Last Update 17 Sep 25

Fair value Decreased 7.12%A reduced revenue growth forecast and a slight decline in net profit margin have driven a decrease in SBO’s consensus analyst price target from €42.82 to €39.78.

Valuation Changes

Summary of Valuation Changes for SBO

- The Consensus Analyst Price Target has fallen from €42.82 to €39.78.

- The Consensus Revenue Growth forecasts for SBO has significantly fallen from 3.9% per annum to 3.4% per annum.

- The Net Profit Margin for SBO has fallen slightly from 12.63% to 12.05%.

Key Takeaways

- Strategic expansion into new regions, coupled with operational improvements, is poised to boost sales growth and improve net margins globally.

- Focus on new energy markets and 3D metal printing aims to diversify revenue streams and leverage global energy transition trends.

- Geopolitical uncertainties and market weaknesses are pressuring Schoeller-Bleckmann's earnings, with operational expenses and cautious customer spending contributing to reduced revenue.

Catalysts

About Schoeller-Bleckmann Oilfield Equipment- Manufactures and sells steel products worldwide.

- Schoeller-Bleckmann's strategic regional expansion, particularly into the Middle East, Central America, and Latin America, is expected to drive sales growth in non-U.S. markets, potentially boosting future revenue streams.

- The successful operational turnaround in the Oilfield Equipment division, returning to double-digit EBIT margins, indicates improved cost-efficiency, which can positively impact net margins.

- The focus on new energy markets, particularly carbon capture, geothermal applications, and hydrogen, aligns with global energy transition trends and could open new revenue channels for growth.

- Strong cash flow generation and a financing round have increased liquidity, providing capital for strategic initiatives, which may enhance future earnings stability.

- Investment in 3D metal printing as part of AMS diversification efforts is expected to increase non-oil-related revenue, potentially improving overall revenue stability and margins.

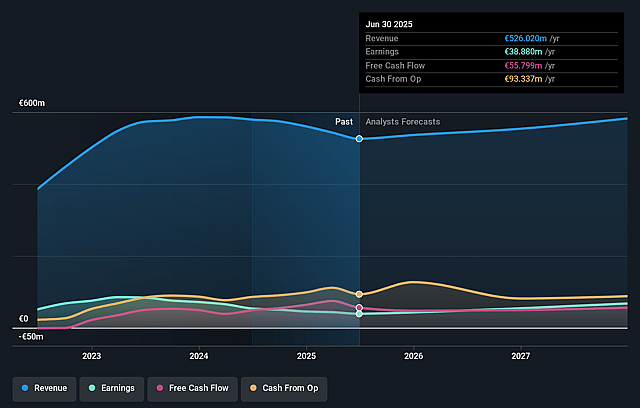

Schoeller-Bleckmann Oilfield Equipment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SBO's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 12.6% in 3 years time.

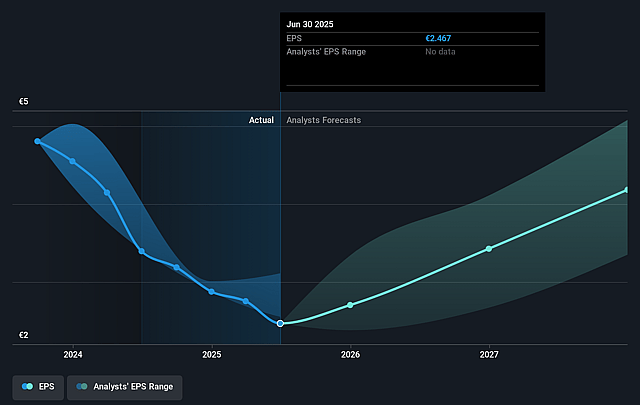

- Analysts expect earnings to reach €74.6 million (and earnings per share of €4.18) by about September 2028, up from €38.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €85.2 million in earnings, and the most bearish expecting €52.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from 10.7x today. This future PE is greater than the current PE for the GB Energy Services industry at 10.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.98%, as per the Simply Wall St company report.

Schoeller-Bleckmann Oilfield Equipment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The U.S. market's weakness has negatively affected sales, and despite some regional success, sales remain slightly below last year's levels, impacting revenue stability.

- Concerns over oil market volatility and potential oversupply, along with geopolitical uncertainties, add pressure on commodity pricing, which could affect future earnings.

- The AMS division experienced a significant foreign exchange loss and a moderation in customer demand, resulting in lower revenue and impacting net margins.

- Increased operational expenses and less favorable product mix in the Oilfield Equipment division during the first half of the year reduced earnings, though there has been some recovery.

- AMS customers are showing a more cautious approach to spending due to excess inventory, which could lead to a reduction in future revenues from this segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €42.825 for SBO based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €50.5, and the most bearish reporting a price target of just €35.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €590.7 million, earnings will come to €74.6 million, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 8.0%.

- Given the current share price of €26.4, the analyst price target of €42.82 is 38.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SBO?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.