Last Update26 Mar 25

Key Takeaways

- Diversification into shale oil and renewables is enhancing production, revenue growth, and improving operational margins.

- Increased reserves and export opportunities bolster long-term earnings, revenue diversification, and optimize net margins.

- Pampa Energía's strategic diversification and strong financial management position it for stable growth amidst increasing oil and gas production and renewable energy investments.

Catalysts

About Pampa Energía- Operates as an integrated power company in Argentina.

- The development of Rincón de Aranda, a flagship shale oil project, is expected to significantly increase production to 20,000 barrels per day by December 2025. This project will contribute significantly to revenue growth in the coming years as the company diversifies into shale oil.

- The commissioning of the PEPE 6 wind farm and potential future investments in renewable energy enhance Pampa Energía's power segment, which already boasts a high availability rate. These factors are likely to bolster EBITDA growth and improve operational margins in the power generation business.

- The company's robust reserve replacement ratio and increased proven reserves, particularly in shale oil and gas, signal strong future production capabilities. This should positively impact long-term earnings as the company capitalizes on these expanded resources.

- The potential for increased natural gas exports to Chile and Brazil, alongside plans for an LNG project, presents opportunities for revenue diversification and growth beyond domestic markets. Successful implementation could enhance EBITDA by tapping into higher-value export markets.

- The expected regulatory changes facilitating the ability for generators to self-procure fuel may allow Pampa Energía to optimize its fuel sourcing strategies, reducing costs, and potentially improving net margins in both its E&P and power generation segments.

Pampa Energía Future Earnings and Revenue Growth

Assumptions

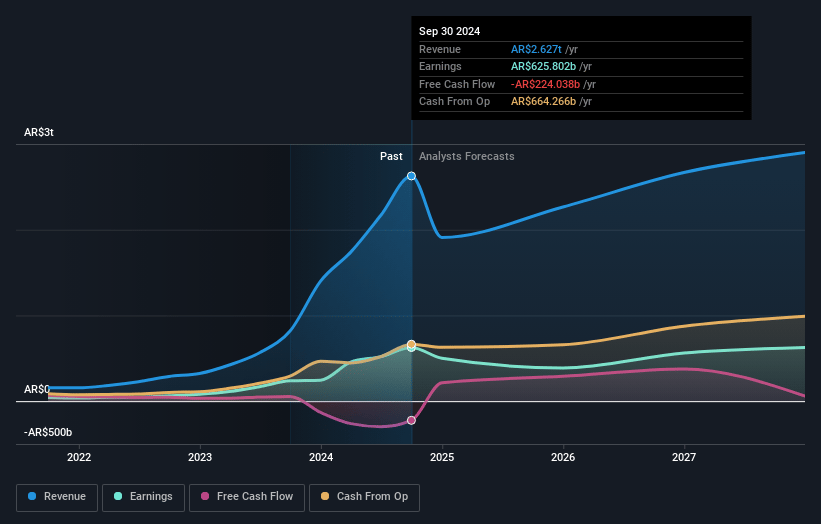

How have these above catalysts been quantified?- Analysts are assuming Pampa Energía's revenue will grow by 18.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 32.6% today to 23.7% in 3 years time.

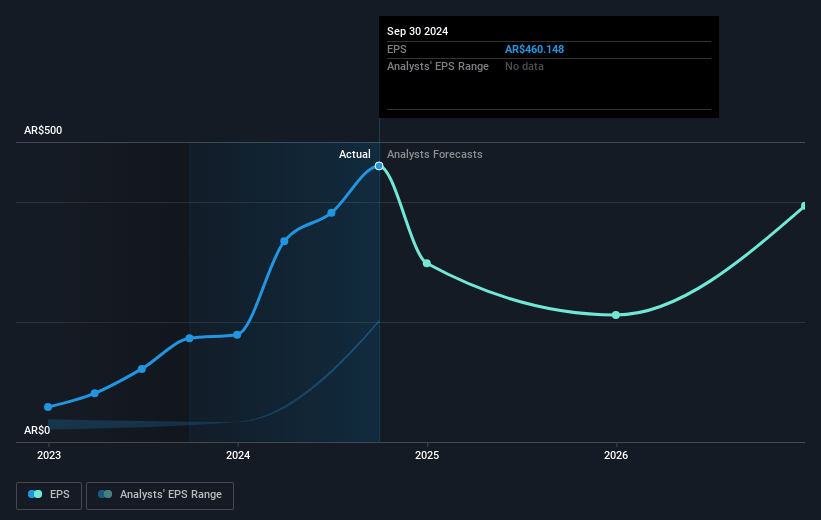

- Analysts expect earnings to reach ARS 684.2 billion (and earnings per share of ARS 381.24) by about March 2028, up from ARS 564.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, up from 10.5x today. This future PE is greater than the current PE for the US Electric Utilities industry at 10.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 24.69%, as per the Simply Wall St company report.

Pampa Energía Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Pampa Energía has seen a significant increase in gas production, hitting record highs, driven by strong performance in their Vaca Muerta wells. This production growth indicates potential increased revenue from oil and gas sales.

- The development of the Rincón de Aranda shale oil project aims to diversify Pampa's energy portfolio, transitioning from gas only to include oil, which could increase future revenue streams as demand for oil remains strong.

- Pampa Energía has invested in green energy, such as commissioning the PEPE 6 wind farm, thereby increasing its capacity in renewable energy production. This diversification could lead to steady revenue growth amidst a global shift towards green energy.

- Pampa's financials are strengthened by a reduction in net debt to its lowest since 2016, supported by strong cash flows from power and gas operations. This improved balance sheet could positively impact its earnings and financial stability.

- The hedge strategy that Pampa implemented, locking in oil prices at $72 per barrel for part of its production, provides some level of earnings reliability and shields the company from potential price volatility in the near term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ARS4010.0 for Pampa Energía based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ARS4800.0, and the most bearish reporting a price target of just ARS3200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ARS2892.9 billion, earnings will come to ARS684.2 billion, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 24.7%.

- Given the current share price of ARS4345.0, the analyst price target of ARS4010.0 is 8.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.