Key Takeaways

- Growing climate risks, weak demographics, and market volatility threaten profitability, while reliance on Central and Eastern Europe increases exposure to local economic and political instability.

- Legacy operational challenges and slow digital transformation could reduce efficiency and competitiveness compared to more technologically advanced rivals.

- Geographic diversification, strong capital position, and effective rate adjustments in response to inflation support Vienna Insurance Group's sustained profit growth and resilience in key Central and Eastern European markets.

Catalysts

About Vienna Insurance Group- Engages in providing insurance products and services in Austria and internationally.

- The rise in climate change-driven extreme weather events across Central and Eastern Europe is likely to increase the frequency and severity of insurance claims, putting upward pressure on the combined ratio and reducing net margins for Vienna Insurance Group over the long term.

- Persistently low or potentially negative interest rates in Europe threaten to depress investment income from VIG's substantial fixed-income portfolio, limiting the company's ability to grow earnings and eroding return on equity despite short-term gains from recent interest rate movements.

- Demographic headwinds, specifically the aging and shrinking working-age population in several CEE markets, are expected to slow demand growth in key life and health insurance segments, constraining organic revenue expansion over the coming years.

- Continued overexposure to economically and politically volatile CEE markets increases the risk of instability in earnings, with local market downturns or adverse regulatory shifts likely to disrupt revenue and profit growth.

- Slow progress and persistent operational inefficiencies related to legacy systems and decentralized structures could keep VIG's expense ratios elevated compared to more agile and digitally advanced competitors, undermining net profitability and leaving the group vulnerable to market share losses.

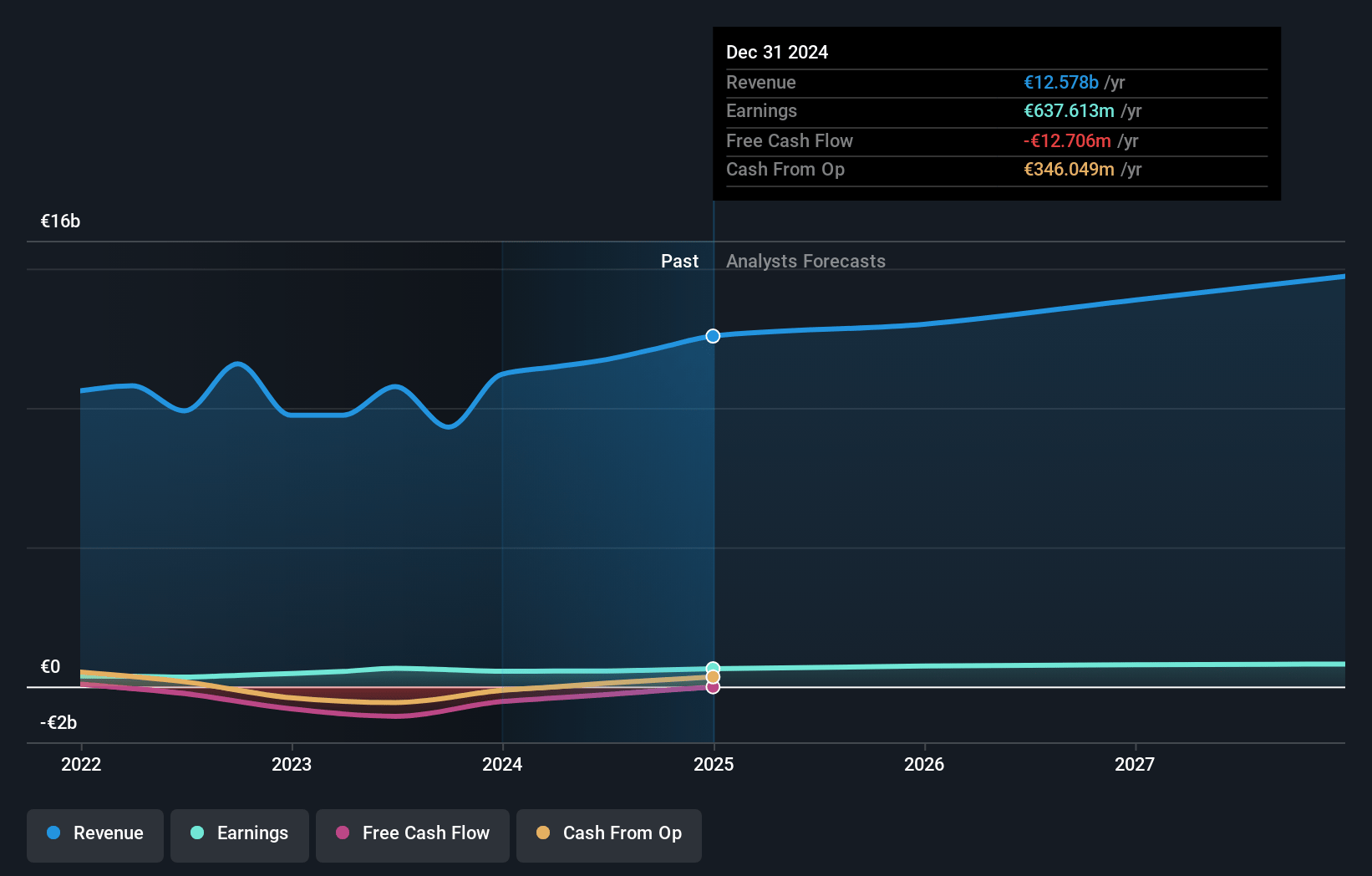

Vienna Insurance Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Vienna Insurance Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Vienna Insurance Group's revenue will grow by 6.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 5.1% today to 5.0% in 3 years time.

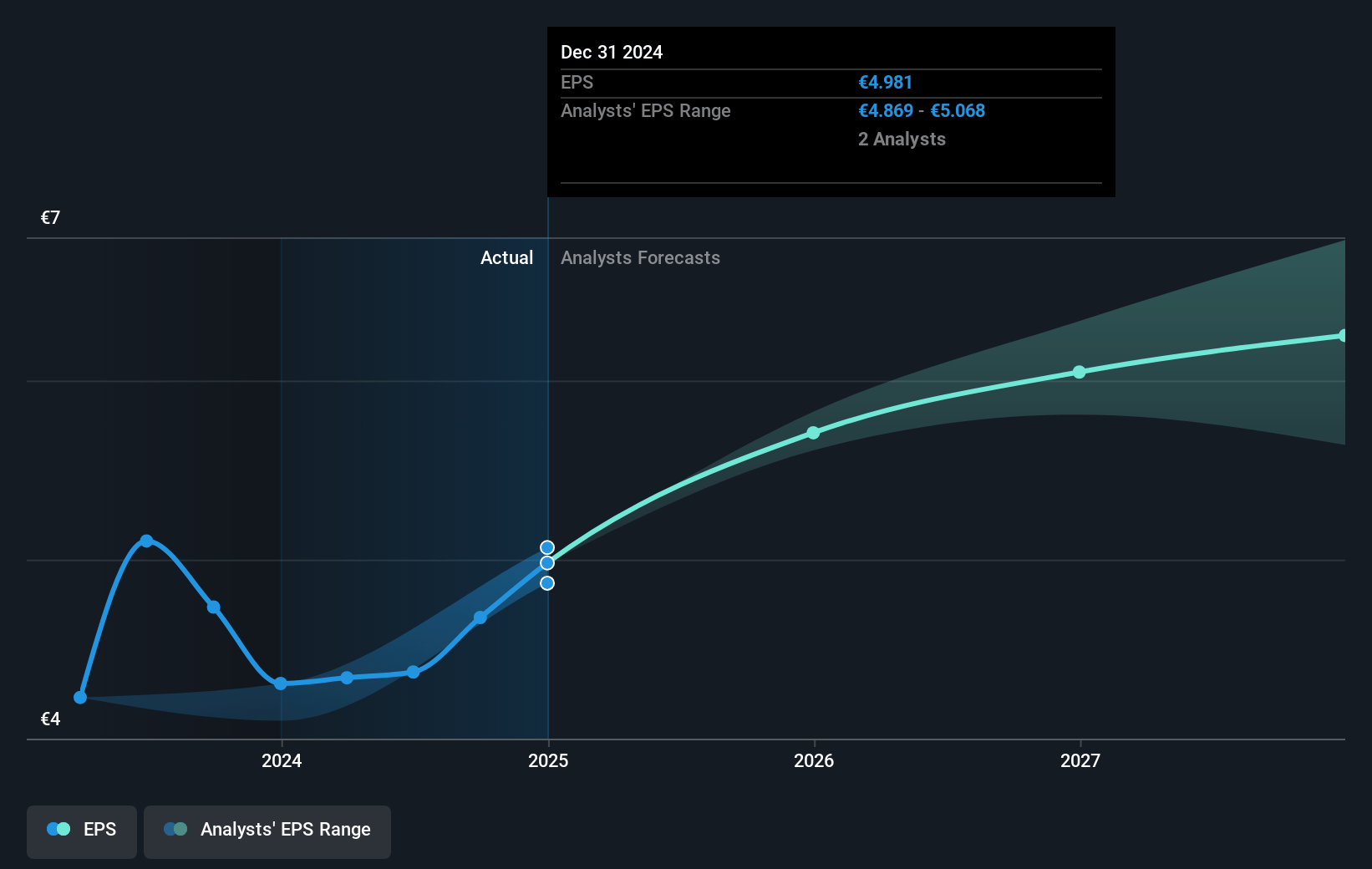

- The bearish analysts expect earnings to reach €748.7 million (and earnings per share of €5.84) by about July 2028, up from €637.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.9x on those 2028 earnings, down from 8.9x today. This future PE is lower than the current PE for the GB Insurance industry at 9.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.59%, as per the Simply Wall St company report.

Vienna Insurance Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong premium growth across all core geographies, particularly double-digit growth in Poland, Romania, Bulgaria, and Special Markets like Türkiye, signals Vienna Insurance Group is capturing rising insurance demand in Central and Eastern Europe, which directly supports sustained revenue and profit growth.

- The company is successfully passing inflation-linked claim cost increases into rate adjustments due to its ability to reprice annual contracts in Central and Eastern Europe and to use favorable indexation on long-term Austrian contracts, which allows maintenance or improvement of net margins and cost ratios.

- The robust solvency ratio of 271 percent, well above regulatory requirements, combined with successful debt management and the ability to issue oversubscribed sustainability bonds at favorable spreads, point to strong capital strength and stability, underpinning earnings resilience even in volatile environments.

- VIG's ongoing M&A activity and geographic diversification, including expansions in Albania, Moldova, and through the acquisition of a leading Polish financial broker, enhance both top-line growth potential and reduce concentration risk, supporting future earnings and profit growth.

- Persistent favorable economic tailwinds in its key markets-such as higher GDP growth in Poland, Czech Republic, Bulgaria, and Romania relative to the broader Euro area-are likely to continue fueling insurance penetration and premium revenue growth, challenging expectations of a sustained share price decline.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Vienna Insurance Group is €24.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vienna Insurance Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €49.5, and the most bearish reporting a price target of just €24.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €15.1 billion, earnings will come to €748.7 million, and it would be trading on a PE ratio of 4.9x, assuming you use a discount rate of 5.6%.

- Given the current share price of €44.3, the bearish analyst price target of €24.5 is 80.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.