Last Update05 Sep 25

With both the discount rate and future P/E essentially unchanged, there is no material change to analysts’ valuation outlook for Emirates NBD Bank PJSC, with the consensus price target steady at AED28.67.

What's in the News

- Upcoming board meeting scheduled to approve previous minutes, review Q2 2025 financial results, and consider regular business activities.

Valuation Changes

Summary of Valuation Changes for Emirates NBD Bank PJSC

- The Consensus Analyst Price Target remained effectively unchanged, at AED28.67.

- The Discount Rate for Emirates NBD Bank PJSC remained effectively unchanged, moving only marginally from 20.32% to 20.33%.

- The Future P/E for Emirates NBD Bank PJSC remained effectively unchanged, at 12.87x.

Key Takeaways

- Rising demand for banking services and geographic diversification are driving sustained revenue growth and reducing dependence on the UAE market.

- Digital innovation, product expansion, and a dominant retail position are strengthening efficiency, fee income, and long-term profitability.

- Profitability faces pressure from narrowing margins, elevated costs, asset quality concerns, and dependence on favorable market conditions, challenging future earnings growth and capital strength.

Catalysts

About Emirates NBD Bank PJSC- Provides corporate, institutional, retail, treasury, and Islamic banking services.

- Ongoing economic diversification in the UAE and broader GCC region, combined with strong GDP growth forecasts, is driving robust demand for both corporate and consumer banking services; this has enabled Emirates NBD to revise its loan growth guidance upwards to low double digits, pointing to sustained revenue and earnings expansion.

- Accelerated adoption of digital banking and investments in tech innovation are materially improving operating efficiency, contributing to a declining cost-to-income ratio (now below 31%), which supports long-term margin expansion and profitability.

- Significant loan growth momentum in key international markets (notably Saudi Arabia, Egypt, India, Turkey, and Singapore, with double-digit increases), alongside plans for further organic and inorganic expansion, is diversifying earnings streams and reducing reliance on the UAE market, strengthening top-line growth and risk-adjusted returns.

- Expansion and innovation in higher-margin businesses such as wealth management, private banking, and structured products (with strong gains in fee and commission income-up 18% YoY) are increasing non-interest income, which helps offset NIM pressure and boosts net profit growth.

- Continued reputation as a dominant retail bank (e.g., 35% UAE credit card spend market share, rapid card product growth) and a strong, low-cost CASA deposit base (60% CASA ratio) position Emirates NBD to benefit from further international trade flows and capital inflows into Dubai, supporting funding cost advantages and facilitating higher net interest margins.

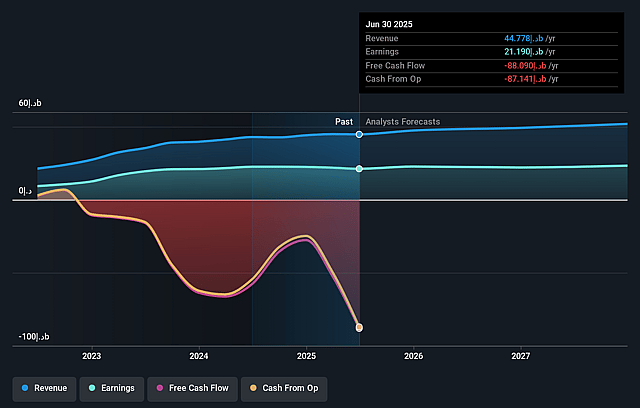

Emirates NBD Bank PJSC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Emirates NBD Bank PJSC's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 47.3% today to 46.0% in 3 years time.

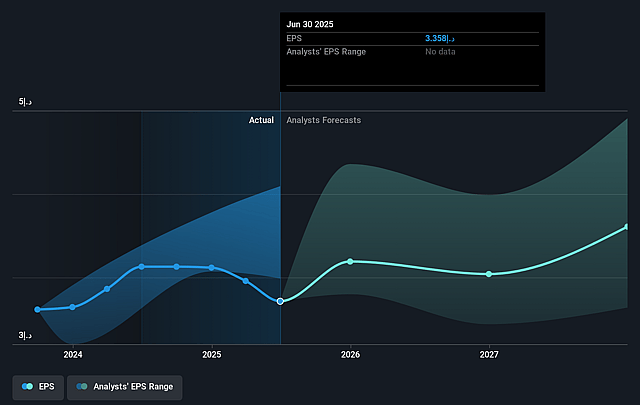

- Analysts expect earnings to reach AED 24.5 billion (and earnings per share of AED 3.85) by about September 2028, up from AED 21.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as AED21.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, up from 7.3x today. This future PE is greater than the current PE for the AE Banks industry at 9.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.32%, as per the Simply Wall St company report.

Emirates NBD Bank PJSC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained pressure on net interest margins due to ongoing and anticipated policy rate cuts in both the UAE and Turkey, combined with increasing competition and high market liquidity, could compress profitability and earnings over time.

- Asset quality risks in Turkey remain elevated, as DenizBank continues to face high cost of risk (guidance of 250 basis points for 2025) and macroeconomic uncertainty; normalization may still result in persistently higher provisioning costs that could weigh on group net profits.

- High operating expenses due to significant, ongoing investments in international expansion, digital transformation (including GenAI), and workforce growth could erode net margins if revenue growth slows or efficiency improvements lag.

- Continued reduction in sovereign loan exposure and corresponding increase in risk-weighted assets (RWA density) may strain capital adequacy and require enhanced capital generation to maintain current CET1 ratios, with potential downstream impact on lending growth and return on equity.

- Dependence on strong economic and property market conditions in the UAE and key international markets makes growth assumptions vulnerable to cyclical downturns, while lack of material new government borrowing and a shift to pre-funded real estate development reduce opportunities for high-volume, low-risk loan growth-potentially impacting future revenue trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED28.672 for Emirates NBD Bank PJSC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED32.6, and the most bearish reporting a price target of just AED25.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be AED53.3 billion, earnings will come to AED24.5 billion, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 20.3%.

- Given the current share price of AED24.65, the analyst price target of AED28.67 is 14.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.