Last Update01 May 25

Key Takeaways

- Partnership with Medidata and intellectual property control enhancements forecast expanded operations and new revenue streams through optimized sales opportunities and technology partnerships.

- Technological investments in data analytics and infrastructure aim to boost market share and operational efficiency, improving margins and accelerating revenue recognition.

- Decreased contracted future revenue and reduced workforce may challenge long-term growth, while larger competitors threaten Cogstate's market share in the CNS segment.

Catalysts

About Cogstate- A neuroscience technology company, engages in the creation, validation, and commercialization of digital brain health assessments used in both academic and industry sponsored research.

- The partnership with Medidata is expected to significantly scale Cogstate's operations by accessing their broader reach and resources, potentially increasing future revenue through new sales opportunities in diverse clinical trial indications outside of traditionally focused areas.

- Recent technological investments in advanced analytics and automated data analysis are anticipated to lead to market share gain and efficiency, potentially driving higher net margins through cost reductions and enhanced operational efficiency.

- The renegotiation with Eisai allows Cogstate to regain control of its intellectual property in the primary care market, opening opportunities for partnerships in technology adoption and potential revenue streams in clinical trial prescreening activities.

- Continued investment in commercializing data insights and analytics via a modern data lake infrastructure will drive quality improvements and efficiency, contributing to enhanced gross margins by providing advanced data monitoring solutions to customers.

- The trend in executing sales contracts that have a faster revenue recognition timeline, due to a shift in the mix of clinical trial indications towards shorter-duration contracts, forecasts an increase in short to mid-term earnings.

Cogstate Future Earnings and Revenue Growth

Assumptions

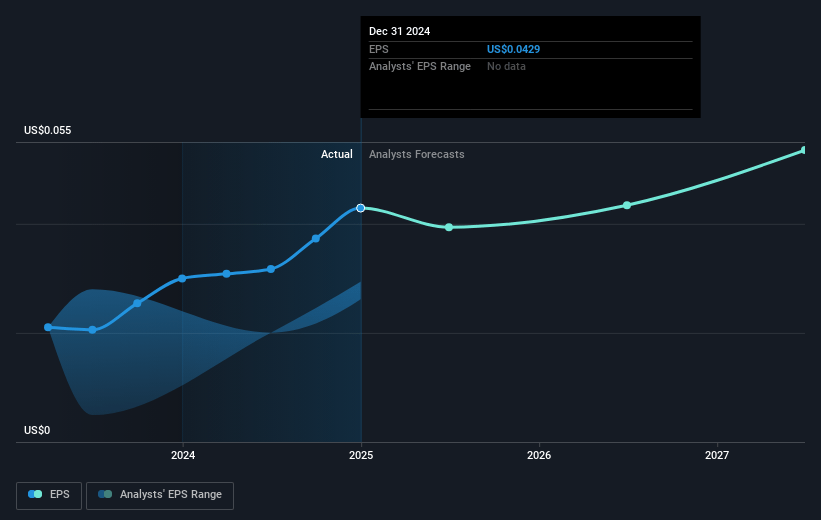

How have these above catalysts been quantified?- Analysts are assuming Cogstate's revenue will grow by 10.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.6% today to 14.9% in 3 years time.

- Analysts expect earnings to reach $9.4 million (and earnings per share of $0.05) by about May 2028, up from $7.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.8x on those 2028 earnings, up from 19.6x today. This future PE is lower than the current PE for the AU Healthcare Services industry at 128.5x.

- Analysts expect the number of shares outstanding to grow by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Cogstate Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The renegotiation of the Healthcare license agreement with Eisai led to a reduction in future receipts by approximately $15 million, which decreases future Healthcare revenue and impacts growth prospects for this segment.

- The revenue recognized in the first half of '25 was higher than sales contracts executed, resulting in an 8% reduction in the value of contracted future Clinical Trials revenue, which could affect future earnings.

- Contracted future revenue at 31 December 2024 was down 20% compared to the previous year, indicating potential challenges in sustaining long-term revenue growth.

- The company's significant workforce reduction could pose risks if not managed properly, potentially affecting operational capacity and efficiency, thus impacting net margins.

- While CNS market growth presents opportunities, the increasing interest and involvement of larger competitors, like Medidata, could introduce competitive pressures that might impact Cogstate's market share and future revenue potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.5 for Cogstate based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $62.9 million, earnings will come to $9.4 million, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of A$1.33, the analyst price target of A$1.5 is 11.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.