Key Takeaways

- The Build, Transform, and Grow strategy aims to improve earnings quality and consistency, enhancing revenue and margins across segments.

- Strategic initiatives in Building and RV Solutions, alongside digital innovations, are projected to boost revenue growth and profitability.

- The RV Solutions segment faces challenges from reduced discretionary spending and cost pressures, while limited reinvestment opportunities may hinder long-term growth for Fleetwood.

Catalysts

About Fleetwood- Engages in the design, manufacture, sale, and installation of modular accommodation and buildings in Australia and New Zealand.

- The Build, Transform, and Grow strategy provides a roadmap for medium

- to long-term improvements in earnings quality and consistency, thus enhancing revenue and net margins across operating segments.

- The company's significant investment in scaling its Building Solutions capabilities and maintaining a robust order bank, which is expected to generate up to a 30% revenue uplift in the second half of FY '25, is likely to positively impact revenue and earnings.

- The strategic review and restructuring of the RV Solutions segment, aimed at achieving a return to profitability in the second half of FY '25, are expected to contribute to earnings by reducing costs and enhancing operational efficiencies.

- Community Solutions' increased contracted occupancy rates and high demand for accommodations like Searipple and Osprey Villages are anticipated to further expand EBIT margins due to increased revenue and profitability from higher utilization.

- The commercialization of the Glyde technology platform and digital initiatives in RV Solutions, such as digital commerce platforms, are poised to drive revenue growth and improve customer engagement, ultimately contributing to increased revenue and potentially higher margins.

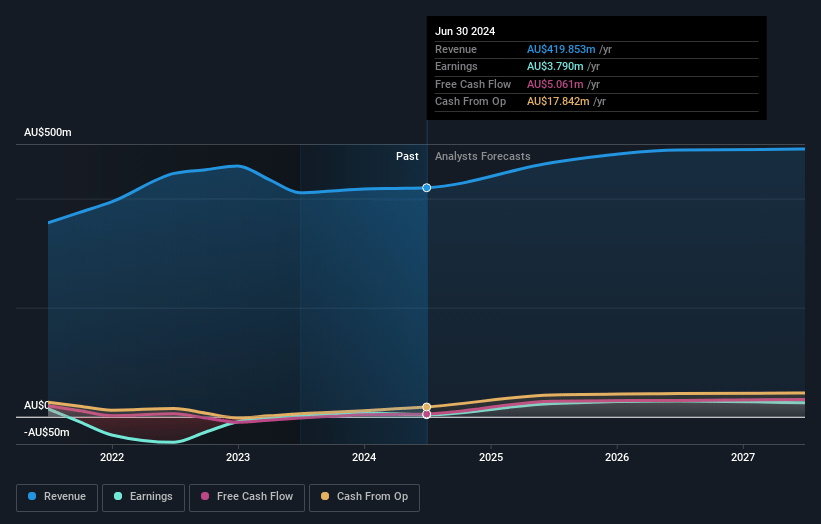

Fleetwood Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fleetwood's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.0% today to 6.7% in 3 years time.

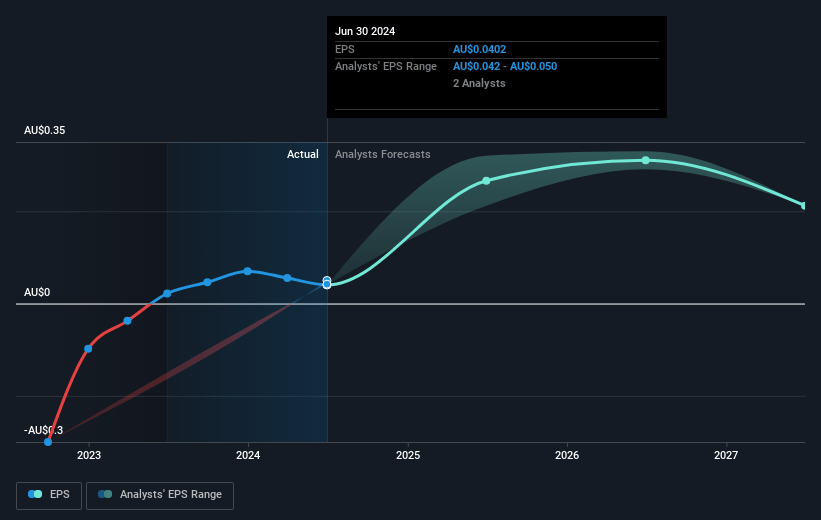

- Analysts expect earnings to reach A$36.8 million (and earnings per share of A$0.27) by about July 2028, up from A$4.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 55.3x today. This future PE is lower than the current PE for the AU Consumer Durables industry at 18.2x.

- Analysts expect the number of shares outstanding to decline by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.77%, as per the Simply Wall St company report.

Fleetwood Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The RV Solutions segment is experiencing headwinds due to cost-of-living pressures affecting consumer discretionary spending, which has led to softer demand, higher input costs, and an inability to pass on price increases, impacting margins and profitability. This could negatively affect overall earnings.

- The company has taken a $6 million goodwill impairment and $1.9 million in restructuring costs for the RV Solutions business, which indicates significant financial adjustments and challenges in that segment, negatively affecting net margins.

- While Building Solutions is seeing growth, the segment faces potential seasonal revenue softening, which could result in fluctuating margins and affect the overall financial performance of the company.

- Future opportunities in modular construction, especially relating to government contracts, may not materialize quickly due to slowed initiatives, as seen with the New South Wales government's modular task force, potentially impacting future revenue streams.

- The company's strategy to maintain a high dividend distribution of 100% of net profit after tax along with limited immediate capital investment opportunities could restrict reinvestment into growth initiatives, potentially affecting long-term revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$2.795 for Fleetwood based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$551.8 million, earnings will come to A$36.8 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 7.8%.

- Given the current share price of A$2.75, the analyst price target of A$2.8 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.