Key Takeaways

- Operational integration and disciplined digital transformation are expected to enhance efficiency, margins, and revenue growth through cost savings and expanded digital adoption.

- Demographic trends and strategic capital deployment position the company for sustainable fee income, robust loan growth, and resilient earnings amid evolving European markets.

- Heavy dependence on interest income, regional concentration, rising costs, regulatory pressures, and digital disruption all threaten revenue growth, efficiency, and long-term profitability.

Catalysts

About BAWAG Group- Operates as a holding company for BAWAG P.S.K.

- Ongoing integration of Knab and Barclays Consumer Bank Europe, with expected completion by year-end (including exit from transitional service agreements and rebranding), should unlock operational synergies and drive further cost efficiency, supporting higher net margins over time.

- Increasing digital engagement-evidenced by BAWAG's disciplined digital transformation and lowered cost/income ratio-positions the company to benefit from rising digital adoption in Europe, reducing cost-to-serve and boosting long-term operating margins.

- Demographic tailwinds from aging populations in Western Europe are poised to increase demand for personalized, fee-based financial products (e.g., retirement planning), potentially expanding BAWAG's revenue streams and supporting sustainable fee income growth.

- Strong capital ratios, substantial liquidity, and ongoing share buybacks provide flexibility to capitalize quickly on future M&A opportunities, which, given BAWAG's proven integration capabilities, can further accelerate earnings and revenue growth.

- BAWAG's robust risk management, focus on conservative underwriting, and strategic allocation of excess liquidity position it to benefit from continued urbanization and economic growth in Central and Eastern Europe, supporting sustained loan growth and balancing asset quality, which should reinforce steady earnings expansion.

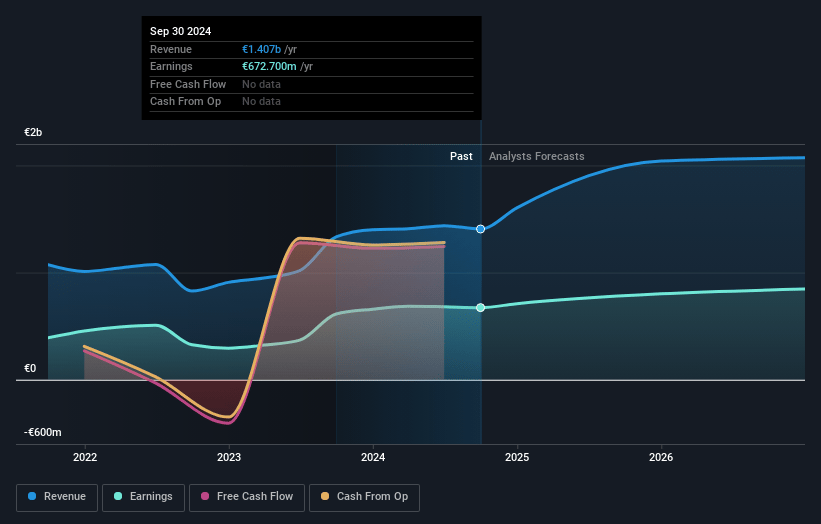

BAWAG Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BAWAG Group's revenue will grow by 12.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 47.2% today to 42.6% in 3 years time.

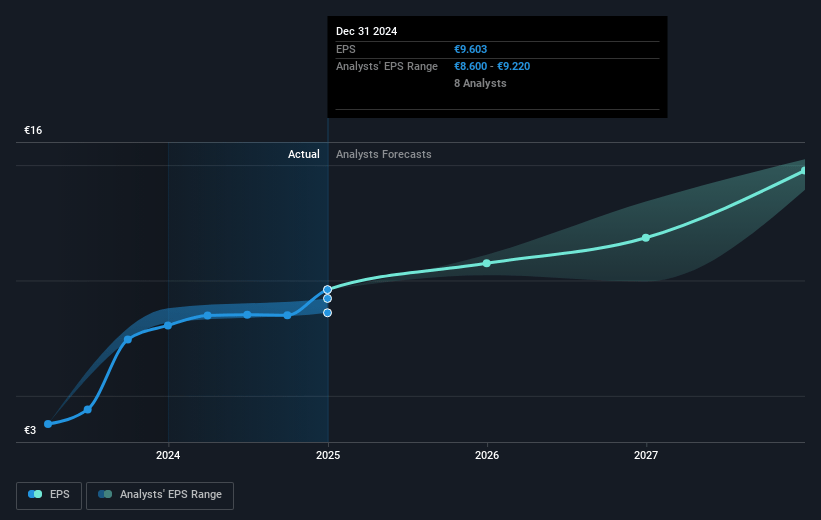

- Analysts expect earnings to reach €984.2 million (and earnings per share of €13.41) by about July 2028, up from €772.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from 11.0x today. This future PE is greater than the current PE for the AT Banks industry at 9.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.62%, as per the Simply Wall St company report.

BAWAG Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank's high reliance on interest income and exposure to a low or declining interest rate environment in Europe-where even modest rate cuts or a prolonged low-rate scenario can compress net interest margins-poses a risk to future revenue and profitability.

- BAWAG's core business remains concentrated in the DACH/NL region (Germany, Austria, Netherlands) with only limited diversification outside Western Europe, leaving it vulnerable to local economic downturns or credit cycle volatility, which could materially impact earnings through higher loan defaults or impairments.

- Rising operating costs, including wage inflation from collective bargaining agreements and ongoing integration expenses from recent acquisitions, may pressure operational efficiency and net margins, particularly if cost reductions post-integration do not materialize as planned.

- The European banking sector's mounting regulatory and legal requirements-including potential legal risks in Austria and higher regulatory charges-contribute to increased compliance and provision costs, thereby weighing on BAWAG's expense base and net profit.

- Persistent competitive threats from fintechs, neobanks, and other non-bank lenders-combined with digital disruption-can erode BAWAG's market share, pressure fee income and customer retention, and drive further margin compression, directly impacting revenue growth and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €120.006 for BAWAG Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €141.06, and the most bearish reporting a price target of just €79.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.3 billion, earnings will come to €984.2 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of €107.9, the analyst price target of €120.01 is 10.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.