Key Takeaways

- Recent acquisitions and expanded distribution are creating new efficiency gains, revenue growth, and access to under-penetrated markets.

- Investments in digital infrastructure, higher-margin proprietary products, and ESG-aligned offerings are driving margin expansion and sustainable, long-term earnings growth.

- Dependence on acquisitions, China-based supply chains, rising tech investment, and competition from digital disruptors all threaten Stealth's revenue stability, margins, and growth ambitions.

Catalysts

About Stealth Group Holdings- Operates as an industrial distribution company in Australia and internationally.

- Integration of recent acquisitions-including Force Technology-has materially expanded Stealth's distribution footprint, added 3,000+ retail outlets, and unlocked cross-selling and cost synergies, which have only just started to flow through, pointing to ongoing efficiency gains and revenue acceleration as the expanded network matures and under-penetrated regions are targeted (impacts: revenue, net margins).

- Strong ramp-up in proprietary and private label product lines (currently 16% of sales vs. a 10% 2028 target) and exclusive brands, alongside value-added offerings such as Tool Hire (85% margins), are set to lift gross margins and drive sustainable earnings growth as the higher-margin portfolio mix increases (impacts: gross margin, net margins, earnings).

- Stealth's significant investments in digital infrastructure, B2B e-commerce, AI-driven automation, and multi-channel online marketplaces (including JB Hi-Fi, Woolworths) position the company to capture growing B2B e-commerce demand, tap new customer segments, and lower SG&A costs-enhancing top-line growth and margin expansion as digital adoption accelerates across Australia (impacts: revenue, operating costs, net margins).

- Heightened focus on workplace safety and ESG compliance is driving increased demand for certified PPE and safety products-Stealth's core offering (e.g., RIVO brand launch, partnerships with top global suppliers), suggesting a resilient, growing end-market and revenue opportunities as regulatory standards tighten over time (impacts: revenue).

- Ongoing industry consolidation and Stealth's disciplined capital allocation-emphasizing high-return growth, productivity gains, and shutdown of underperforming operations-are enabling further scale benefits, recurring B2B revenue streams, and operational leverage, setting the stage for robust, long-term EBITDA and EPS expansion (impacts: EBITDA margins, EPS, profitability).

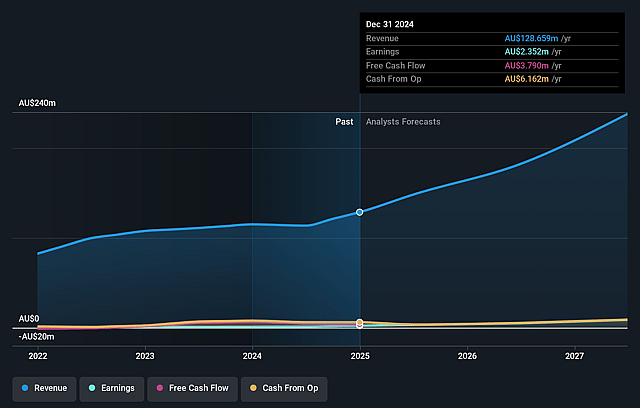

Stealth Group Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Stealth Group Holdings's revenue will grow by 30.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 4.5% in 3 years time.

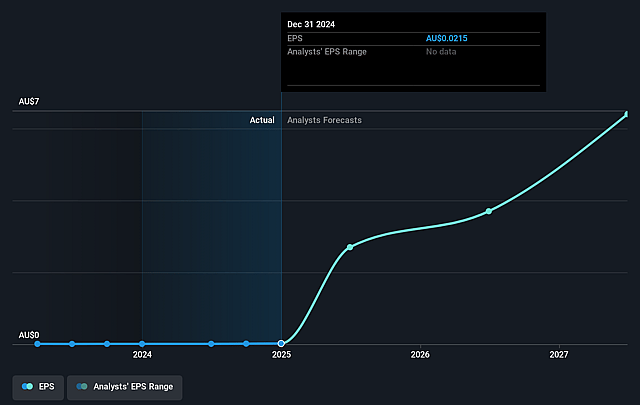

- Analysts expect earnings to reach A$14.2 million (and earnings per share of A$0.1) by about September 2028, up from A$3.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, down from 33.8x today. This future PE is greater than the current PE for the AU Trade Distributors industry at 16.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.06%, as per the Simply Wall St company report.

Stealth Group Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy strategic reliance on ongoing acquisitions and integration of recently acquired brands (such as Force Technology and private labels) carries risk of execution failures, cultural misfits, or underperforming units, which could disrupt operational efficiency and impede revenue growth and margin expansion.

- The company's significant exposure to supply chains and manufacturing in China presents persistent geopolitical, trade, and tariff risks; escalation (e.g., US-China tensions or cost shocks) could raise input costs or disrupt product availability, negatively affecting gross margins and earnings.

- Accelerating B2B digital transformation and e-commerce adoption by manufacturers (including direct-to-customer models and online competitors with greater scale or lower cost structures) could bypass or outcompete Stealth's distribution channels, eroding long-term revenue and market share.

- Recent investments in technology, AI, inventory, and store upgrades have sharply increased capital expenditures, diverging from historical norms; a failure to translate these into sufficient productivity gains or sales uplift could compress net margins and reduce free cash flow, impairing future profitability.

- Company targets for substantial growth depend on continued expansion into new geographies, channels, and value-added services, but slower than expected adoption, customer churn (especially among large B2B clients), or weaker industrial sector demand could stall top-line growth and drive earnings volatility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.27 for Stealth Group Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$312.5 million, earnings will come to A$14.2 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of A$0.82, the analyst price target of A$1.27 is 35.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.