Key Takeaways

- Overcapacity in Europe and external trade barriers threaten prices and revenue growth, despite efforts in cost leadership and geographic diversification.

- Input cost inflation and slow demand in mature markets may hinder margin improvements and make future earnings vulnerable to regional disruptions.

- Structural overcapacity, soft demand, and rising competition threaten long-term pricing power and margins, with recent improvements driven mostly by cost-saving measures rather than durable market strength.

Catalysts

About Mayr-Melnhof Karton- Manufactures and sells cartonboard and folding cartons in Germany, Austria, and internationally.

- While long-term demand for cartonboard is expected to benefit from the accelerating move away from plastic and stricter environmental regulations that incentivize renewable packaging, Mayr-Melnhof Karton continues to face persistent industry overcapacity, especially in virgin fiberboard in Europe. This overcapacity could result in continued price pressures and limit revenue growth over the medium to long term.

- Although sustained investment in production technology and efficiency initiatives have supported recent improvements in operating profit and demonstrate potential for margin expansion, the company's ability to drive further gains may be constrained by increasing input cost inflation and labor expenses in Europe, ultimately threatening net margin stabilization if unable to pass through costs.

- Even as structural e-commerce growth and population shifts are supportive of packaging demand globally, current soft consumer goods demand and the risk of demand stagnation in mature European markets where the company remains heavily exposed could constrain volumes and suppress topline revenue growth relative to global peers.

- While Mayr-Melnhof has diversified its product mix and geographic footprint through acquisitions and targeted growth in higher value-added packaging segments, its ongoing reliance on the European supply-demand dynamic for core cartonboard remains a vulnerability, potentially exposing future earnings to regional market disruptions and growing competitive intensity from global industry players.

- Despite completing targeted mill closures and emphasizing cost leadership, the slow pace of industry-wide rationalization and possible redirection of Nordic supply into Europe due to external trade barriers may result in further downward price pressure. This could weigh on both average selling prices and operating profitability if excess capacity persists longer than anticipated.

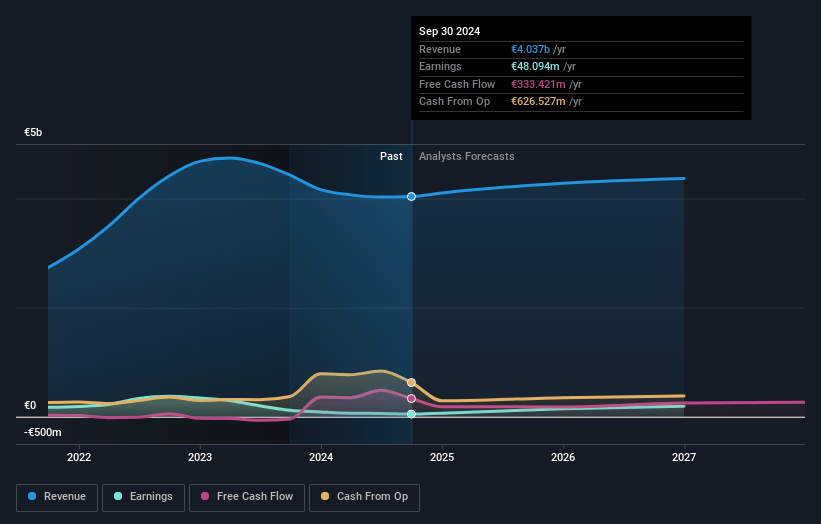

Mayr-Melnhof Karton Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mayr-Melnhof Karton compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mayr-Melnhof Karton's revenue will decrease by 0.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.9% today to 5.1% in 3 years time.

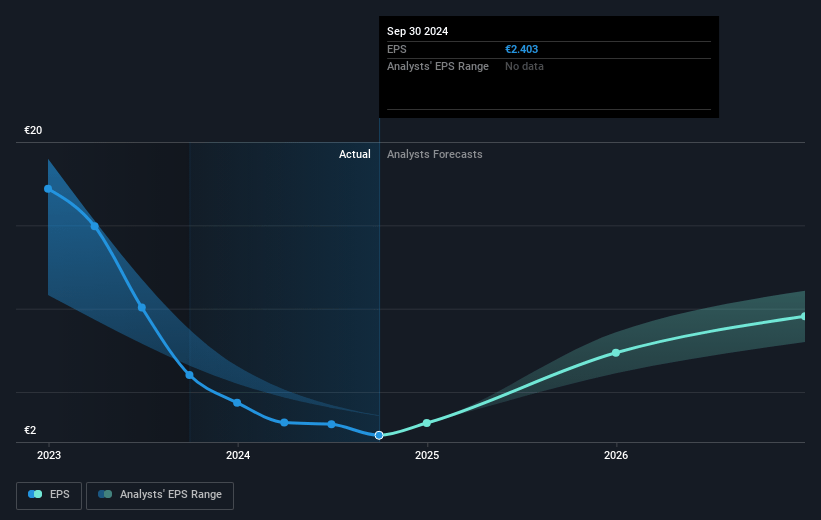

- The bearish analysts expect earnings to reach €207.7 million (and earnings per share of €10.39) by about July 2028, up from €118.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, down from 12.6x today. This future PE is lower than the current PE for the GB Packaging industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 1.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.06%, as per the Simply Wall St company report.

Mayr-Melnhof Karton Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent overcapacity in the European virgin fiberboard market, driven by new capacity additions and slow industry consolidation, is leading to a supply glut that puts downward pressure on pricing and overall revenue growth for Mayr-Melnhof Karton over the long term.

- Market demand for both board and packaging remains notably soft despite recent operational improvements, indicating weak secular growth and increased risk to sustaining or growing topline revenues in the future.

- Accelerating imports and possible diversion of Nordic capacity back into Europe due to U.S. tariff changes could further intensify price competition and exacerbate margin compression for Mayr-Melnhof Karton.

- The company's recent profit improvements are attributed primarily to internal cost-saving programs rather than structural demand or price tailwinds, suggesting that such self-help measures may have diminishing returns and limited impact on maintaining or increasing long-term earnings.

- Ongoing cost inflation, particularly in personnel within Europe, could challenge the company's ability to protect or expand net margins if competitive or demand conditions do not allow for full cost pass-through.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mayr-Melnhof Karton is €82.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mayr-Melnhof Karton's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €115.0, and the most bearish reporting a price target of just €82.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €4.1 billion, earnings will come to €207.7 million, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of €75.7, the bearish analyst price target of €82.2 is 7.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.