Narratives are currently in beta

Key Takeaways

- The acquisition of HSBC Argentina and positive economic conditions in Argentina could enhance Galicia's market share, revenue, and profit growth.

- Decreasing inflation and interest rates, along with a strong capital position, improve earnings potential and revenue diversification opportunities.

- Persistent inflation and currency devaluation in Argentina could negatively impact Grupo Financiero Galicia's margins and earnings, amid integration challenges from acquiring HSBC.

Catalysts

About Grupo Financiero Galicia- A financial service holding company, provides various financial products and services to individuals and companies in Argentina.

- Grupo Financiero Galicia's planned acquisition of HSBC Argentina could significantly increase its net income and contribute to future profit growth, as HSBC's operations become integrated and synergies are realized. The deal could enhance Galicia's market share, offering potential for increased revenue and earnings.

- The expectation of a recovering Argentine GDP by 5% next year is predicted to support strong loan growth, with loans projected to increase by up to 50% in real terms in 2025. This growth should bolster revenue and contribute positively to future financial performance.

- The ongoing decrease in inflation rates, along with a reduction in interest rates, is likely to improve net interest margins. The bank expects a more favorable spread between the costs of deposits and loan yields, which could enhance overall earnings.

- The current high capital ratio provides the bank with a solid foundation for future loan growth and investment opportunities, without the immediate need for additional capital raising. This preserves shareholder value and supports sustainable growth in earnings.

- The recent rally in Lecaps (Argentine government bonds) and the potential restructuring of the securities portfolio could yield additional income for Grupo Financiero Galicia, positively impacting future financial results and supporting revenue diversification.

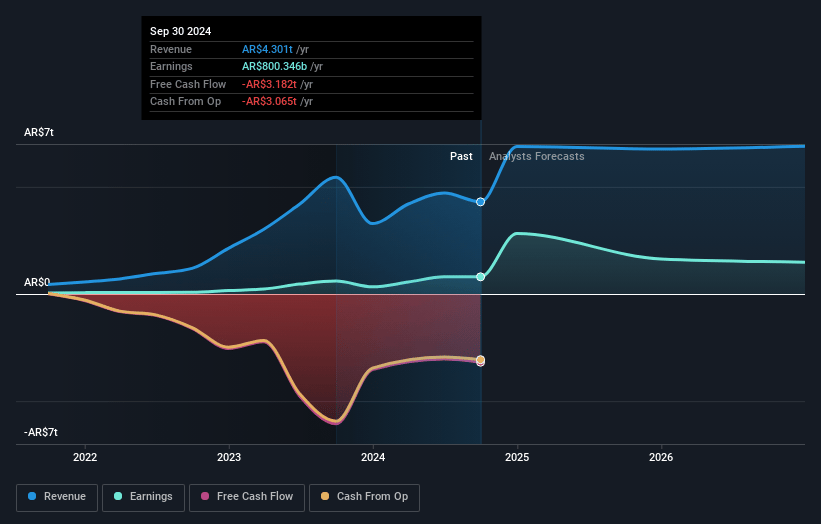

Grupo Financiero Galicia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Grupo Financiero Galicia's revenue will grow by 22.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.6% today to 19.9% in 3 years time.

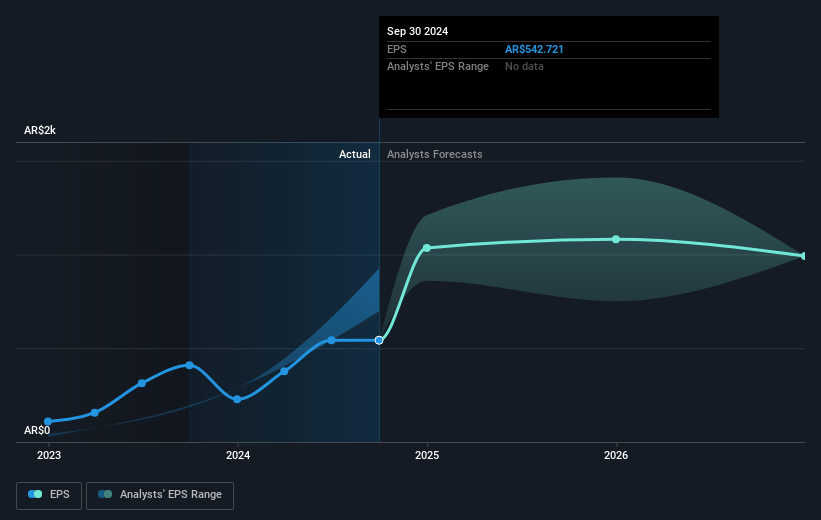

- Analysts expect earnings to reach ARS 1577.1 billion (and earnings per share of ARS 1197.47) by about January 2028, up from ARS 800.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ARS1051.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, up from 15.4x today. This future PE is greater than the current PE for the US Banks industry at 15.4x.

- Analysts expect the number of shares outstanding to decline by 6.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 29.4%, as per the Simply Wall St company report.

Grupo Financiero Galicia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The high and persistent inflation rates in Argentina, reaching 101.6% in the first 9 months of 2024, pose a risk to real purchasing power and could impact Grupo Financiero Galicia's net margins and overall cost of operations.

- The significant exchange rate devaluation, with a 63.3% year-over-year devaluation in September 2024, increases the risk of currency volatility that could negatively impact earnings, especially given the reliance on foreign currency deposits.

- Despite a reported overall improvement, Banco Galicia's net income for the quarter was 47% lower than the previous year due to a 50% decrease in operating income, indicating challenges in profit generation that could affect future revenue performance.

- The exposure to political and macroeconomic volatility in Argentina could lead to unpredictable fiscal policies and economic conditions, potentially affecting lending and deposit rates that are crucial to maintaining profitability.

- The acquisition of HSBC and the integration process could entail execution risks and unforeseen costs, potentially affecting short-term earnings and the expected synergies from the merger.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ARS9493.1 for Grupo Financiero Galicia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ARS13200.0, and the most bearish reporting a price target of just ARS8114.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ARS7930.5 billion, earnings will come to ARS1577.1 billion, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 29.4%.

- Given the current share price of ARS7770.0, the analyst's price target of ARS9493.1 is 18.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives