Key Takeaways

- Robust project launches, overseas buyer demand, and strategic investments in Egypt and the UK drive revenue and earnings growth in the UAE market.

- High occupancy rates, strategic ventures, and education sector expansion contribute to sustained EBITDA growth and improved net margins.

- New domestic tax and high leverage may pressure Aldar's net profit margins, while asset transformations and acquisitions carry risks for future revenue growth.

Catalysts

About Aldar Properties PJSC- Engages in the real estate development, investment, construction, leasing, management, sale, and related services in the United Arab Emirates.

- The launch of new projects and strong demand for existing developments in the UAE, particularly from overseas buyers and resident expatriates, are likely to drive revenue growth. The planned launch of Fahid Island with a diverse product offering will further bolster sales. This impacts revenue positively.

- The strategic investments and acquisitions in Egypt and the UK have shown strong sales growth, with substantial backlogs providing visibility on future revenue. Continued cross-selling into the UAE markets strengthens this position, enhancing earnings.

- The addition of Masdar City assets and the development-to-hold strategy contribute to an increase in adjusted EBITDA. Near full occupancy and rising rental rates also enhance net margins.

- The opening of new schools under Aldar Education and an increase in enrollment present significant growth potential, with organic growth anticipated from both existing and new capacities, driving future revenue and earnings.

- The high occupancy rates and rental rate improvements in the investment properties portfolio, alongside strategic joint ventures such as the JV with Mubadala for a retail platform, are set to sustain growth in EBITDA and net margins.

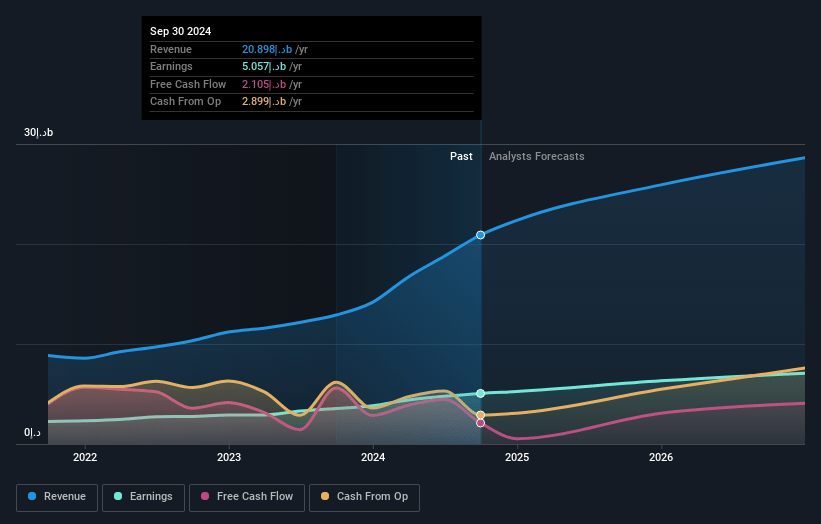

Aldar Properties PJSC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aldar Properties PJSC's revenue will grow by 14.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.1% today to 22.3% in 3 years time.

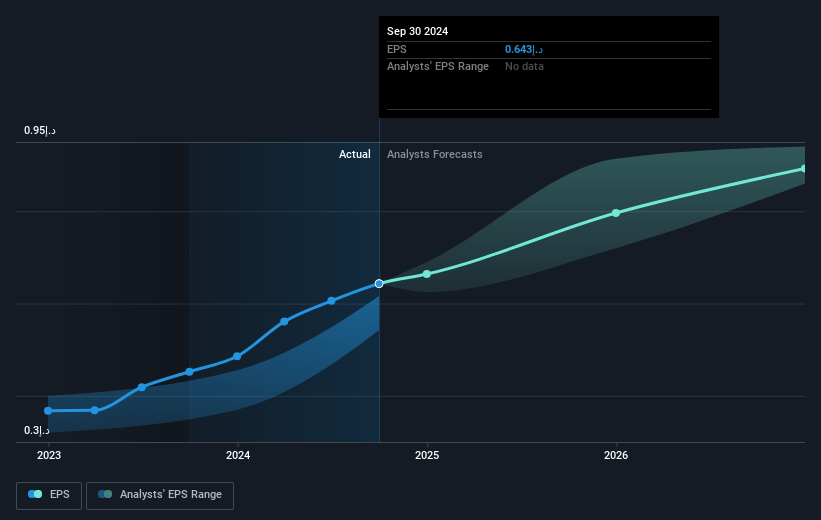

- Analysts expect earnings to reach AED 8.4 billion (and earnings per share of AED 1.07) by about May 2028, up from AED 5.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as AED9.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, up from 11.2x today. This future PE is greater than the current PE for the AE Real Estate industry at 8.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.19%, as per the Simply Wall St company report.

Aldar Properties PJSC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The introduction of a 15% domestic minimum top-up tax in the UAE could increase Aldar's effective tax rate, impacting net profit margins and overall earnings.

- The temporary decline in earnings from the Hospitality and Leisure segment, due to a AED 1.5 billion transformation program that has several assets offline, could suppress net margins and profitability in the near term.

- The potential for rising property prices in Abu Dhabi, although reflecting strong demand, may limit growth if the market becomes inaccessible to a broader customer base, potentially impacting future sales and revenue growth.

- High leverage due to recent financial activities, like hybrid capital issuances and substantial transaction deals, could put pressure on financial stability and liquidity, potentially affecting net margins and strategic growth initiatives.

- A reliance on Masdar City assets and other recent acquisitions for EBITDA growth may present risk if those assets do not perform to expectations, affecting revenue and earnings consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED9.844 for Aldar Properties PJSC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED11.3, and the most bearish reporting a price target of just AED8.13.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be AED37.5 billion, earnings will come to AED8.4 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 21.2%.

- Given the current share price of AED8.26, the analyst price target of AED9.84 is 16.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.