R$23.0 is 4.3% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.