Key Takeaways

- Syensqo is positioned for margin and revenue recovery as inventory destocking subsides and demand for lightweight, sustainable materials accelerates.

- Ongoing cost savings, decarbonization tailwinds, and reduced one-off expenses support future free cash flow growth and robust earnings expansion.

- Exposure to trade tensions, cost inflation, end-market weakness, and post-demerger execution risks threatens Syensqo's margins, earnings stability, and revenue predictability.

Catalysts

About Syensqo- Engages in the research, development, and production of advanced materials for industrial and consumer applications worldwide.

- Inventory destocking in the electronics and semiconductor segments—Syensqo's key headwind in Specialty Polymers—is expected to end in the second half of 2025, with customer order books indicating resumed purchases and stronger volumes, likely supporting top-line revenue and margin recovery.

- The surge in global defense and civil aerospace spending, most notably the €800 billion Rearm Europe plan and robust order books in the U.S. and India, is driving double-digit growth in composites for space and defense, positioning Syensqo to capture long-term revenue and earnings expansion as lightweight materials demand accelerates.

- Major capital expenditure projects (such as the PVDF facility in Tavaux and new growth CapEx) are peaking in 2025 and will roll off in 2026, while large one-off separation costs from the Solvay demerger will not repeat, improving free cash flow and net margin conversion in future years.

- The global transition toward decarbonization and demand for cleaner, sustainable materials is benefiting Syensqo’s advanced product portfolio—enabling higher market share, value-based pricing, and new contract wins, which should expand margins and support durable revenue growth.

- Accelerated restructuring and €200 million in targeted cost savings are on track to deliver margin expansion and offset inflationary pressures, with the restructuring benefits more weighted toward the second half of 2025 and full realization in 2026, positively impacting net profits and earnings growth.

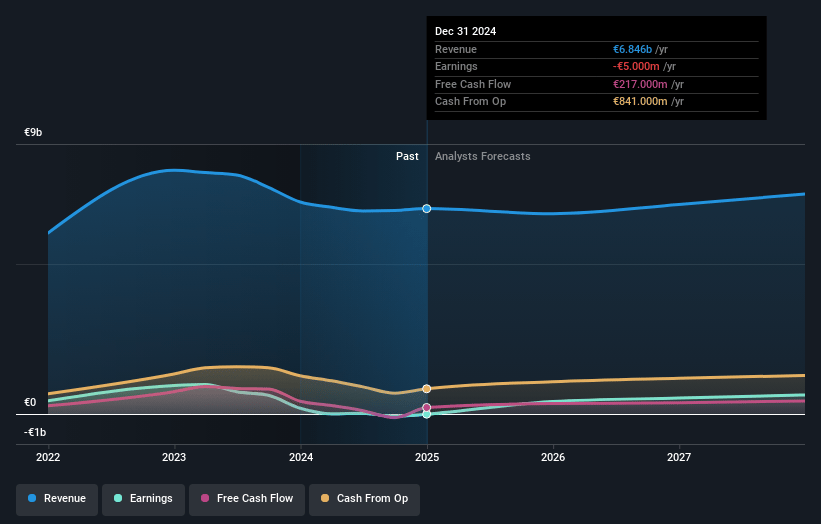

Syensqo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Syensqo's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.6% today to 8.1% in 3 years time.

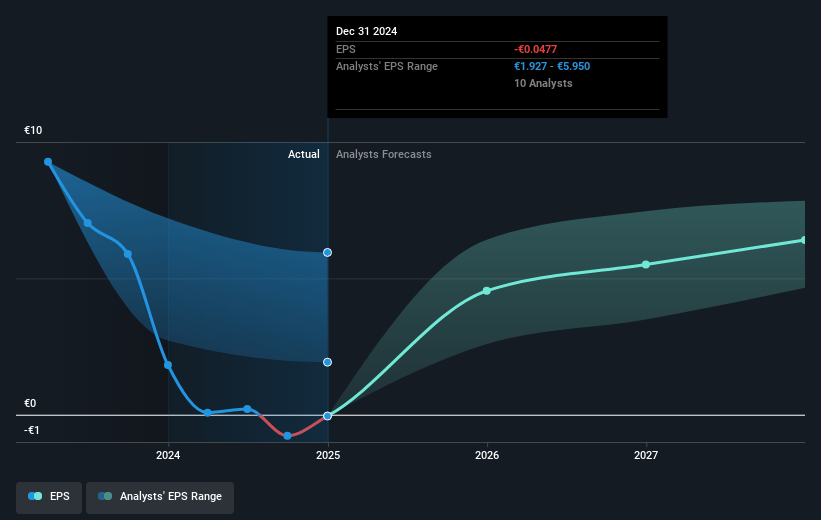

- Analysts expect earnings to reach €581.5 million (and earnings per share of €5.97) by about July 2028, up from €-108.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €669 million in earnings, and the most bearish expecting €431 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.6x on those 2028 earnings, up from -66.9x today. This future PE is lower than the current PE for the BE Chemicals industry at 27.6x.

- Analysts expect the number of shares outstanding to decline by 1.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Syensqo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global tariff volatility and escalating trade tensions, especially between the US and China, have increased uncertainty and operating costs for Syensqo, potentially impacting revenues through supply chain disruptions and lower demand visibility.

- Persistent volume declines in core Specialty Polymers—driven by significant year-on-year falls in electronics (30% down) and ongoing automotive sector headwinds—pose a risk to top-line growth and may lead to prolonged revenue and earnings pressure if end-market recoveries are slower or competition intensifies.

- Elevated inflation in input costs, particularly oleochemicals in Novecare and rising fixed/variable costs due to restructuring and efficiency programs, may outpace cost-saving initiatives, leading to margin compression and reduced net earnings.

- The company faces execution risks post-demerger from Solvay, including continued overhead from system separation, possible loss of operational synergies, and a lengthy transition period, all of which could elevate indirect costs and negatively affect net margins and free cash flow.

- Syensqo’s reliance on cyclical and concentrated end-markets (e.g., aerospace, defense, certain large electronic/semiconductor customers) increases vulnerability to external shocks and demand fluctuations, introducing higher earnings volatility and compromising revenue predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €81.938 for Syensqo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €95.0, and the most bearish reporting a price target of just €70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €7.2 billion, earnings will come to €581.5 million, and it would be trading on a PE ratio of 16.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of €70.52, the analyst price target of €81.94 is 13.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.