Last Update26 Aug 25Fair value Increased 47%

The significant increase in Perenti's future P/E multiple despite lower revenue growth expectations suggests an upward re-rating of its valuation, driving the consensus analyst price target higher from A$1.65 to A$2.13.

What's in the News

- Announced ordinary dividend of AUD 0.0425 for the six months ended June 30, 2025.

- Provided fiscal year 2026 revenue guidance of $3.45 billion to $3.65 billion.

- Reaffirmed fiscal year 2025 revenue and EBIT(A) guidance.

- Extended buyback plan duration to September 9, 2025.

Valuation Changes

Summary of Valuation Changes for Perenti

- The Consensus Analyst Price Target has significantly risen from A$1.65 to A$2.13.

- The Future P/E for Perenti has significantly risen from 8.52x to 11.36x.

- The Consensus Revenue Growth forecasts for Perenti has significantly fallen from 4.1% per annum to 2.7% per annum.

Key Takeaways

- Expansion into new regions, digital innovation, and strong ESG positioning are broadening market opportunities, improving efficiency, and enhancing Perenti's revenue growth and margins.

- Improved cash flow and reduced debt are enabling increased investment, higher shareholder returns, and strengthening overall financial resilience.

- Margin pressure, geographic risk, talent shortages, and rising ESG compliance threaten Perenti's revenue stability, earnings growth, and ability to diversify or sustainably expand profits.

Catalysts

About Perenti- Operates as a mining services company worldwide.

- The accelerating demand for critical minerals (such as copper, lithium, and nickel) driven by global energy transition and electrification is fueling a large and sustained pipeline of projects, which underpins Perenti's long-term contract opportunities and provides high revenue visibility and growth potential.

- Expanded presence and contract wins in North America and ongoing diversification beyond Africa and Australia are reducing geographic concentration risk, broadening Perenti's addressable market, and positioning it to capture a larger share of global mining investment, supporting future revenue growth and margin stability.

- Adoption and commercialization of digital mining solutions and automation (via investments in idoba and fleet optimization) are expected to improve operational efficiency and safety, supporting gradual EBITDA margin expansion and higher long-term earnings.

- The steady trend among mining companies to outsource complex operations to contractors with strong ESG credentials and technical expertise plays to Perenti's strengths, as tightening environmental and social standards favor established, diversified operators-supporting both contract pipeline growth and premium pricing, enhancing margins.

- Record cash generation and ongoing deleveraging have strengthened the balance sheet, enabling Perenti to allocate additional capital toward growth projects, pay higher dividends and conduct buybacks, all of which are likely to support EPS and shareholder returns in the medium to long term.

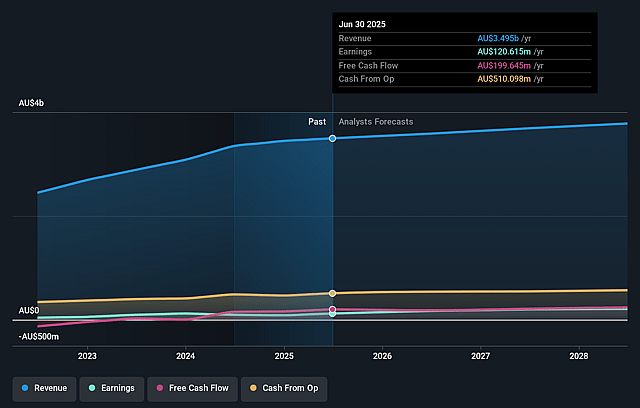

Perenti Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Perenti's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.5% today to 5.5% in 3 years time.

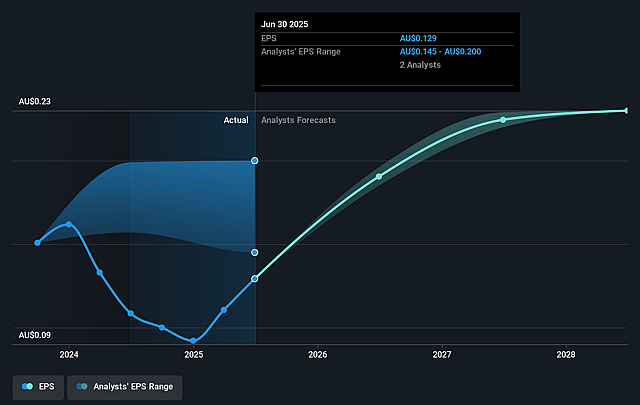

- Analysts expect earnings to reach A$208.7 million (and earnings per share of A$0.23) by about September 2028, up from A$120.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, down from 18.0x today. This future PE is lower than the current PE for the AU Metals and Mining industry at 15.5x.

- Analysts expect the number of shares outstanding to decline by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.55%, as per the Simply Wall St company report.

Perenti Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent margin pressure and client bargaining power, especially in contract mining, could limit Perenti's ability to sustainably expand net margins, as evidenced by past financial underperformance in Botswana and recent project conclusions, potentially capping long-term earnings growth.

- Geographic concentration in Africa and Australia, with relatively new and small exposure in North America, increases exposure to political instability, regulatory changes, and operational disruptions, which could adversely impact revenue stability and future cash flow.

- Slower recovery in exploration drilling and ongoing underutilization in areas such as Mining and Technology Services indicate that macro industry headwinds or technological disruption could limit top-line growth and reduce Perenti's ability to diversify earnings streams.

- Structural workforce challenges in the mining sector, including skill shortages and labor inflation, could elevate operational costs and slow project delivery, placing further pressure on operating margins and overall profitability.

- Increasingly stringent ESG requirements and evolving regulatory frameworks may elevate compliance costs and restrict permit access, particularly in higher-risk jurisdictions, potentially delaying projects and eroding future revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$2.42 for Perenti based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.65, and the most bearish reporting a price target of just A$2.15.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$3.8 billion, earnings will come to A$208.7 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 7.5%.

- Given the current share price of A$2.34, the analyst price target of A$2.42 is 3.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.