Key Takeaways

- Expansion into genetic molecular testing and operational efficiency initiatives are set to bolster revenue growth and enhance net margins.

- Strategic acquisitions domestically and internationally offer accelerated growth potential by expanding market share and leveraging synergies.

- Post-COVID revenue uncertainties, inflationary pressures, and potential Medicare rebate cuts pose significant risks to Australian Clinical Labs' profitability and revenue growth.

Catalysts

About Australian Clinical Labs- Provides pathology diagnostic services in Australia.

- Australian Clinical Labs is expanding its capabilities in genetic molecular testing services, including new carrier screening and melanoma tests, which are expected to bolster revenue growth as they gain market adoption.

- The company's operational efficiency program, including labor efficiency improvements and automation in lab operations (Lab of the Future), is anticipated to enhance net margins by reducing costs and increasing productivity.

- ACL's digital transformation and AI initiatives, particularly in billing and data entry processes, are projected to increase private billing revenue and enhance earnings through improved operational efficiency.

- The gap in pre-COVID and current expected volumes ($60 million revenue shortfall) is anticipated to close as GP availability improves, which could lead to a significant increase in revenue as volumes return to trend levels.

- ACL's strategic focus on acquisitions, both domestically and potentially internationally, provides a pathway for accelerated growth in revenue and earnings by expanding market share and leveraging synergies.

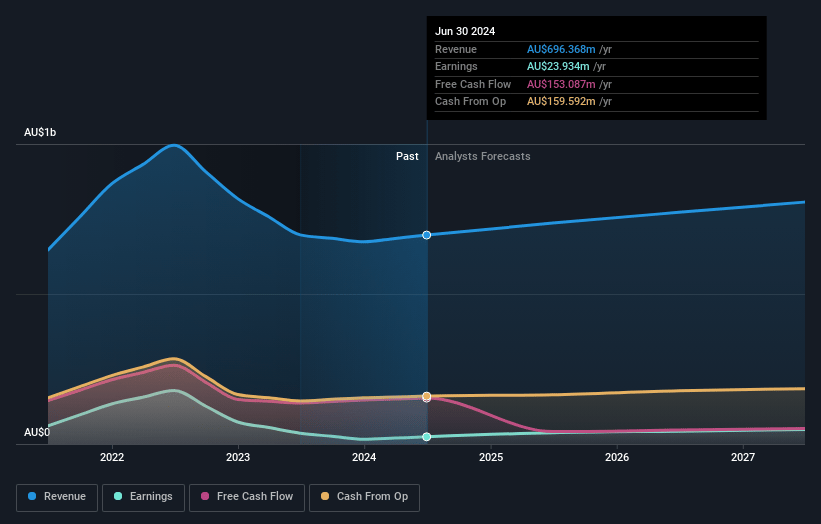

Australian Clinical Labs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Australian Clinical Labs's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.2% today to 5.7% in 3 years time.

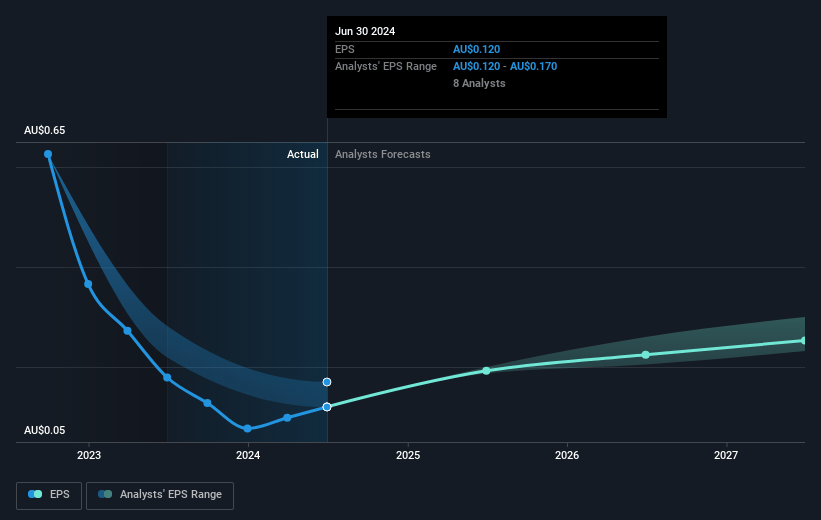

- Analysts expect earnings to reach A$48.2 million (and earnings per share of A$0.24) by about May 2028, up from A$30.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, down from 20.0x today. This future PE is lower than the current PE for the AU Healthcare industry at 133.0x.

- Analysts expect the number of shares outstanding to decline by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Australian Clinical Labs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The large gap in expected trend volumes post-COVID, amounting to approximately $60 million in revenue, indicates a significant revenue downside risk if the volumes do not recover to pre-COVID levels. This impacts revenue and overall earnings potential.

- Continued inflationary pressures, particularly in labor costs (including a 3.75% increase in wages and superannuation), may squeeze net margins despite operational efficiencies. This could lead to reduced profitability.

- Fluctuating and uncertain volume trends, particularly in the first half of the fiscal year, suggest potential volatility in revenue streams, making it challenging to maintain consistent growth and stable earnings.

- Potential government-imposed reductions in Medicare rebates and incomplete compensation through patient billing could constrain revenue growth and negatively influence net margins.

- High value consumables used in carrier screening and respiratory tests, combined with inflationary trends, could increase costs disproportionately and thus compress margins if not adequately offset by pricing strategies or volume growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.783 for Australian Clinical Labs based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.0, and the most bearish reporting a price target of just A$3.15.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$838.2 million, earnings will come to A$48.2 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of A$3.12, the analyst price target of A$3.78 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.