Key Takeaways

- Heavy reliance on a concentrated customer and geographic base exposes Tabreed to project delays and macroeconomic risks, potentially limiting revenue growth.

- Ongoing regulatory, technological, and environmental pressures may increase costs, constraining margins and affecting long-term earnings stability.

- Overdependence on the UAE, capital intensity, evolving technology, and potential shifts in urban policy pose significant risks to Tabreed's growth, margins, and expansion prospects.

Catalysts

About National Central Cooling Company PJSC- Supplies chilled water in the United Arab Emirates and internationally.

- Although urbanization and the accelerating push for sustainable infrastructure across the GCC support a growing pipeline of large-scale district cooling projects, Tabreed remains heavily exposed to a small number of master developments concentrated in the UAE and is significantly reliant on government-related entities; this geographic and customer concentration may limit revenue growth if regional mega-project timelines are delayed, canceled, or impacted by macroeconomic shocks.

- While rising energy efficiency and environmental sustainability regulations favor district cooling over traditional systems and help underpin Tabreed's ability to secure long-term, inflation-linked contracts, these same regulations demand continual investment in new technologies and carbon reduction, which could pressure margins if required upgrades or emission targets become more stringent and costly to implement.

- Despite a steady growth trajectory supported by the expansion of district cooling into underpenetrated markets like India and Egypt, Tabreed could face headwinds from technological disruption if distributed cooling solutions or high-efficiency alternatives gain traction-potentially eroding future demand and threatening client retention, thereby affecting long-term revenue visibility.

- Even as Tabreed's robust free cash flow and improved leverage ratio position it well to fund growth and maintain credit ratings, its ongoing multi-year capital commitments-such as the AED 1.5 billion spend on Palm Jebel Ali-raise the risk of returns being dampened by project delays, rising construction and maintenance costs, or a mismatch between capacity ramp-up and actual cooling demand, which in turn would weigh on net margins and investable cash flows.

- Although Tabreed's technological investments and efficiency drives have enabled EBITDA margin expansion and provide a cushion against seasonal consumption swings, water scarcity and tightening environmental regulations in core GCC markets could trigger higher operational costs or constrained plant capacity utilization over time, ultimately capping prospective earnings and limiting further margin improvement.

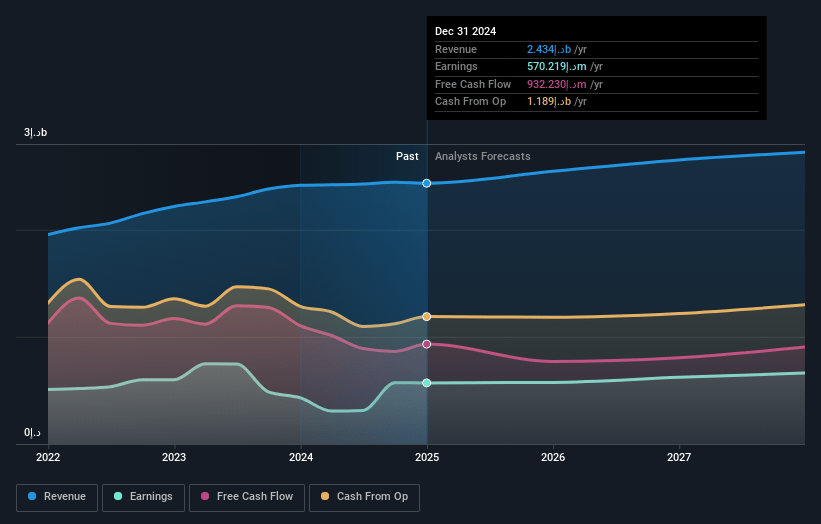

National Central Cooling Company PJSC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on National Central Cooling Company PJSC compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming National Central Cooling Company PJSC's revenue will grow by 3.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 23.6% today to 23.3% in 3 years time.

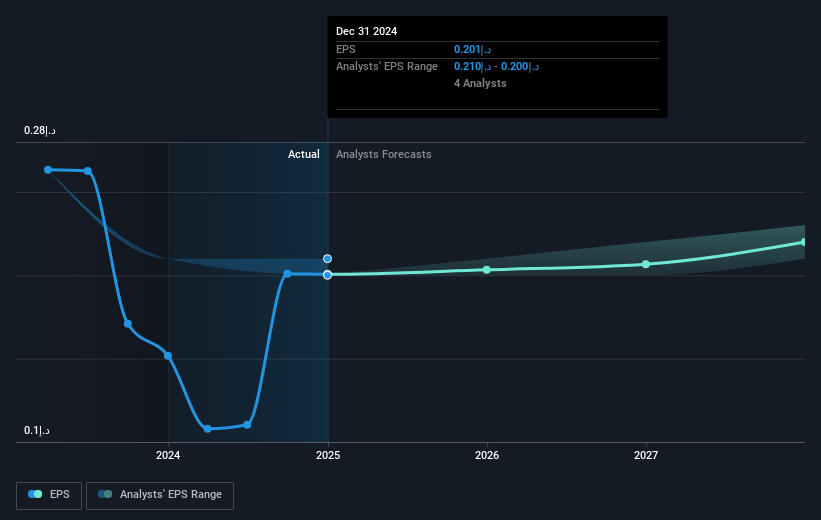

- The bearish analysts expect earnings to reach AED 631.2 million (and earnings per share of AED 0.22) by about July 2028, up from AED 573.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 23.9x on those 2028 earnings, up from 14.5x today. This future PE is greater than the current PE for the AE Water Utilities industry at 17.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.09%, as per the Simply Wall St company report.

National Central Cooling Company PJSC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on the UAE for 83% of total connected capacity, with international operations in India and Egypt still representing a minor portion, exposes Tabreed to significant concentration risk, meaning that any negative regional economic or regulatory shock could disproportionately impact future revenues and long-term earnings growth.

- District cooling remains capital intensive, with annual organic capital expenditure guidance of AED 200 million to AED 300 million and large-scale projects like Palm Jebel Ali requiring AED 1.5 billion over multiple years, so any underperformance in revenue growth or delays in project ramp-up can suppress free cash flow and pressure the company's ability to sustain margin expansion and dividend increases.

- Secular trends toward decarbonization and rapid changes in cooling technology could render existing district cooling assets less competitive, forcing higher upgrade costs or diminishing the long-term demand for Tabreed's core offerings, which could erode both margins and return on invested capital.

- Despite recent improvement, Tabreed's leverage ratio of 3.5 times net debt to EBITDA remains material, so any unexpected rise in interest rates, disruption in capital markets, or operational underperformance could strain the balance sheet and limit the ability to fund future expansion or maintain an attractive dividend yield.

- Future secular shifts in urban development-such as reduced pace of mega-projects, changes in government policy, or a pivot to more decentralized, efficient cooling solutions-could curb the underlying demand for district cooling infrastructure, leading to flattish or declining revenue growth, and increasing the risk that long-term earnings expectations are not met.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for National Central Cooling Company PJSC is AED3.14, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of National Central Cooling Company PJSC's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED4.8, and the most bearish reporting a price target of just AED3.14.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be AED2.7 billion, earnings will come to AED631.2 million, and it would be trading on a PE ratio of 23.9x, assuming you use a discount rate of 19.1%.

- Given the current share price of AED2.92, the bearish analyst price target of AED3.14 is 7.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.