Key Takeaways

- Urbanization and housing shortages are fueling long-term demand, while eco-friendly product innovation and regulation position GWA for market share gains and higher margins.

- Focus on digital transformation, recurring revenues, and strong financial discipline supports operational efficiency, strategic expansion, and sustained shareholder returns.

- Heavy reliance on the Australian market, weak key segments, and uncertainty in cost benefits expose GWA Group to risks of stagnant growth and margin pressure.

Catalysts

About GWA Group- Research, designs, manufactures, imports, and markets building fixtures and fittings to residential and commercial premises in Australia, New Zealand, the United Kingdom, and internationally.

- Sustained urban population growth and ongoing housing stock shortages in Australia and the UK are expected to drive increased demand for new builds and multi-residential construction, supporting long-term revenue growth for GWA as the market recovers.

- Rising regulation and consumer preference for water-efficient and sustainable building products are likely to benefit GWA's pipeline of innovative offerings and recent eco-friendly product launches, positioning the company for market share gains and premium pricing, which supports future revenue and net margin expansion.

- GWA's focused investment in new product development and digital transformation, including smart product ranges and enhanced digital platforms, is expected to drive differentiation, capture higher-margin sales, and improve operational efficiency, bolstering net margins and cash flow over the medium term.

- Strong execution of maintenance plumber engagement and continuous merchant partnership expansion (e.g., "Win the Plumber" and growing spare part sales) are deepening recurring revenue streams from repair and renovation markets, supporting predictable earnings even in tougher construction cycles.

- The company's robust cash generation, disciplined cost control, and low leverage provide capacity for strategic bolt-on acquisitions or further capital returns while enhancing long-term earnings growth and supporting higher shareholder returns through dividends and buybacks.

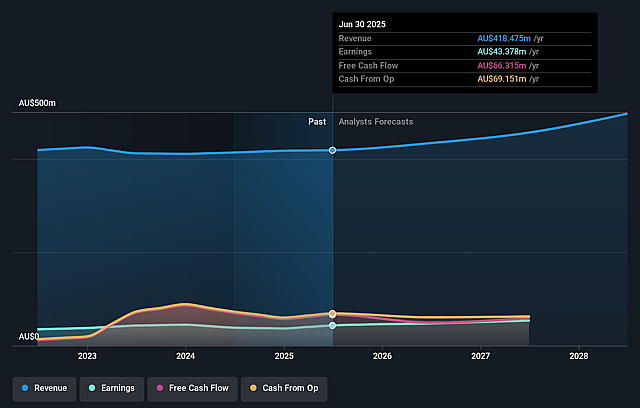

GWA Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GWA Group's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.4% today to 12.0% in 3 years time.

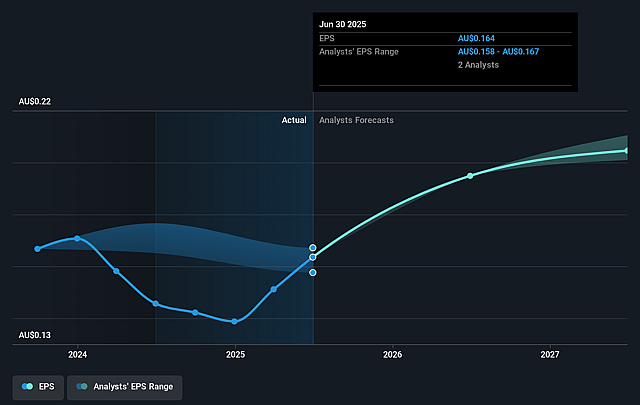

- Analysts expect earnings to reach A$59.5 million (and earnings per share of A$0.23) by about September 2028, up from A$43.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.9x on those 2028 earnings, up from 15.5x today. This future PE is greater than the current PE for the AU Building industry at 16.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.13%, as per the Simply Wall St company report.

GWA Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A prolonged decline and ongoing weakness in key markets like New Zealand and soft residential/commercial segments in New South Wales, Australia, exposes GWA Group to persistent headwinds, risking stagnating or declining group revenue if these markets do not recover as expected.

- The company's heavy reliance on Australia (84% of group revenue) and limited international diversification heightens vulnerability to regional economic downturns, interest rate shifts, or local construction industry slowdowns, which could negatively affect revenue stability and future earnings.

- Structural headwinds in the Australian market, such as uncertain timing of multi-residential recoveries, persistent subdued renovation/repair activity due to cost of living pressures, and delayed or limited new housing/commercial completions, threaten future volume and revenue growth prospects.

- The emergence of pricing pressures, as customers opt for more affordable products and lower-margin product mixes, combined with margin impacts from exchange rate fluctuations, may offset gains from cost discipline and limit long-term net margin expansion.

- Although cost controls and operational efficiencies have delivered margin improvement, sustainability is uncertain due to ongoing supply chain/manufacturer challenges (such as those in China); if such cost benefits are not repeatable, normalized EBIT and future net margins may come under pressure.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.0 for GWA Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$496.8 million, earnings will come to A$59.5 million, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 8.1%.

- Given the current share price of A$2.53, the analyst price target of A$3.0 is 15.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.