Key Takeaways

- Optimization of Port Logistics and IT integration could enhance net margins and earnings by reducing costs and improving asset utilization.

- Acquisitions and ESG investments may drive revenue growth, attract eco-friendly clients, and strengthen the business pipeline for stable future earnings.

- Decreased profitability and revenue, inefficient asset use, compressed margins, and significant debt could limit Silk Logistics Holdings' financial flexibility and growth potential.

Catalysts

About Silk Logistics Holdings- Provides port-to-door landside logistics and supply chain services in Australia.

- Silk Logistics is focusing on driving efficiencies and optimizing its Port Logistics property portfolio, which could help improve net margins through better utilization of assets and reducing unnecessary costs.

- The company is integrating technology solutions, like the 4PL distribution IT system, which is expected to improve carrier partner management, potentially reducing operational costs and enhancing earnings.

- The acquisition of Secon has expanded Silk's port-to-door logistics services, offering new bulk container logistics and bonded warehousing services, which could drive revenue growth from an expanded customer base and service offerings.

- The continued investment in ESG initiatives, such as the electric vehicle trial and reducing emissions in new facilities, may enhance Silk's reputation and attract environmentally conscious clients, positively impacting future revenue growth.

- New business wins and increased contracted recurring revenue underscore a growing business pipeline, likely bolstering future revenue and contributing to more stable earnings over time.

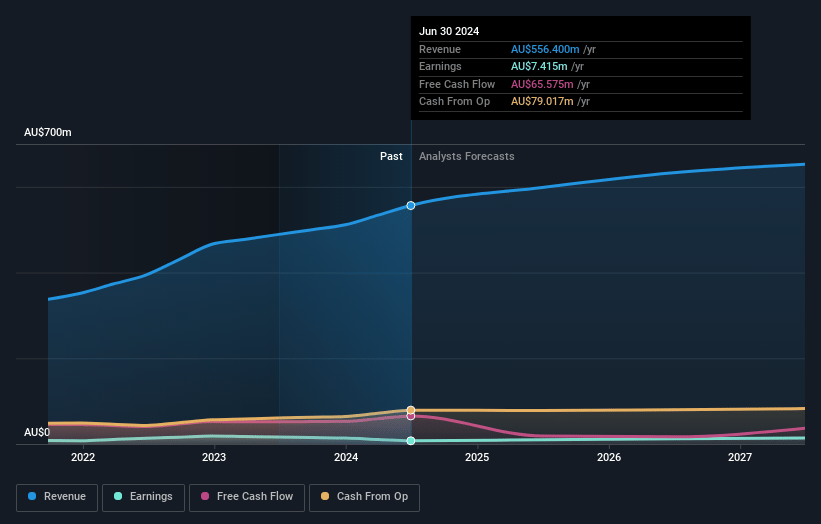

Silk Logistics Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Silk Logistics Holdings's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.2% today to 2.9% in 3 years time.

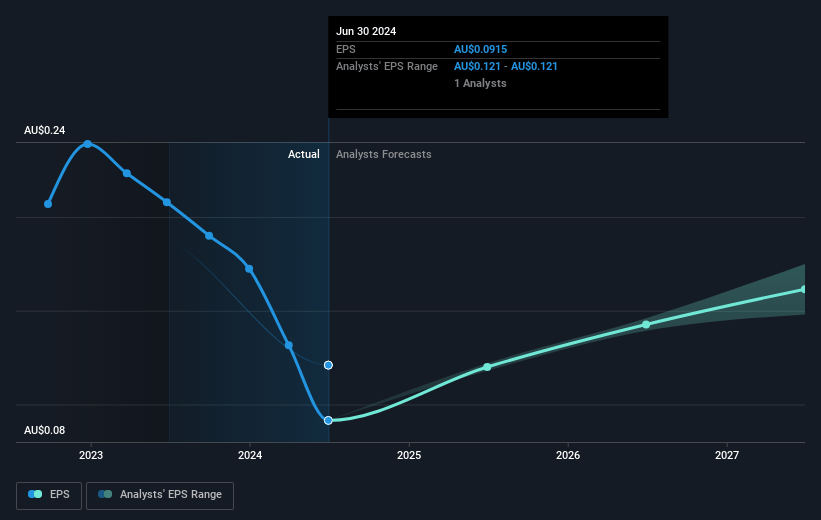

- Analysts expect earnings to reach A$20.0 million (and earnings per share of A$0.16) by about May 2028, up from A$-907.0 thousand today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from -135.3x today. This future PE is lower than the current PE for the AU Logistics industry at 15.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.4%, as per the Simply Wall St company report.

Silk Logistics Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant reduction in underlying NPAT from $7.6 million to $2.4 million could indicate challenges in generating net profits, potentially impacting future earnings growth.

- The decrease in warehouse occupancy to 71.7%, despite recent improvements, suggests inefficiencies in asset utilization, which could negatively influence revenue and margins.

- Higher depreciation and amortization charges related to new leases and the acquisition of Secon, as well as restructure costs, have compressed EBIT margins, impacting overall profitability.

- Contract logistics revenues decreased by 3.8%, affected by lower warehouse utilization and distribution volumes, which could constrain future revenue and earnings expansion.

- The company's net debt of $32.6 million, with leverage ratios of 2.3x net and 3.1x gross, although within covenants, may limit financial flexibility and constrain cash flow available for growth investments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$2.127 for Silk Logistics Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$677.7 million, earnings will come to A$20.0 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 11.4%.

- Given the current share price of A$1.5, the analyst price target of A$2.13 is 29.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.