Key Takeaways

- Accelerating demand, streamlined operations, and digital transformation position Semperit for outsized margin and free cash flow expansion versus industry peers.

- Strong balance sheet, flexible production, and premium technologies enable disproportionate growth, resilience, and effective M&A-driven sector consolidation.

- Heavy reliance on cyclical, energy-intensive sectors and limited pricing power leave Semperit exposed to weak earnings, margin erosion, and threats from competition and regulation.

Catalysts

About Semperit Holding- Develops, produces, and sells rubber products for the medical and industrial sectors worldwide.

- While analyst consensus expects revenue to rebound as project delays unwind, this is likely too conservative; accelerating order activity across most divisions, combined with significant pent-up demand in core industrial and mining applications, positions Semperit for a much sharper and earlier-than-expected upswing in top-line growth, leading to operating leverage that could deliver EBITDA and net margin expansion at a pace well above historical cycle recoveries.

- Analysts broadly agree that ongoing cost reduction and operational streamlining will gradually improve margins, but they may be underestimating Semperit's ability to structurally reset its fixed cost base and working capital needs, which-when paired with the OneERP digital transformation-could produce sustained step-changes in net margins and free cash flow conversion far in excess of the sector average.

- The company's scalable global footprint and flexible production model-including major investments like DH5 in Odry, automated "ghost shifts" at Rico, and rapid workforce ramp-up strategies-make Semperit exceptionally poised to capture disproportionate share from the ongoing wave of global infrastructure expansion and supply chain reshoring, translating into outperformance in volume growth and higher factory utilization rates.

- Intensifying regulatory focus on sustainability and the premiumization of industrial components creates an environment in which Semperit's advanced elastomer technologies and local-for-local production will consistently command higher pricing and market share, supporting both durable margin uplift and more resilient long-term revenue streams.

- With a strong balance sheet and an active M&A pipeline, Semperit is in a unique position to seize distressed or attractively priced targets in fragmented markets, setting the stage for outsized inorganic growth, operational synergies, and significant EPS accretion over the coming years.

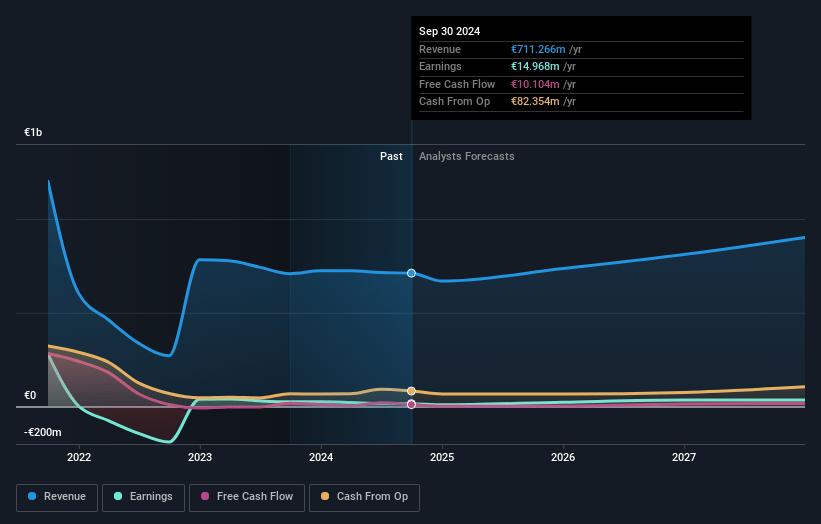

Semperit Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Semperit Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Semperit Holding's revenue will grow by 11.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.1% today to 5.4% in 3 years time.

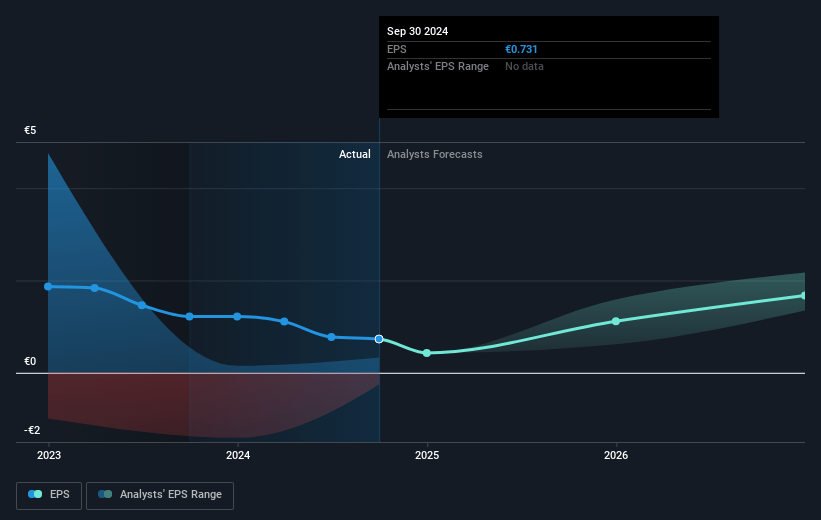

- The bullish analysts expect earnings to reach €48.5 million (and earnings per share of €2.36) by about July 2028, up from €-789.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.7x on those 2028 earnings, up from -343.7x today. This future PE is lower than the current PE for the GB Machinery industry at 14.8x.

- Analysts expect the number of shares outstanding to decline by 1.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.31%, as per the Simply Wall St company report.

Semperit Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued top line pressure from low global order activity, delays in major projects and exposure to weak end markets, especially in construction and agriculture, could suppress revenue growth and result in persistently weak earnings.

- The company's heavy exposure to cyclical sectors and project-based business, such as Belting, creates earnings volatility and increases risk of underutilization, which can quickly erode EBITDA margins and lead to net losses, as evidenced in current results.

- Semperit's high operating leverage and limited pricing power in the face of cost inflation, especially from energy and materials, leave it vulnerable to margin contraction and possible long-term pressure on net profit.

- Intensifying competition from lower-cost Asian peers, particularly in traditional hose and belting products, threatens Semperit's market share and margin sustainability, further exacerbated by possible substitution with advanced or sustainable materials, potentially impacting both revenue and future gross margins.

- Rising environmental regulation and carbon reduction mandates may impose substantial compliance costs or necessitate unprofitable capital expenditures, given Semperit's energy-intensive legacy production methods, potentially impacting long-term EBITDA and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Semperit Holding is €19.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Semperit Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €19.0, and the most bearish reporting a price target of just €13.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €903.0 million, earnings will come to €48.5 million, and it would be trading on a PE ratio of 9.7x, assuming you use a discount rate of 9.3%.

- Given the current share price of €13.18, the bullish analyst price target of €19.0 is 30.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.