Last Update 15 Dec 25

ALL: Rising Dividend And Stable Margins Will Support Stronger Returns

Analysts have modestly raised their price target on Aristocrat Leisure, reflecting slightly higher assumed discount rates and a marginal uptick in long-term valuation multiples, as macro uncertainties appear less disruptive to earnings than previously feared.

Analyst Commentary

Analyst perspectives on Aristocrat Leisure highlight a balanced mix of optimism around earnings resilience and caution regarding valuation and macro risk, with recent target moves reflecting these cross-currents.

Bullish Takeaways

- Bullish analysts see the modest target increase as confirmation that macro headwinds are proving less disruptive to Aristocrat Leisure's earnings trajectory than initially feared, supporting a premium to historical valuation multiples.

- Stabilizing external conditions and a lack of severe downside surprises in recent trading updates are viewed as evidence that the business can compound earnings through cycles, underlining confidence in long term growth assumptions.

- The incremental uplift in long term valuation multiples suggests growing conviction that Aristocrat Leisure can continue to execute on product innovation and market share gains, particularly in digital and high margin segments.

- By resetting discount rates only slightly higher while still raising the target, bullish analysts signal that Aristocrat Leisure's cash flow durability and balance sheet strength are sufficient to absorb a more conservative macro framework.

Bearish Takeaways

- Bearish analysts are wary that the recent target upgrade is modest relative to the share price move year to date, implying limited upside if execution or industry growth normalizes from elevated levels.

- Higher assumed discount rates underscore persistent concerns around interest rate volatility and broader risk premia, which could compress multiples if sentiment towards cyclical or gaming exposed names deteriorates.

- Some remain cautious that consensus long term growth expectations embed a smooth earnings path that may not fully account for regulatory shifts, competitive intensity, or potential pullbacks in discretionary spending.

- The reliance on slightly higher valuation multiples to support the new target is seen by more conservative investors as leaving less margin of safety if Aristocrat Leisure underdelivers on pipeline, cost discipline, or capital allocation.

What's in the News

- Aristocrat Leisure Limited increased its ordinary dividend to AUD 0.49 per share for the six months ended September 30, 2025, signaling confidence in cash flow and earnings visibility (Key Developments).

- The dividend will be paid on December 8, 2025, providing a near term capital return to shareholders (Key Developments).

- Shares will trade ex dividend on November 25, 2025, with a record date of November 26, 2025, setting the timetable for eligible investors (Key Developments).

Valuation Changes

- Fair Value Estimate: unchanged at A$72.81 per share, indicating no revision to the intrinsic value assessment.

- Discount Rate: risen slightly from 7.93 percent to 8.00 percent, reflecting a modestly more conservative risk and macro assumption set.

- Revenue Growth: effectively unchanged at about 5.35 percent, suggesting a stable outlook for top line expansion.

- Net Profit Margin: effectively unchanged at about 26.85 percent, implying no material shift in expected profitability levels.

- Future P/E: risen slightly from 27.36x to 27.42x, pointing to a marginally higher valuation multiple applied to forward earnings.

Key Takeaways

- Strategic divestitures and integration of new business units could enhance market reach and focus on core strengths, potentially increasing growth and profits.

- Market share gains, optimized operations, and strategic R&D investments are expected to sustain profitability, boost content deployment, and support expansion into new markets.

- The company's reliance on North America and strategic investments may risk revenue stability and increase debt, while earnings face pressure from asset sales and impairments.

Catalysts

About Aristocrat Leisure- Operates as a gaming content and technology company in Australia and internationally.

- The integration of NeoGames and the establishment of Aristocrat Interactive are expected to drive significant growth, with opportunities in iLottery and iGaming expanding market reach and potentially increasing revenue.

- The successful sale of Plarium and the strategic review of Big Fish Games may allow Aristocrat to focus more on its core gaming strengths, potentially enhancing future revenue growth and profit margins.

- Market share gains in North America and a strong lineup of new gaming content (such as Phoenix Link and the Baron Upright cabinet) are expected to sustain and possibly increase revenue and profitability.

- Ongoing cost management efforts and supply chain optimizations have already led to margin expansions, which are expected to continue supporting net margin improvements.

- Continued focus on strategic R&D investments and technology enhancements is anticipated to accelerate content deployment and facilitate expansion into new markets, potentially boosting long-term revenue and earnings growth.

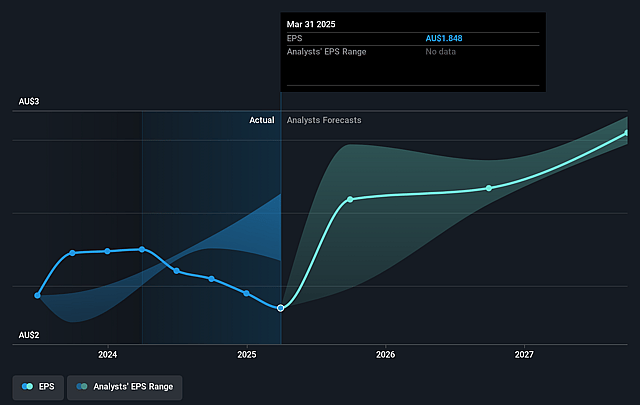

Aristocrat Leisure Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aristocrat Leisure's revenue will grow by 2.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.0% today to 26.6% in 3 years time.

- Analysts expect earnings to reach A$2.0 billion (and earnings per share of A$3.26) by about September 2028, up from A$1.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.1x on those 2028 earnings, down from 36.8x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to decline by 0.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Aristocrat Leisure Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of Plarium is expected to be dilutive to NPATA by mid

- to high single-digit percentage points in FY '25, which may impact overall earnings negatively.

- The impairment charge of approximately USD 110 million related to Big Fish Games indicates challenges in that segment, potentially affecting revenue and net margins.

- The high reliance on North American gaming operations for profit growth signifies a dependency on this market, which could pose risks to revenue stability if market conditions shift unfavorably.

- Ongoing strategic M&A and investments, while aimed at growth, may require significant capital, impacting cash flows and potentially leading to increased debt levels if not managed efficiently.

- The integration of NeoGames and the associated investments could lead to higher operating costs in the near term, possibly impacting net margins until the integration and scaling are fully realized.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$71.522 for Aristocrat Leisure based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$79.3, and the most bearish reporting a price target of just A$52.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$7.3 billion, earnings will come to A$2.0 billion, and it would be trading on a PE ratio of 28.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$69.04, the analyst price target of A$71.52 is 3.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Aristocrat Leisure?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.