Why Gold Isn't Outperforming

Reviewed by Michael Paige, Stella Marie Ong

What Happened in the Market This Week?

Market Insights for week ending 23rd October

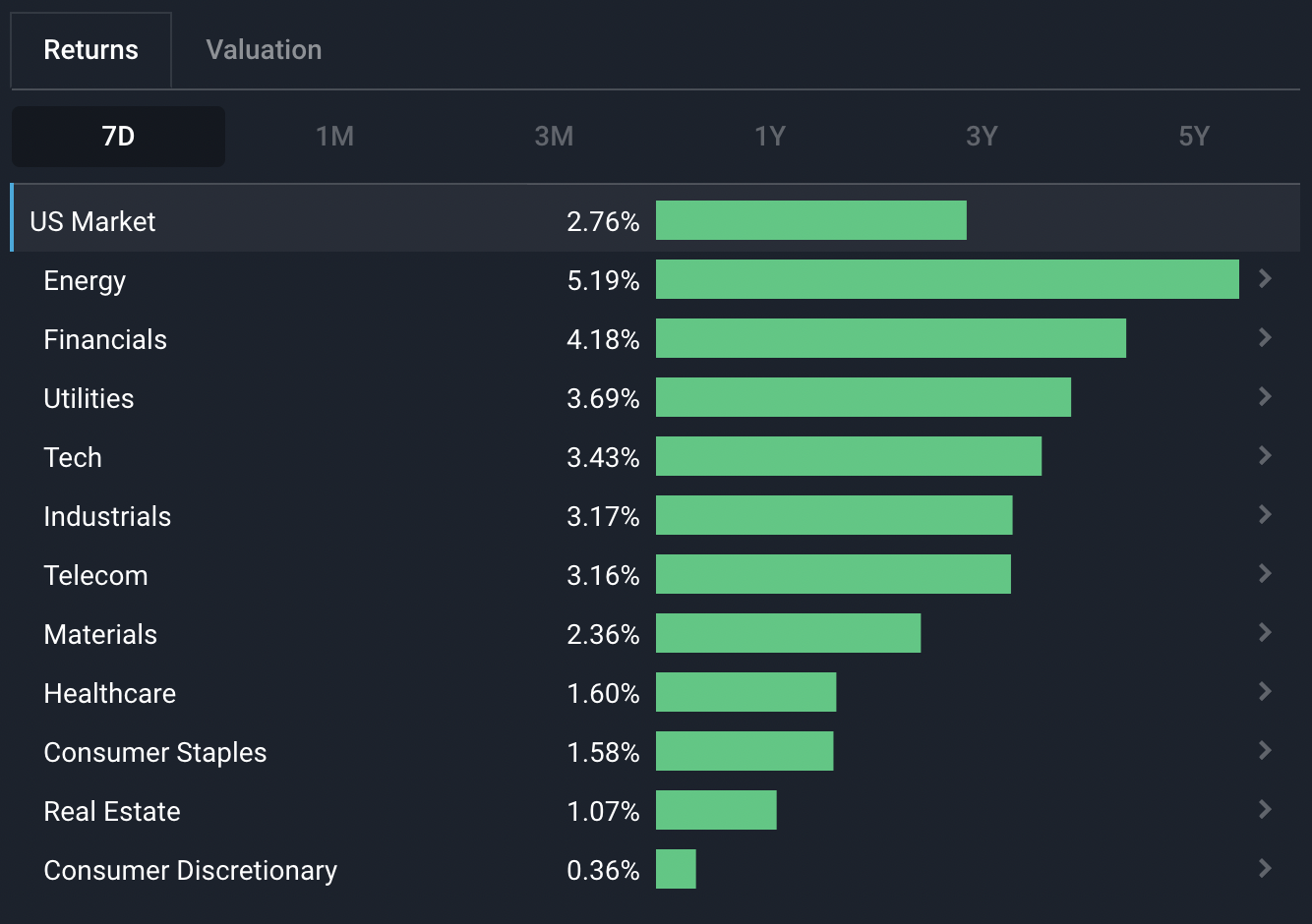

Compared to last week’s sea of red, investors appear a lot more optimistic this week with all sectors in the green. Financials led the way after some of the banks reported expected quarterly results. The telecoms sector also had some good news for a change with Netflix (Nasdaq:NFLX) surprising investors and reporting better subscriber numbers.

| U.S. Sector 7D Performance - 21st October 2022 - Simply Wall St |

Some of the developments we have been watching over the last week include:

- The gold price has underwhelmed investors this year despite record high inflation and a bear market in stocks and bonds.

- The U.S. has imposed controls on semiconductor exports to China which could have far ranging implications.

- Liz Truss stepped down just 6 weeks into the role, right after sacking the Chancellor of the Exchequer. The iceberg lettuce did not give any comment on its victory, because it’s a lettuce.

Is Gold Still a Valid Portfolio Hedge?

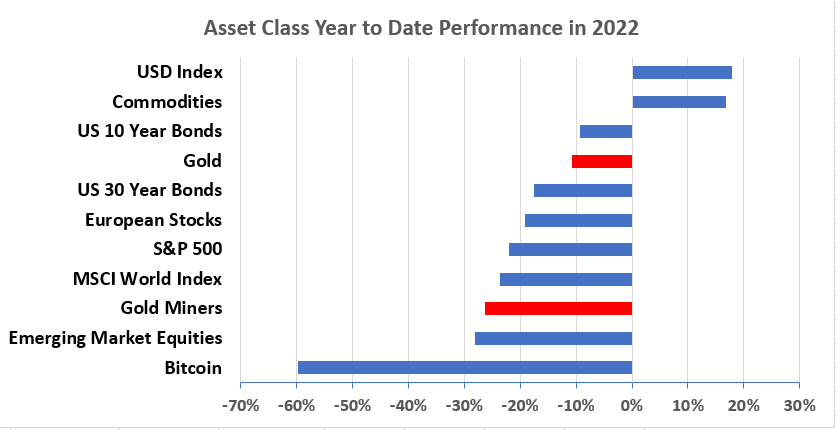

The performance of the gold price in 2022 has been somewhat… surprising. Gold is now trading at $1,640, down 7.7% from a year ago and 20% off the March high. Gold, like the USD, is usually seen as a safe haven for investors to park cash in while the market experiences volatility. While it has outperformed many other asset classes, it hasn’t performed as many people would have expected given the record high inflation and bear market in both stocks and bonds. If gold was ever going to generate strong returns, 2022 should have been the year. So what gives?

Gold mining companies have fared even worse as their costs have risen while revenues have fallen with the gold price.

Gold and Gold Miners’ Performance vs Other Asset Classes - Data from: Tradingview.com

Why has the gold price underperformed expectations?

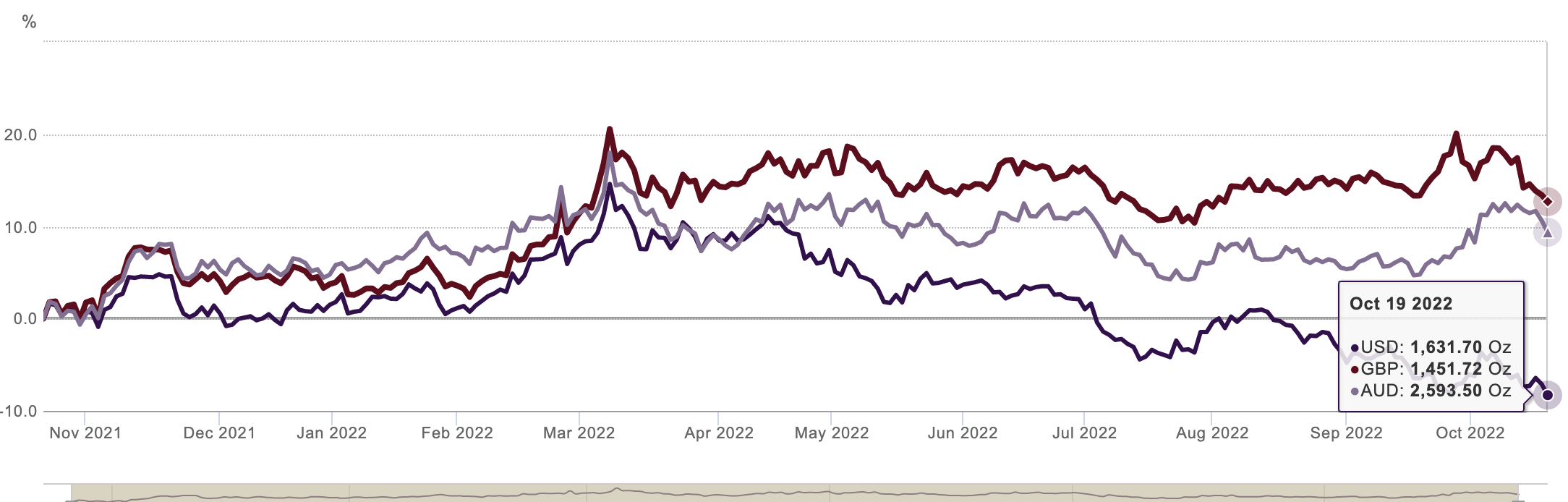

There are several reasons for gold’s relatively weak performance. Firstly, gold is priced in U.S. dollars, so when the dollar is strong - as it has been all year - gold appears relatively weak. To illustrate the point, iIf we look at the performance of gold in GBP, it’s up 8% YTD. In addition, because the dollar has remained in a strong uptrend through most of the year, there has been little reason to look for an alternative safe haven.

Secondly, higher interest rates have made leveraged positions more expensive to hold and have magnified losses as prices have fallen. The gold price rallied sharply in 2020 when central banks began quantitative easing programs (which increased the money supply) and again early this year when Russia invaded Ukraine, and inflation began to spike. It’s likely that a lot of this buying was made with leverage when rates were very low. As the gold price fell, those positions fell into a loss (which was magnified by the leverage) while the cost of owning the positions increased due to higher rates.

Gold price chart in USD (ending lowest), GBP (ending highest), and AUD (middle line) Image Credit: Goldhub

Finally, we can probably assume that gold is now facing competition from digital gold - AKA Bitcoin - which has changed the market dynamics to some extent. Some of the capital that may have previously flown to gold is now tied up in Bitcoin, which has unfortunately fared even worse this year.

When will the Gold Price recover?

If you’re looking for a catalyst, the USD and interest rates are likely to be the key to gold’s future direction. An escalation of geopolitical risk would probably increase investor’s interest in gold - but as long as the USD remains in an uptrend, there is little reason for investors to look elsewhere. But, if the dollar begins to weaken, gold would look relatively attractive and could offer investors an alternative safe haven.

A Fed pivot, or signs that rates will stop rising, could also lead to a higher gold price. Gold often rallies when there is a perception that the Fed’s action will devalue the USD or create an asset price bubble. This would also tie in with fears of a financial crisis which could lead to the Fed being forced to provide liquidity to the system.

💡 The Insight: Investing in Gold has Pros and Cons

Gold is widely viewed as an inflation hedge, but in reality the stock market has proved to be a much better inflation hedge over the long term. That said, gold has a good track record as a hedge against portfolio volatility caused by geopolitics, systemic risk or recession fears. While its performance has been disappointing (so far) during this bear market, a portfolio with an allocation to gold would still have had less volatility and better performance than a portfolio with 100% allocation in equities.

For Short or Medium-Term Investors (< 5 years)

If you want to include gold exposure in your portfolio, you can either hold gold itself, gold ETFs or shares of gold miners. Gold miners have leveraged exposure to the gold price because their production costs are (relatively) static while revenue rises and falls with the price of gold. This means that their profits increase faster than the gold price rises, but the opposite occurs when the gold price falls.

The production cost for gold mining companies varies substantially. In the first quarter this year, Harmony Gold’s (NYSE:HMY) production cost was $1800, meaning at the current gold price it would make a loss on any gold it sold. On the other hand, Barrick Gold (NYSE:GOLD) and Endevour Mining Plc (TSX:EDV) reported production costs of $1,164 and $848 respectively, giving them more of a cushion. If you invest in gold shares, make sure you know what their production costs are (actually called all-in sustainable costs), and how much cash they have.

For Long-Term Investors (5+ years)

Gold, like cash and bonds (prior to 2022 at least) can reduce the volatility of a portfolio. But, like any hedge (option strategies included), there is a cost to performance over the long term. Each investor needs to make a trade-off between potential returns and volatility. This comes down to the amount of volatility you can tolerate before you panic into irrational decisions. Checking in again with your personal financial objectives and risk profile will help you make an informed decision.

U.S. Imposes Controls on Semiconductor Exports to China

The U.S. has imposed wide ranging restrictions on the way U.S. citizens and semiconductor companies can do business with Chinese tech companies. The controls are designed to limit China's access to high performance chips, and the equipment used to make them, as well as intellectual property. U.S. citizens have also been banned from working for certain types of companies in China.

The primary reason for the controls is to limit China’s military capabilities, but this is also part of the battle between the U.S. and China over technology and intellectual capital.

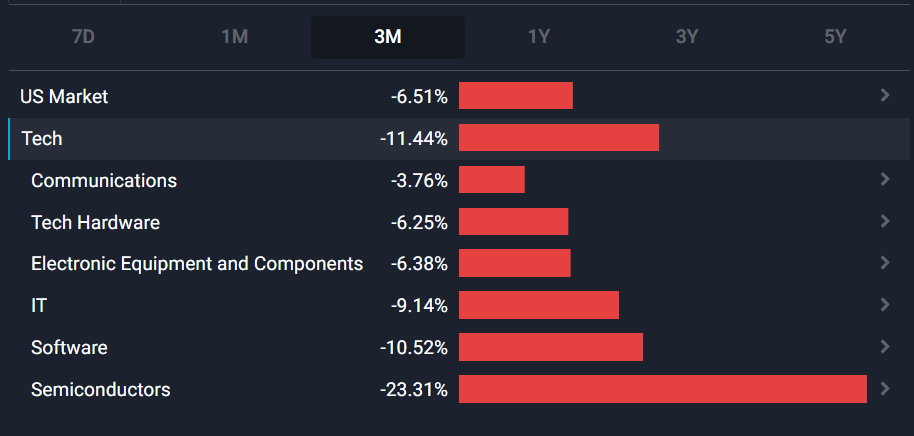

This move wasn’t entirely unexpected. In August, Nvidia (Nasdaq:NVDA) mentioned in an SEC filing that it had been notified of the restrictions. But it’s more bad news for an industry that’s already dealing with slowing demand. AMD (Nasdaq:AMD) recently warned that third quarter revenue would be 14% less than expected due to low demand from the PC market.

Tech Sector Industry Returns Over the Last Three Months - Simply Wall St

Which companies will be affected by the chip restrictions?

The companies that are most affected are those that work very closely with China’s semiconductor manufacturers. These include Lam Research (Nasdaq:LRCX), KLA Corporation (Nasdaq:KLA) and Applied Materials (Nasdaq:AMAT).

Companies like Nvidia and AMD that sell chips to Chinese companies will also be affected. Nvidia has already indicated that it will lose around $400 million of sales in the third quarter which works out to about 5% of revenues. Similar figures have been mentioned for AMD, while Intel seems to be less exposed.

The controls don’t only apply to U.S. companies, but to any companies in the semiconductor ecosystem that wants to do business with U.S. companies. In particular, this applies to Taiwan Semiconductor (NYSE:TSM) in Taiwan, Samsung Electronics (KOSE:A005930) in South Korea and ASML (ENXTAM:ASML) in the Netherlands.

These controls wouldn't have been a complete surprise to China either, and the country has been investing heavily in its own chip industry. Nevertheless, the lack of access to equipment is likely to cripple China’s own semiconductor industry. It could also be a disaster for China’s electric vehicle makers including Nio (NYSE:NIO), XPeng (NYSE:XPEV) and Li Auto (Nasdaq:LI) - although it’s not clear whether or how they will be affected yet.

💡 The Insight: Government Policy can alter Industries

These export controls could have far reaching implications. The supply chain for electronic goods, machinery, auto and even household appliances is incredibly complicated. One smartphone has numerous chips in it, while an electric vehicle requires thousands of chips. Tesla, for example, uses chips from 43 different companies in each vehicle.

It only takes one missing component to bring an entire production line to a halt. Eventually, the semiconductor ecosystems will be reorganized - but in the meantime, manufacturing industries could be in for another round of supply chain bottlenecks.

For Investors: At this stage, it isn’t entirely clear which products will and won’t fall under the ban. Some components clearly do, but others may be excluded depending on their end use. This topic is likely to come up during earnings calls over the next few weeks and will probably be one of the first questions analysts ask - so keep an eye out in the media for more clarity.

Liz Truss Steps Down After Just 6 Weeks

There was more drama in the U.K. as Liz Truss, now the ex-PM, had stepped down amidst the chaos surrounding her short-term role as the head of state. This was merely days after she was forced to fire the Chancellor of the Exchequer (Kwasi Kwarteng) who was just 38 days in the job.

While elections would be required to find the next Prime Minister, Jeremy Hunt replaced Kwai Kwarteng as the new Chancellor, and immediately reversed the economic plan on which Truss was elected. This included scraping proposed tax cuts and limiting energy bill caps.

💡 The Insight: The Power of Monetary Policy

In the 1990s, Bill Clinton allegedly said “You mean to tell me that the success of the program and my re-election hinges on the Federal Reserve and a bunch of $%@# bond traders?"

The last few weeks have once again shown how much power the bond market has over the careers of politicians. Regardless of what politicians and central bankers say, bond markets can be very quick to discount economic reality.

Key Events This Week

This is ‘Big Tech Earnings Week’.

Look out for:

- Alphabet (Nasdaq:GOOGL) and Microsoft (Nasdaq:MSFT) on Tuesday;

- Meta (Nasdaq:META) on Wednesday, and;

- Apple (Nasdaq:AAPL) and Amazon (Nasdaq:AMZN) on Thursday.

There are hundreds of other companies reporting - some of the big ones include: Shopify (NYSE:SHOP), UPS (NYSE:UPS), Coca Cola (NYSE:KO), GM (NYSE:GM), Visa (NYSE:V) and Intel (Nasdaq:INTC).

In regards to economic data this week, we have:

- China’s GDP growth rate is now due on Monday, after being postponed by a week.

- On Wednesday, Australia’s latest inflation rate is due, and in the U.S., new home sales will be published.

- On Thursday the ECB rate decision will be announced and in the U.S., the advance GDP growth rate will be published.

- On Friday, the Bank of Japan will also announce its interest rate decision. In the U.S., personal income and spending data is due, as well as the University of Michigan sentiment index.

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.