Narratives are currently in beta

Key Takeaways

- Strategic expansion and loan growth in Saudi Arabia and retail sectors are expected to drive future revenue and increase market share.

- AI-driven digital transformation and ESG initiatives could enhance efficiency, margins, and attract new customer segments, supporting resilient earnings.

- Competitive pressures and interest rate changes pose risks to net margins, earnings, and asset quality, necessitating careful management of foreign expansions and impairment allowances.

Catalysts

About Emirates NBD Bank PJSC- Provides corporate, institutional, retail, treasury, and Islamic banking services.

- Emirates NBD is experiencing significant growth in loan volumes, driven by a 49% increase in loan growth in Saudi Arabia and strong growth in both retail and corporate lending; this is expected to support future revenue as loan demand continues to rise across various sectors.

- The bank's investment in digital transformation and deployment of AI and machine learning to improve customer services and operations, including customer behavior prediction and streamlining onboarding processes, is poised to enhance operational efficiency and potentially improve net margins.

- Strong growth in net interest income was achieved despite falling interest rates, with a significant increase in fee and commission income from new products, indicating future resilience in earnings through diversified income streams.

- Expansion of the bank's presence in key markets, such as Saudi Arabia (with increased branches) and continued investment in the Turkish market, is positioned to drive further revenue growth through increased regional market share and customer acquisition.

- Ongoing investment in ESG initiatives, including achieving the highest number of platinum-certified branches globally and introducing sustainable financial products, aligns with growing market demand for ESG-compliant services, which may attract new customer segments and bolster future earnings.

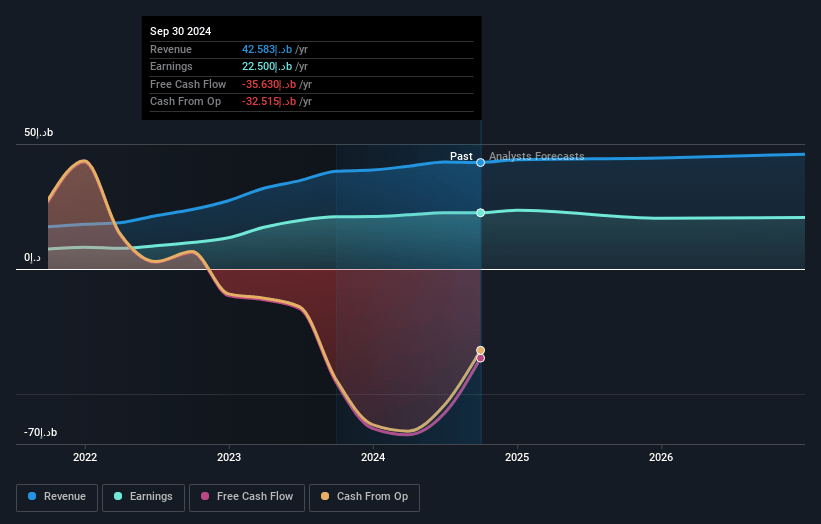

Emirates NBD Bank PJSC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Emirates NBD Bank PJSC's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 52.8% today to 41.5% in 3 years time.

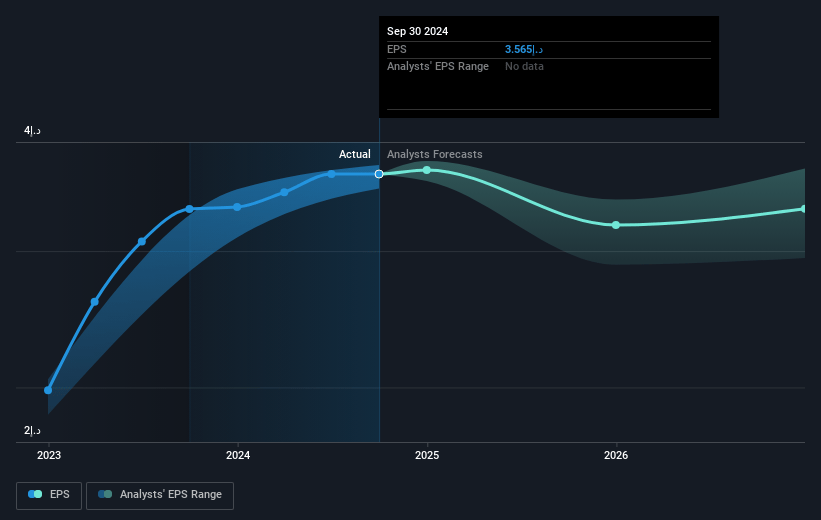

- Analysts expect earnings to reach AED 19.2 billion (and earnings per share of AED 3.06) by about December 2027, down from AED 22.5 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as AED 23.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.4x on those 2027 earnings, up from 5.7x today. This future PE is greater than the current PE for the AE Banks industry at 12.9x.

- Analysts expect the number of shares outstanding to decline by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.89%, as per the Simply Wall St company report.

Emirates NBD Bank PJSC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates in Turkey have led to higher DenizBank delinquency rates, potentially impacting the overall cost of risk and necessitating increased impairment allowances, which may suppress net margins and earnings.

- The bank faces competitive loan pricing pressure in the UAE due to abundant liquidity, which might compress net interest margins and affect the profitability and revenue growth.

- Falling interest rates globally could further pressure net interest margins, particularly for a bank with a significant portion of low-cost CASA deposits, leading to squeezed earnings if loan growth does not compensate sufficiently.

- DenizBank's lower non-client-related income year-on-year, partly due to lack of mark-to-market gains witnessed in previous volatile periods, may contribute to variability in non-funded income, impacting overall revenue streams.

- Expansion in KSA, while driving growth, could expose the bank to elevated credit risk and creditor rights issues in foreign jurisdictions, potentially affecting asset quality and net margins if not managed carefully.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED 23.8 for Emirates NBD Bank PJSC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED 28.5, and the most bearish reporting a price target of just AED 19.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be AED 46.3 billion, earnings will come to AED 19.2 billion, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 19.9%.

- Given the current share price of AED 20.15, the analyst's price target of AED 23.8 is 15.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives