Last Update 26 Nov 25

Fair value Decreased 12%CAT: Upcoming Industry Momentum Will Fuel Outperformance Over The Coming Year

Narrative Update on Catapult Sports

Analysts have revised their price target for Catapult Sports downward from A$7.97 to A$7.02, citing adjustments for fair value and discount rate. However, they maintain a positive outlook due to expectations of sustainable, above-consensus revenue growth in the sports technology sector.

Analyst Commentary

Recent analyst coverage has highlighted both positive momentum and key challenges for Catapult Sports. The following summarizes the main perspectives influencing valuation and investor sentiment.

Bullish Takeaways- Bullish analysts argue that the sports technology sector is positioned for sustained, above-average growth relative to broader economic indicators. This supports the company's strong revenue outlook.

- There is confidence in Catapult's ability to outperform consensus revenue estimates, which is attributed to its expanding market presence and robust product suite.

- The company's initiatives are expected to bolster its competitive advantage and drive further scale, which could positively impact long-term valuation.

- Recent price targets reflect expectations that revenue growth will remain resilient, even with changing market conditions.

- Bearish analysts remain cautious about the pace at which projected revenue growth can be achieved. They cite uncertainties around market adoption and execution risks.

- There are ongoing concerns regarding the sustainability of valuation multiples, especially if sector growth slows or broader economic conditions change.

- Downward revisions to price targets indicate potential sensitivity to discount rates and evolving assumptions about fair value.

What's in the News

- Catapult Sports Ltd completed a Follow-on Equity Offering totaling AUD 13.26 million, issuing 2,074,750 ordinary shares at AUD 6.39 per share (Key Developments).

- The company completed another Follow-on Equity Offering for AUD 130 million, issuing 19,461,078 ordinary shares at AUD 6.68 each. This offering also included a subsequent direct listing feature (Key Developments).

- Catapult Sports Ltd filed for a Follow-on Equity Offering of AUD 130 million, mirroring recent successful transactions (Key Developments).

- The company filed for a separate Follow-on Equity Offering of AUD 20 million, planning to issue nearly 3 million shares at AUD 6.68 per share (Key Developments).

- Catapult Sports Ltd was added to the S&P/ASX 200 Index, reflecting its growing significance in the Australian market (Key Developments).

Valuation Changes

- Fair Value: Decreased from A$7.97 to A$7.02. This reflects a downward adjustment in overall company valuation.

- Discount Rate: Marginally reduced from 8.05% to 7.99%. This indicates a slight shift in risk assessment for future cash flows.

- Revenue Growth: Increased slightly from 17.49% to 17.60%. This suggests higher expected top-line expansion.

- Net Profit Margin: Improved from 7.00% to 11.37%. This signals stronger expected profitability.

- Future P/E: Declined substantially from 136.63x to 79.56x. This indicates a lower price-to-earnings multiple based on forward estimates.

Key Takeaways

- Strong revenue growth driven by cross-selling, innovative product introductions, and entry into new verticals and markets.

- High customer retention and operating leverage highlight stable revenue stream and significant growth potential in emerging women's sports market.

- Heavy reliance on new products and key sports markets faces execution risks and potential revenue fluctuations amidst competitive, geopolitical, and regulatory challenges.

Catalysts

About Catapult Group International- A sports science and analytics company, provides sporting teams and athletes with technologies designed to optimize athlete performance, avoid injury, and improve return to play in Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

- Catapult's annualized contract value (ACV) rose by 20% year-over-year, driven by cross-selling and expansion into new verticals, indicating strong future revenue growth and increased customer engagement.

- The introduction of innovative products such as the Sideline Video analysis for American Football and new algorithms for various sports is expected to enhance the product suite and drive revenue growth by attracting new customers and expanding the existing base.

- High customer retention rates (96.2%) and strong growth in average ACV per Pro Team (11% year-over-year) suggest a stable revenue stream and potential for further margin expansion through ongoing cross-selling efforts.

- The company's operating leverage has resulted in a 75% year-over-year incremental profit margin, highlighting efficiencies that are expected to enhance net margins as the business scales.

- Expansion into the growing women's sports market and potential adoption of new technologies by major leagues (e.g., NFL) represent significant growth opportunities that could positively impact revenue and contribute to sustained earnings growth.

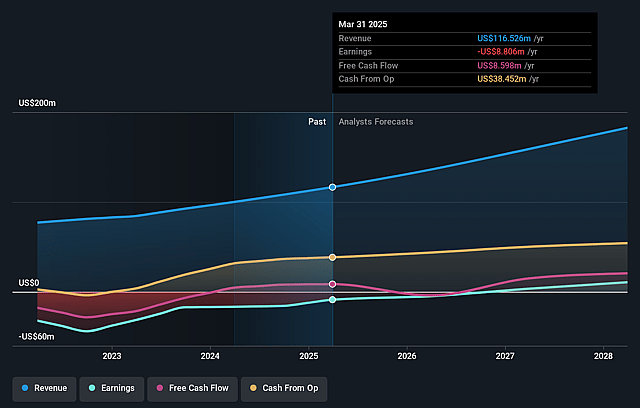

Catapult Group International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Catapult Sports's revenue will grow by 15.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -7.6% today to 5.9% in 3 years time.

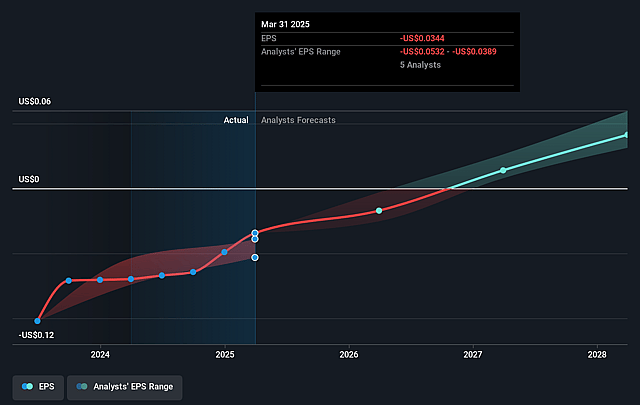

- Analysts expect earnings to reach $10.6 million (and earnings per share of $0.04) by about September 2028, up from $-8.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $12.0 million in earnings, and the most bearish expecting $9.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 142.5x on those 2028 earnings, up from -115.3x today. This future PE is greater than the current PE for the AU Software industry at 33.4x.

- Analysts expect the number of shares outstanding to grow by 1.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.98%, as per the Simply Wall St company report.

Catapult Group International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Catapult's growth strategy relies heavily on the success of its new products and cross-selling, especially the Sideline Video product in American Football, which could face competitive threats or changes in NCAA rules impacting revenue and ACV growth.

- The company's decision to cease operations in the Russian market, though only impacting less than 1% of future revenue, highlights risks related to geopolitical issues that could affect earnings in other regions.

- The reliance on a few key sports markets, such as American Football and soccer, may expose Catapult to revenue fluctuations due to changes in those industries, like shifts in league investments or regulations.

- There is a dependence on maintaining high ACV retention and successful multi-vertical growth, which carries execution risks; any decline in customer satisfaction or increased churn could impact recurring revenues and profitability.

- Despite impressive growth and cash flow improvements, the company's need to strengthen its balance sheet and reduce remaining debt underscores potential financial instability risks, affecting net margins in the event of unexpected expenses or revenue shortfalls.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$6.623 for Catapult Sports based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$7.65, and the most bearish reporting a price target of just A$6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $180.9 million, earnings will come to $10.6 million, and it would be trading on a PE ratio of 142.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$5.83, the analyst price target of A$6.62 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Catapult Sports?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.