Key Takeaways

- Major public infrastructure investments and a growing order backlog are set to drive sustained revenue growth and project pipeline stability.

- Focus on sustainable construction, higher margin projects, and digitalization is expected to expand profitability and support future earnings potential.

- Persistent inflation-driven cost pressures, elevated debt, and weak residential demand collectively threaten margin growth, financial flexibility, and reliable earnings for PORR.

Catalysts

About PORR- Operates as a construction company in Austria, Germany, Poland, the Czech Republic, Italy, Romania, Switzerland, Serbia, Great Britain, Slovakia, Norway, Belgium, and internationally.

- Substantial government and EU-driven infrastructure investment (such as the €48bn Polish railway program and €500bn German special funds) is set to drive sustained demand for PORR across civil engineering and infrastructure, positioning the company for higher baseline revenue growth and improved visibility in its project pipeline.

- Accelerated shift toward sustainable construction and green infrastructure, supported by both regulatory drivers and PORR's internal investments in modular and energy-efficient building solutions, is expected to open up higher value opportunities and support margin expansion over time.

- Robust and broad-based order intake growth-especially in Germany, Austria, and CEE-signals a significant turnaround and secures PORR's high backlog, indicating potential for rising revenues and improved earnings stability in coming years.

- Increased targeting of higher margin projects (management now bidding for long-term 4% EBIT margin projects versus historical levels) coupled with ongoing digitalization and lean management drive should gradually lift net margins and earnings.

- Por's strong liquidity position and improved equity ratio provide capacity for further growth investments (including capacity expansions and strategic acquisitions), reducing financial risk and supporting future earnings potential.

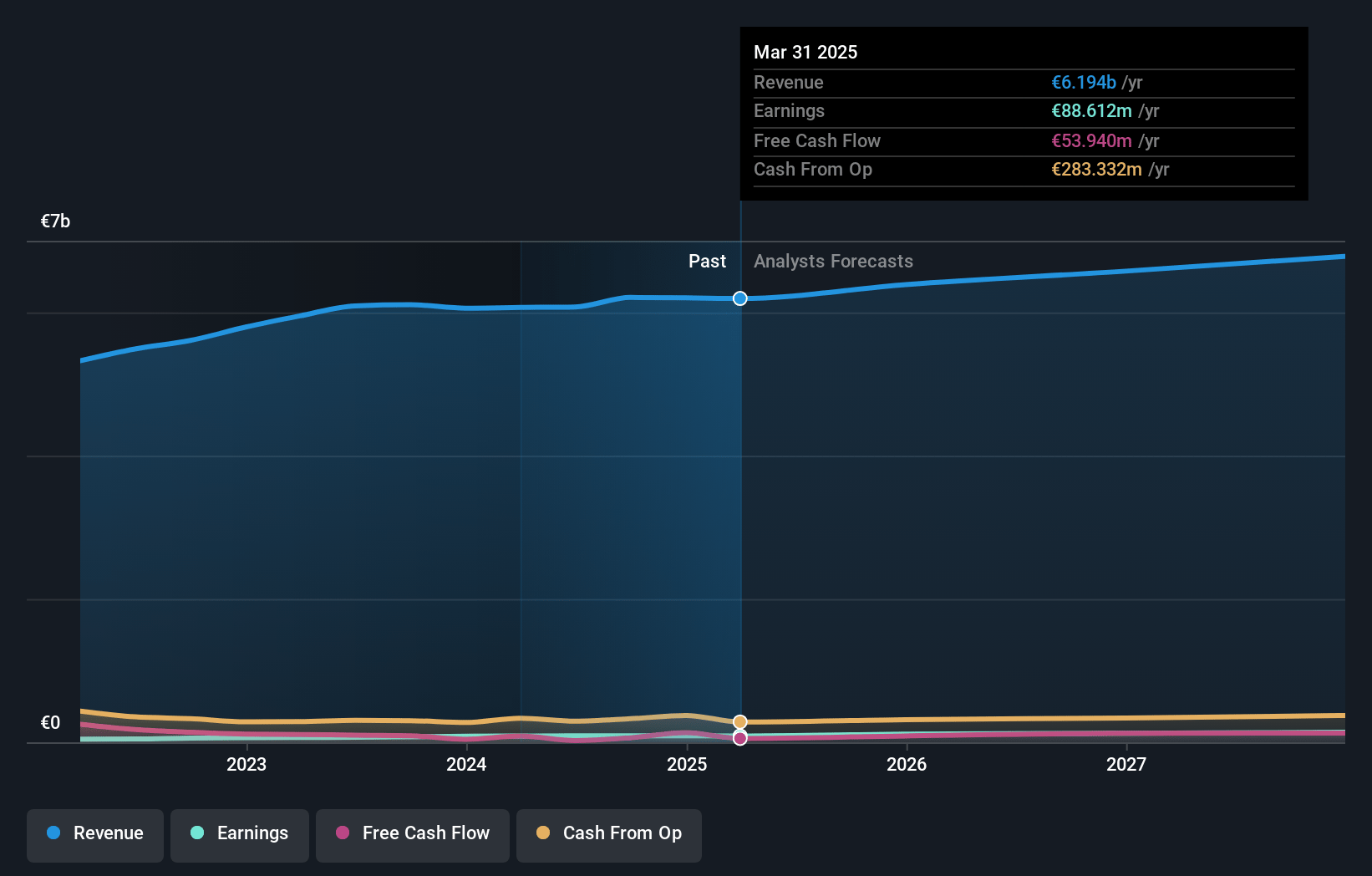

PORR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PORR's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.4% today to 2.2% in 3 years time.

- Analysts expect earnings to reach €147.9 million (and earnings per share of €3.49) by about July 2028, up from €88.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €175.3 million in earnings, and the most bearish expecting €126.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, down from 12.3x today. This future PE is lower than the current PE for the GB Construction industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 1.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

PORR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent labor cost pressures and inflationary adjustments, notably highlighted by relatively high addition in the personnel cost expense as a result of the inflation-related adjustments, risk compressing net margins and increasing earnings volatility into the future.

- A significant increase in net debt driven by one-off payments (hybrid bond redemption, share buybacks, acquisitions) and reduced supplier financing, combined with declines in operating cash flow (operating cash flow, leading to a decline of €91 million compared to 2024), may threaten financial flexibility and constrain future investment capacity, impacting earnings growth and liquidity.

- Ongoing weakness and delayed recovery in residential construction-even as management notes only a partial and modest contribution from this segment (It's part of the numbers, but not to that really huge amount)-expose PORR to risks from sluggish secular demand in this area, potentially limiting revenue growth and reducing overall group diversification.

- Margin expectations for German market projects remain subdued (in general, margin expectation have been a little bit lower there... Germany will take some time to improve the overall margin), which may challenge PORR's ability to achieve targeted group EBIT margin improvements, restricting long-term profitability.

- Seasonal volatility and project delays caused by unpredictable weather conditions (such as late winter onset leading to delayed project starts) highlight structural risks to reliable top-line and earnings development, especially when coupled with high fixed costs and thin historical margins, thus threatening both revenue predictability and delivery on guidance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €34.617 for PORR based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €37.5, and the most bearish reporting a price target of just €29.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €6.8 billion, earnings will come to €147.9 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 8.4%.

- Given the current share price of €29.0, the analyst price target of €34.62 is 16.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.