Key Takeaways

- The focus on private assets could affect revenue growth if listed investments don't capitalize on market momentum and private market growth assumptions are overly optimistic.

- The significant uranium exposure coupled with weak spot prices and international investment execution risks could lower earnings and affect net asset growth.

- Soul Pattinson's diverse investments, strong balance sheet, and private market focus support high cash flow, stable dividends, and revenue growth amidst market volatility.

Catalysts

About Washington H. Soul Pattinson- An investment company, engages in investing various industries and asset classes in Australia.

- The market's high valuations and Soul Pattinson's deliberate strategy to prioritize investments in private assets over listed portfolios suggest a potential for lower returns from listed investments if they fail to capitalize on market momentum. This might impact revenue growth.

- A significant allocation to uranium-exposed companies in the emerging companies portfolio, coupled with current weakening uranium spot prices, presents the risk of lower-than-expected performance if the anticipated long-term growth in the nuclear industry does not materialize. This could impact earnings.

- The focus on increasing cash generation from private equity and credit portfolios, while beneficial, also signals reliance on these assets to maintain high cash flows amidst lower dividends in the market. If growth assumptions in these private markets are overly optimistic, net margins might suffer.

- They are increasing investments in international private credit and equity markets, but a lack of on-the-ground presence may introduce execution risks and affect their ability to capitalize on these opportunities, potentially affecting earnings.

- Soul Patts' reduction in its large caps portfolio due to concerns over elevated market valuations suggests potential underperformance in this sector could lead to stagnating net asset growth, impacting future shareholder returns.

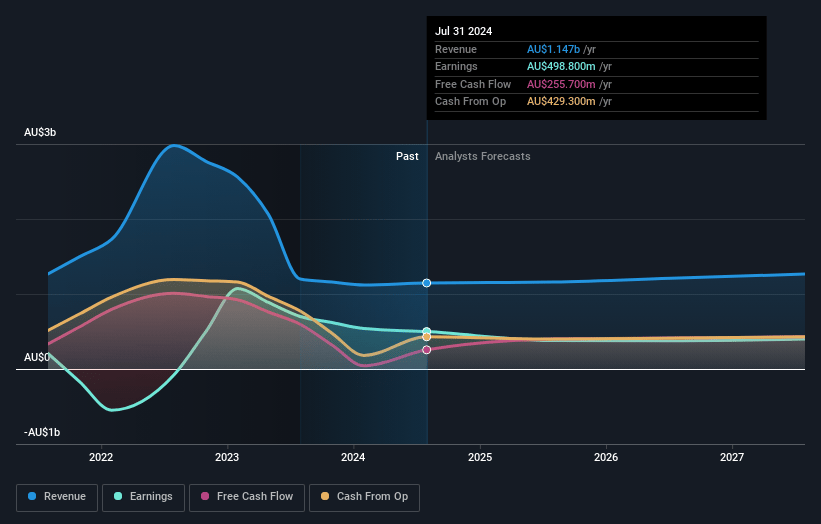

Washington H. Soul Pattinson Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Washington H. Soul Pattinson's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 38.8% today to 30.3% in 3 years time.

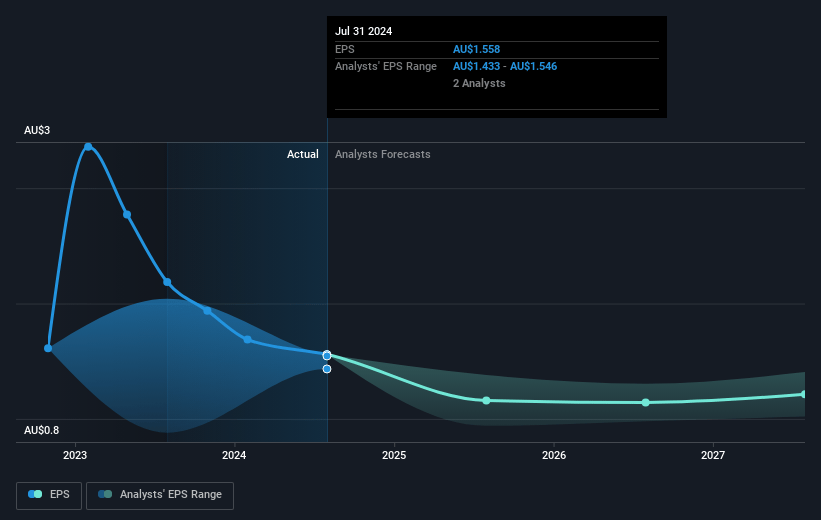

- Analysts expect earnings to reach A$398.3 million (and earnings per share of A$1.12) by about April 2028, down from A$523.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.4x on those 2028 earnings, up from 24.8x today. This future PE is greater than the current PE for the AU Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

Washington H. Soul Pattinson Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Soul Pattinson's strategic investment approach and portfolio diversity have resulted in a strong capacity for cash flow generation, which underpins the company's ability to pay increasing dividends. This resilience and growth in cash generation could positively impact revenue and earnings, challenging the belief in a share price decline.

- The company maintains a robust net asset value (NAV), which has compounded at 12.8% annually over the past three years, surpassing market growth rates. This strong performance and the ability to add $650 million to shareholder wealth over and above market returns suggests potential for continued capital appreciation, impacting revenue and net margins.

- Soul Pattinson's large exposure to private equity and credit markets, which offer greater returns than public markets, indicates a deliberate strategy for long-term growth and income generation. This focus on private markets enhances revenue and earnings potential due to less correlation with equity markets.

- The company's strong balance sheet, with significant cash reserves and low debt levels, provides them financial flexibility to seize new investment opportunities and navigate market uncertainties. This financial strength supports stable net margins and revenue growth.

- Historical outperformance against market downturns, with the company performing 2.4% better than the market during down months, illustrates the defensive qualities of its portfolio. This suggests resilience that could preserve revenue and earnings amidst broader market declines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$35.6 for Washington H. Soul Pattinson based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.3 billion, earnings will come to A$398.3 million, and it would be trading on a PE ratio of 42.4x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$35.27, the analyst price target of A$35.6 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.