Key Takeaways

- Strategic focus on efficiency and cost management is expected to enhance net margins and profitability, notably by transforming Australian hospitals and revisiting capital expenditure.

- Rising private health insurance demand and tech-driven operational efficiencies portend positive revenue growth and margin improvements.

- Operational challenges in international divisions and inflationary pressures could impact margins, earnings, and strategic direction, while low occupancy and cost pressures present additional risks.

Catalysts

About Ramsay Health Care- Owns and operates hospitals in Australia, and internationally.

- The focus on transforming the Australian hospitals by leveraging growth plans at a catchment level suggests that efficient utilization can drive increased revenue and improved margins. These improvements can stem from targeting specific areas for growth and ensuring facilities operate at maximum efficiency, impacting overall earnings positively.

- Strategically ceasing expansionary capital expenditure in Elysium and focusing on operational rigor indicates a shift towards improving capital returns through increased efficiency and cost management, which can enhance net margins and overall profitability.

- The increase in demand for private health insurance in Australia, despite economic pressures, suggests a positive outlook for revenue growth. Ramsay Health expects this trend to continue supporting growth in their services, potentially increasing both top-line and bottom-line results.

- The ramp-up and expansion of emergency departments, which contribute significantly to overnight admissions, is expected to drive more high acuity work, thus increasing overall revenue and potentially improving margins due to higher complexity case management.

- The ongoing digital transformation and investments in technology, including AI and data systems, are designed to enhance operational efficiencies and reduce administrative burdens. This technological focus is well-positioned to streamline operations, potentially increasing net margins and boosting long-term earnings.

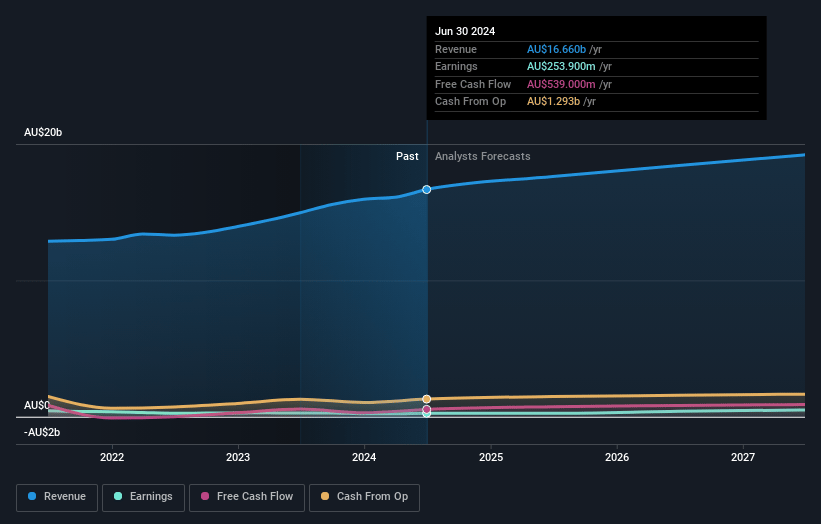

Ramsay Health Care Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ramsay Health Care's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.0% today to 2.6% in 3 years time.

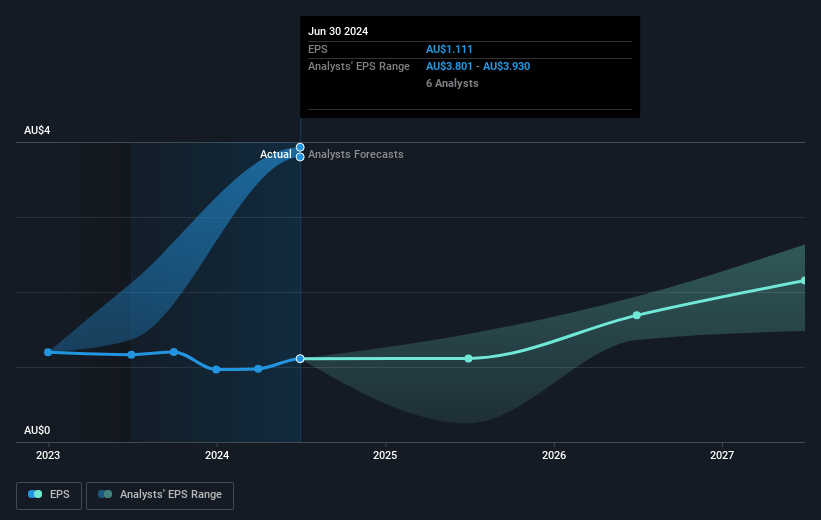

- Analysts expect earnings to reach A$525.6 million (and earnings per share of A$2.26) by about May 2028, up from A$8.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.3x on those 2028 earnings, down from 955.5x today. This future PE is lower than the current PE for the AU Healthcare industry at 133.0x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Ramsay Health Care Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Challenges in Ramsay’s international operations, particularly in the Elysium and Ramsay Santé divisions, are leading to low returns on capital and underperformance, potentially impacting net margins and earnings.

- The appointment of Goldman Sachs to explore options for Ramsay’s stake in Ramsay Santé suggests strategic uncertainties that could affect future revenues and capital returns.

- Sustained inflationary pressures and wage increases, especially in France and the UK, are not fully reflected in tariff indexation, which could compress net margins.

- The continued low occupancy rates in Elysium, paired with a costly $305 million impairment charge, reflect operational challenges that may hinder earnings growth.

- Ongoing negotiations with private health insurers concerning cost pressures indicate potential risks to revenue if Ramsay cannot secure favorable terms to counteract inflationary impacts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$41.026 for Ramsay Health Care based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$58.0, and the most bearish reporting a price target of just A$36.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$19.9 billion, earnings will come to A$525.6 million, and it would be trading on a PE ratio of 22.3x, assuming you use a discount rate of 7.5%.

- Given the current share price of A$33.26, the analyst price target of A$41.03 is 18.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.