Key Takeaways

- The dual-channel market strategy and strategic leadership hiring are set to enhance U.S. market penetration and significantly drive future revenue growth.

- New product approvals and strong validation through peer-reviewed studies are expected to bolster market credibility and diversify revenue streams.

- Heavy reliance on the U.S. market and TELA Bio poses risks due to tariffs, competition, and potential changes in Medicare policies affecting revenue and margins.

Catalysts

About Aroa Biosurgery- Develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix (ECM) technology in the United States and internationally.

- The successful establishment and expansion of Aroa's direct sales team, along with the complementary partnership with TELA Bio, provides a robust market penetration strategy in the U.S. This dual-channel approach is expected to drive future revenue growth significantly.

- The development and expected approval of new components within the Enivo technology platform could lead to product line expansion, enhancing revenue streams and potentially improving net margins due to diversified product offerings.

- The completion and publication of over 100 peer-reviewed studies confirming product efficacy and safety is likely to bolster Aroa's market credibility and attraction within hospitals. This strong body of evidence could contribute to increased sales and revenue growth.

- Continued strategic hiring, including new leadership in the marketing division and a Director of Training, is poised to enhance the effectiveness and efficiency of the U.S. sales operations, likely driving increased revenue and potentially improved net margins through better alignment with market strategies.

- Positive cash flow developments and maintained revenue guidance ($81 million to $84 million) demonstrate financial discipline and operational efficiency, which could translate into sustained profitability and improved earnings.

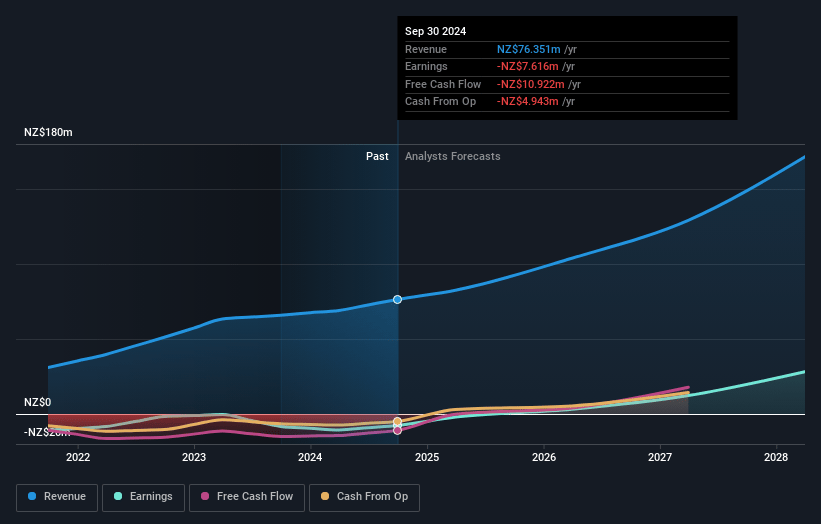

Aroa Biosurgery Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aroa Biosurgery's revenue will grow by 25.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -10.0% today to 13.5% in 3 years time.

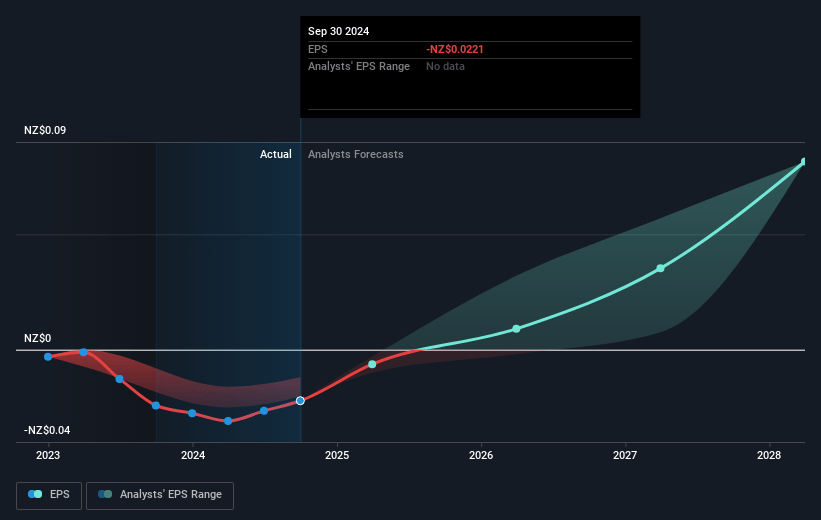

- Analysts expect earnings to reach NZ$20.2 million (and earnings per share of NZ$0.06) by about May 2028, up from NZ$-7.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from -21.5x today. This future PE is lower than the current PE for the AU Biotechs industry at 21.1x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.47%, as per the Simply Wall St company report.

Aroa Biosurgery Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The U.S. government has imposed 10% tariffs on New Zealand goods, which could impact Aroa Biosurgery's cost structure and net margins, although the company expects the net impact to be significantly lower than 10%.

- TELA Bio, Aroa's commercial partner responsible for a significant portion of sales, has experienced sales headwinds such as loss of sales staff and fierce competition, which could affect future revenue growth for Aroa.

- Aroa heavily relies on the U.S. market, with over 95% of sales concentrated there, posing a risk to revenue diversity and exposing the company to potential market-specific economic or regulatory changes.

- Changes in Medicare and insurer policies could affect hospital ordering patterns and demand, potentially impacting revenue and profits on both the Myriad and OviTex product lines.

- Any financial instability of TELA Bio, such as entering Chapter 10 bankruptcy proceedings, could disrupt distribution channels and sales, impacting Aroa's revenue, although the company claims it is positioned to handle such a situation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.846 for Aroa Biosurgery based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$0.95, and the most bearish reporting a price target of just A$0.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NZ$150.3 million, earnings will come to NZ$20.2 million, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$0.44, the analyst price target of A$0.85 is 48.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.