Last Update 11 Nov 25

Fair value Increased 1.82%ANN: Confidence Remains High Despite Tariff Risks and Buyback Initiative Ahead

Analysts have raised their price target for Ansell from A$36.41 to A$37.07. They cite continued confidence in the company's valuation despite industry-wide concerns about tariffs and modest improvements in revenue growth and profit margin projections.

Analyst Commentary

Bullish Takeaways

- Bullish analysts view Ansell’s stock price as undervalued and suggest that the current market discount more than compensates for risks such as potential tariffs.

- Confidence remains high in the company’s ability to maintain positive valuation metrics, even without upward revisions to underlying forecasts.

- Stable price targets reflect expectations that modest improvements in revenue growth and margins may support share price gains over the medium term.

- Ongoing upgrades to "Buy" ratings indicate that analysts see attractive risk-reward prospects based on both current fundamentals and future growth potential.

Bearish Takeaways

- Bearish analysts remain cautious about the impact of tariffs on healthcare personal protective equipment and the broader industry environment.

- There is limited optimism around near-term earnings upgrades, with price targets left largely unchanged alongside the ratings adjustments.

- Concerns persist regarding the pace of revenue growth and the ability to materially improve profit margins in a challenging market.

What's in the News

- Ansell has opened its first Ansell Xperience & Innovation Studio (AXIS) in Alpharetta, Georgia. This new facility provides a collaborative environment for safety innovation, education, and live product demonstrations. Plans are underway to expand with a new AXIS location in Coimbra, Portugal next year. (Company announcement)

- Ansell's Board of Directors has authorized a share buyback plan effective August 25, 2025. The company will repurchase up to 14,594,488 shares, representing 10% of its issued share capital, as a capital management initiative. The program remains valid until September 7, 2026. (Company announcement)

- Ansell is actively seeking acquisitions as part of its strategy. The company is focusing on productivity investments and greater automation in manufacturing processes to enhance growth and differentiation. (Company announcement)

Valuation Changes

- Fair Value Estimate has risen slightly from A$36.41 to A$37.07, reflecting a modest upward adjustment.

- Discount Rate increased from 7.54% to 7.79%, which indicates a slightly higher risk premium used in valuation models.

- Revenue Growth projection increased marginally from 4.80% to 4.93% per year.

- Net Profit Margin forecast is essentially unchanged, moving narrowly from 10.19% to 10.20%.

- Future Price-to-Earnings (P/E) Ratio edged up from 18.19x to 18.48x.

Key Takeaways

- Strong demand in PPE, new product innovation, and global expansion support sustained revenue and earnings growth for Ansell.

- Automation, efficiency improvements, and sustainability initiatives are expected to drive margin expansion and higher long-term cash flow.

- Shifting regulatory, competitive, and sustainability dynamics threaten Ansell's profitability and sales growth due to rising costs, changing customer preferences, and margin pressures.

Catalysts

About Ansell- Designs, sources, develops, manufactures, distributes, and sells hand and body protection solutions in the Asia Pacific, Europe, the Middle East, Africa, Latin America, the Caribbean, and North America.

- Accelerating demand for healthcare PPE and medical products, fueled by the aging global population and rising regulatory safety standards-combined with Ansell's new product launches and innovation (such as antimicrobial gloves and sustainable materials)-should support robust multi-year revenue growth and an improving gross margin profile.

- Heightened workplace safety awareness and infectious disease concerns, post-COVID, continue to drive durable, higher-value PPE usage, supporting both volume and pricing power for Ansell's specialized offerings and thus expected to boost long-term earnings growth.

- Ongoing automation, ERP rollout, and productivity investments (APIP), along with the successful KBU integration, are expected to drive further cost reductions, manufacturing efficiency, and operational leverage-translating into EBIT margin expansion and stronger free cash flow.

- Ansell's diversified geographic and vertical market presence-in combination with growth in emerging market healthcare infrastructure (e.g., India, China, Brazil)-strategically positions the company to capture international expansion opportunities and underpin resilient, above-market revenue growth.

- Increased customer focus on supply chain security and sustainability, compounded by Ansell's leadership in recycling programs (e.g., RightCycle) and low-carbon/eco-friendly products, is likely to enhance customer loyalty and unlock higher-margin sales channels, positively impacting net margins and return on capital over the long run.

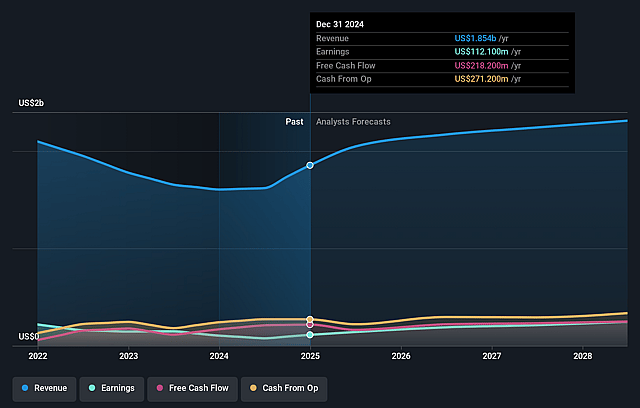

Ansell Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ansell's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.1% today to 10.3% in 3 years time.

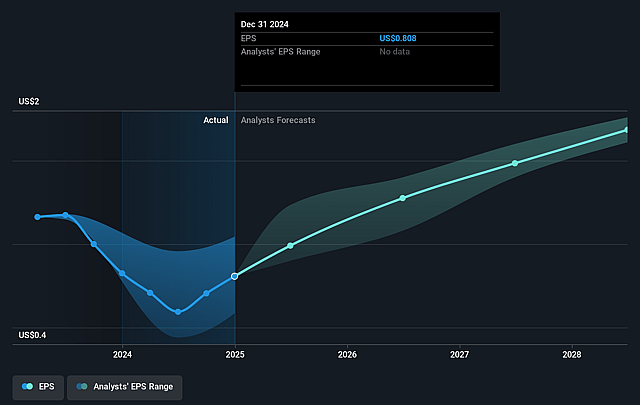

- Analysts expect earnings to reach $237.4 million (and earnings per share of $1.7) by about September 2028, up from $101.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $265 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, down from 32.1x today. This future PE is lower than the current PE for the AU Medical Equipment industry at 34.5x.

- Analysts expect the number of shares outstanding to decline by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.55%, as per the Simply Wall St company report.

Ansell Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising global focus on sustainability and environmental regulations could increase the regulatory burden and costs associated with Ansell's reliance on single-use plastics and synthetic materials in its PPE products, risking margin pressure and potential revenue declines if product portfolios are perceived as less eco-friendly.

- Ongoing margin pressure from higher raw material costs (such as latex and nitrile) combined with limited ability to pass those costs to customers-especially in more commoditized product segments-could weigh on net margins and earnings growth, particularly if tariffs and inflation persist or intensify.

- Growing competition from lower-cost Asian manufacturers as well as potential industry commoditization may erode Ansell's market share and price realization, resulting in slower revenue growth and downward pressure on profitability over the long term.

- The emergence of advanced reusable or biodegradable alternatives in PPE, alongside evolving customer sustainability preferences and regulatory changes, may reduce demand for Ansell's core disposable glove products and negatively affect long-term sales growth.

- Ongoing industry consolidation, including increased purchasing power among healthcare group purchasing organizations and major distributors, could further compress prices and contract terms, impacting Ansell's ability to maintain revenue growth and healthy net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$36.153 for Ansell based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $237.4 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$34.53, the analyst price target of A$36.15 is 4.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.