“The future belongs to those who believe in the beauty of their dreams.”

― Eleanor Roosevelt

We are now ten weeks into our ‘‘Big Trends’ series, and we are having a look at two closely related industries:

- Gaming

- Virtual & Augmented Reality .

The first is one of the oldest technology sectors around, and the second… well it seems to be perpetually on the verge of take-off.

Let’s have a look at how these industries have evolved, the applications of VR and AR, and how to invest in these industries if you’re interested in them!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts!

Gaming - A Lucrative Entertainment Industry

Video games have now been an important part of the tech industry for over 50 years - in fact Atari was one of the very first Silicon Valley startups.

Gaming has also provided the revenue that funded the development of key technologies that were later adopted by other industries.

Many of the components that went into the first personal computers were developed for gaming consoles and arcade games. 3D graphics, GPUs and virtual reality have followed a similar pattern.

Where would AI be now without those GPUs? It’s anyone's guess.

So gaming is not a new trend - yet it continues to grow and evolve as technology allows. It’s also a key driver of development of ‘the metaverse’ and Web 3.0.

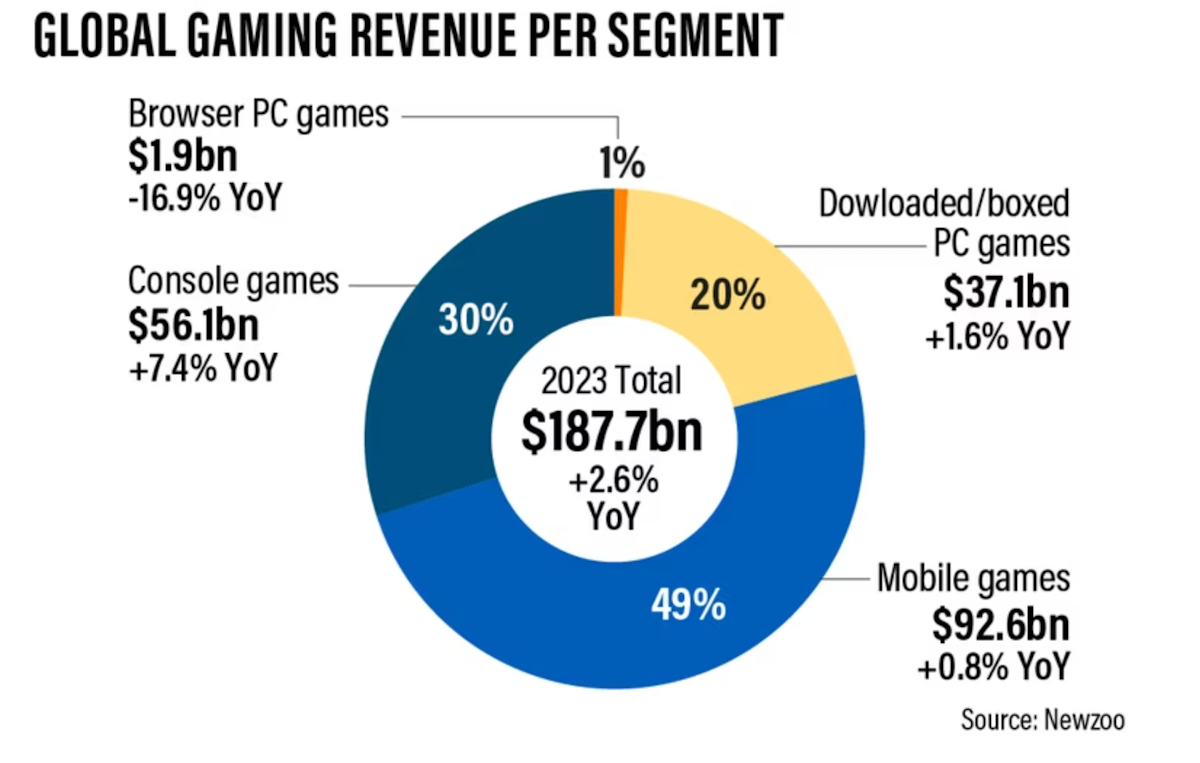

In 2023 the global gaming industry is estimated to generate between $188bn and $396bn in revenue. While I know that’s a huge range, estimates differ based on the definition of “gaming” revenue. They’ve grown at 11 - 15% annually over the last five years.

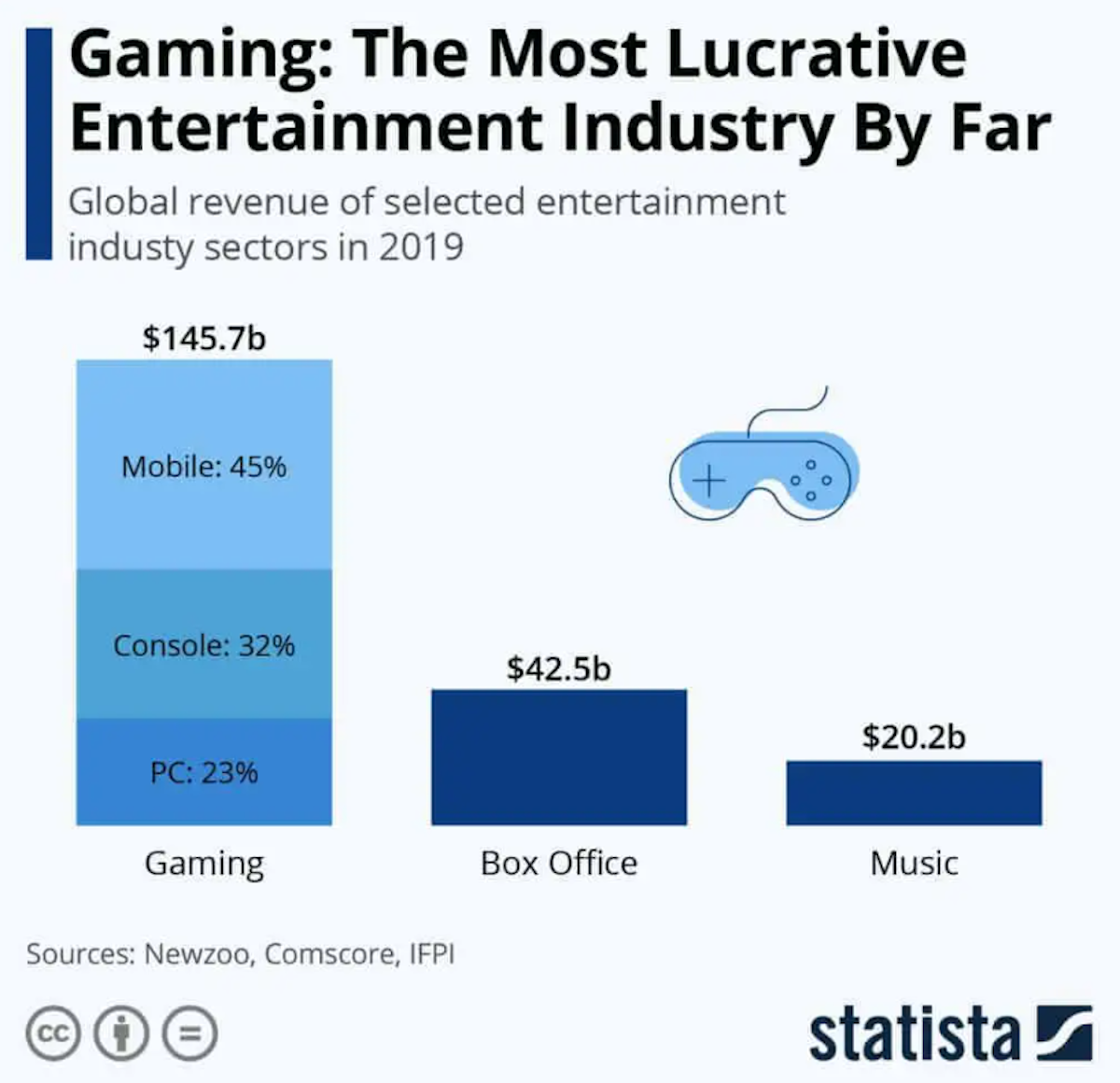

Gaming is now a far larger industry than the global music and film making industries.

In fact, this has been the case for quite a while. The chart below shows how global gaming revenue compared to movies and music combined in 2019, and this was prior to the pandemic, which, as you may have expected, caused the gap to widen even further.

Gaming’s Evolution: From Arcades To Smartphones

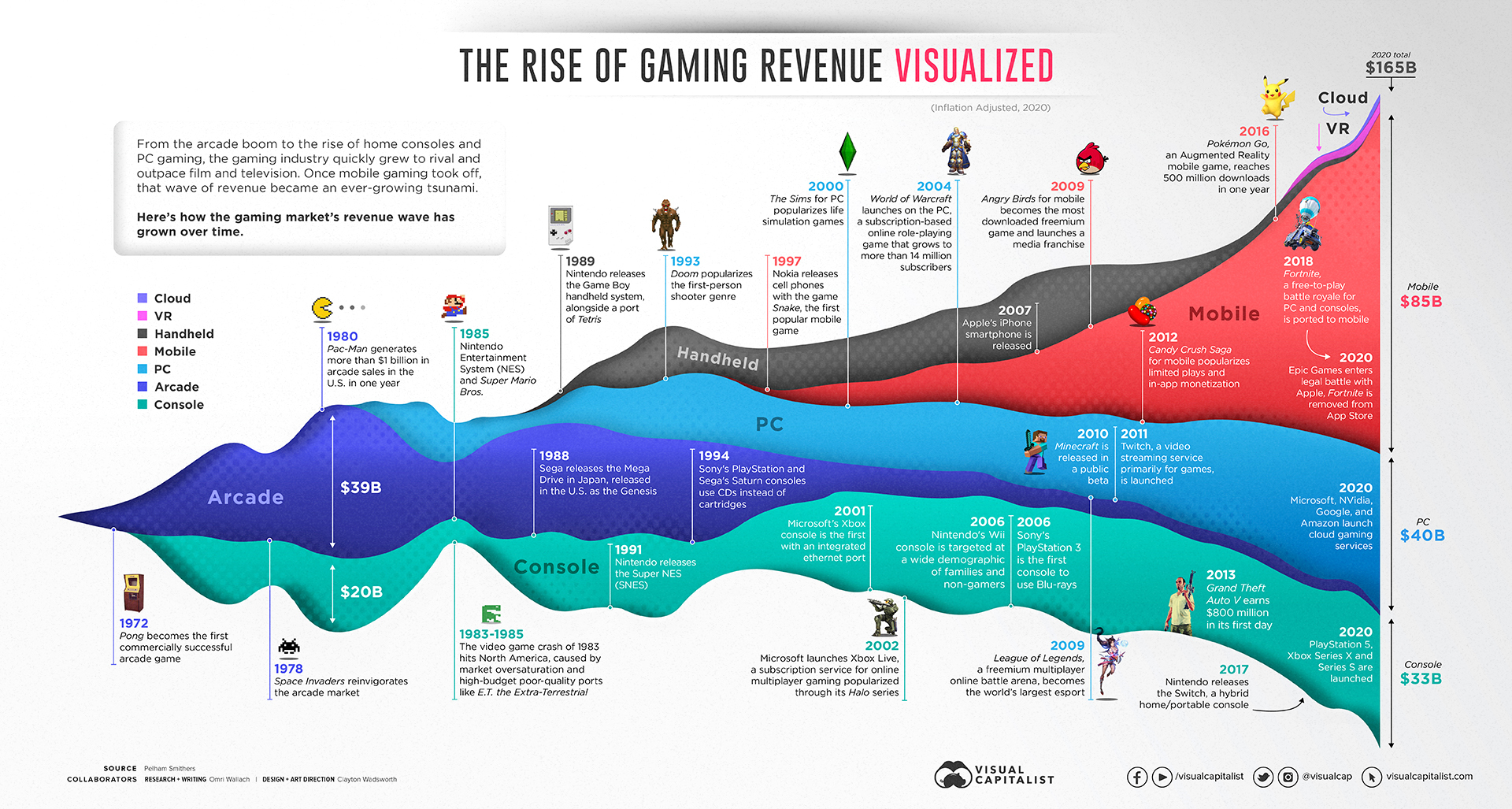

Gaming is a constantly evolving industry. It started with arcade games, which gave way to consoles and PCs, then handheld devices which have given way to mobile phones.

Interestingly, global gaming revenue began to accelerate in 2007 the year the iPhone was launched.

Business models within the industry have also changed.

While sales of consoles and games used to account for nearly all the industry’s revenue, mobile gaming now generates 50% of all revenue via in-app transactions and advertising.

One of the reasons for this is that casual and social games, which dominate on mobile, have broadened the gaming market from just ‘hardcore gamers’,(hundreds of millions globally with consoles and PCs), to over 3 billion mobile phone users.

New areas of growth include Esports and sports betting.

Esports has turned gaming into a competitive sport, bringing with it everything associated with competitive team sports: tournaments, advertising, team ownership, arenas - and yes, even doping scandals .

Sports betting has gained momentum since the US Supreme Court ended a federal ban on sports betting in 2018 . Since then more than half of US states have allowed betting on sports with more expected to follow.

It may seem that the gaming industry is saturated, but it seems to continually evolve, finding new platforms, audiences and revenue streams.

Economics of Games vs Movies

Investment in the creation of games can be a much more profitable investment than other entertainment, like cinema.

Here’s some examples of the best financial performances to give you some context.

-

Rockstar Games (owned by TakeTwo Interactive ):

- The company reportedly spent $265m to create GTA 5 , and in the first 3 days after launch, it generated $1bn in sales.

- Since launch, it has reportedly generated $7.7bn in sales from over 180m copies .

-

That’s an estimated ROI of 29x their original investment.

- This excludes ongoing development costs (which aren’t high) and additional revenue generated from in-game microtransactions ( which are very high - in the hundreds of millions per year ).

-

Minecraft:

- Indie games can have even higher ROI’s. The cost to create Minecraft was the time of one solo developer who built it outside of a day job .

- Minecraft became the best selling game of all time, selling over 230m copies.

- It generated roughly $3bn in sales between 2012 and 2020

- The studio, Mojang Studios , was bought by Microsoft in 2014 for $2.5bn.

- The ROI for Markus Persson, the creator, is huge, considering he became a billionaire from the game .

-

Compare these to the highest grossing movie of all time - Avatar.

- The film cost $237m in 2009 to make, and grossed $2.9bn at the box office.

- While a 12x return isn't, it pales in comparison to the money made in games.

That's not to say there isn't plenty of money to be made in the. movie industry! Here’s a look at some of the most profitable movies of all time .

But what makes video games different from an investment perspective?

There’s a few reasons why video games have the potential to provide such great returns on investment:

- Development teams are cheaper to hire than Hollywood actors.

- Yes, large AAA titles will have budgets comparable to Hollywood movies, but there are commonly small development studios that can see great commercial success in the gaming industry.

- We previously mentioned the success of Minecraft, but Battlebit: Remastered is a recent example which has sold 1.8 million copies thanks to the dedication of a three-person development team .

- Modern video games are living and breathing entities.

- Bad movies will always be bad movies. Once a movie hits the silver screen, there’s nothing more to be done than await the verdict of critics. On the other hand, video games can receive post-launch updates and expansions that can reinvigorate interest in the game.

- No Man’s Sky is a famous example that received harsh criticism on launch, but has managed to receive widespread acclaim through updates and expansions .

- Video games are perfect for post-launch monetization.

- After theatrical release, movies have limited avenues to earn ongoing revenue. Merchandise and royalties from streaming platforms are great ways to keep the revenue flowing, but audiences often have little interaction after the initial 2-3 hour watch period.

- However, video games often can often capture the attention of players for 50+ hours, increasing the likelihood a player spends money on microtransactions for in-game cosmetics, expansions and mechanics which can result in strong revenues even years after the release of the game.

- Merchandising is still a viable avenue for games as well, when you consider Pokemon is the highest grossing media franchise in the world with over $80bn in licensed merchandise sales .

Virtual and Augmented Reality

The potential for virtual and augmented reality has been the subject of successive waves of optimism for years, and most recently when the concept of the metaverse dominated the financial media. But, so far, it's never quite lived up to the hype.

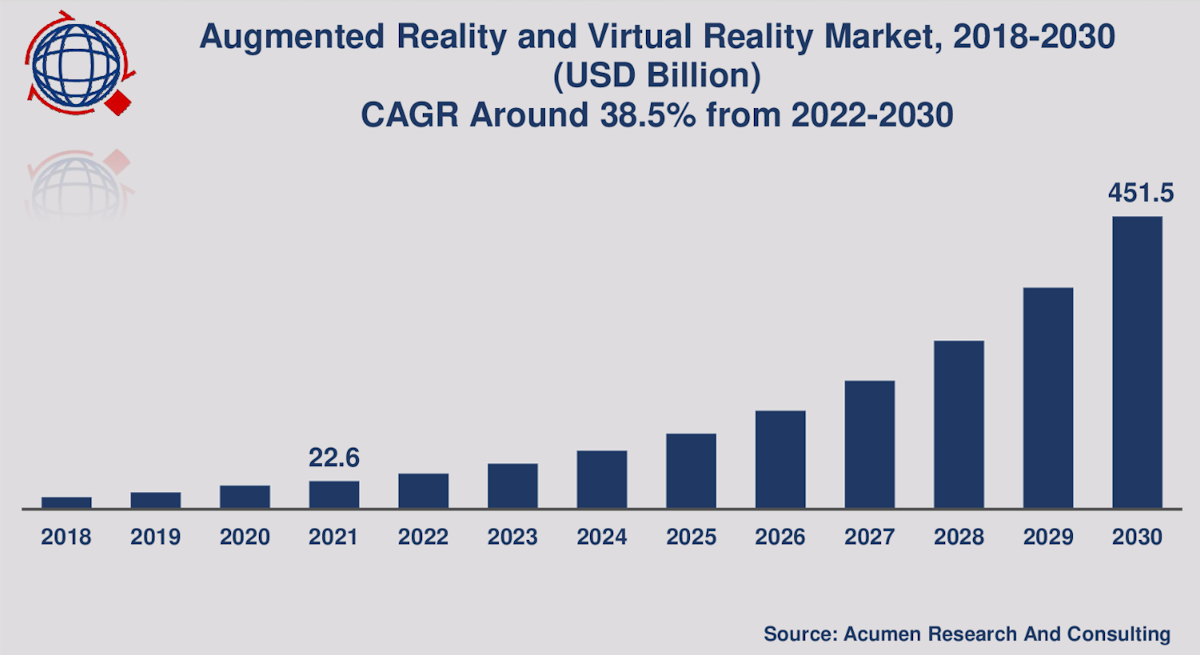

Below is a fairly recent projection for the growth of the industry. But if you go back five or ten years, and look at the forecasts at the time , you’ll see that current revenue is less than half of what it was expected to be.

The industry always seems to be on the cusp of take-off, but it never quite happens.

While AR/VR tech may seem like a very recent step forward, the idea of head mounted displays (HMDs) augmenting your reality have been around for nearly 30 years, with early iterations including the Forte VFX1 Headgear or Nintendo’s Virtual Boy from 1995.

Oculus, which initially started its life as a Kickstarter campaign in August 2012 reginited global tech’s interest. Acquired by Meta (then Facebook) for $2 Billion in 2014.

The Various AR and VR Applications

Right now, the technology is still confined to niche applications and the 20 odd million Oculus headset owners . But it might be more widely used than you think. Here are just a few of the real world applications of AR/VR technology:

-

🎮 Gaming :

- The technology’s original use case continues to be the main driving force behind annual sales figures for AR/VR hardware.

- The usual suspects of Sony, and Meta are continually making advancements in the VR gaming offerings, with the PS VR 2, and the Oculus.

-

👕 Retail:

- AR is gaining traction in retail and ecommerce, where it allows customers to ‘try before they buy’.

- For example, Etsy and other marketplaces for art and furniture use AR to allow customers to visualize products in their home. Fashion retailers are using similar solutions to allow online customers to ‘try on’ clothing virtually.

-

🏠 Real Estate and Construction:

- Both AR and VR are now widely used for marketing in the real estate, construction, architecture, travel industries.

-

🏭 Manufacturing and Design:

- Virtual reality is gaining widespread use in the manufacturing industry for prototyping and design. This is particularly helpful for capital intensive industries like the auto and aerospace industries.

- It’s also used to design and test new factories and production lines. This can be done using both non-immersive VR (ie. 3D models on a computer screen) and fully immersive 3D environments.

-

👷 Training:

- Various iterations of VR have been used to train airline pilots for decades.

- As the technology becomes more accessible and affordable, it's being used to train people in more industries including healthcare, law enforcement and defense.

- As the cost of VR hardware falls it may also be used to ‘gamify’ education at all levels.

What Catalysts Could Lead to an Acceleration for the Industry?

The commercial applications for both AR and VR should see the industry continue to grow at similar rates to the last few years.

An acceleration would probably require widespread adoption amongst consumers which in turn will require one or two catalysts.

-

Firstly, there needs to be content that draws people in.

- Right now, most consumers probably don’t feel like they are missing out - and that’s unlikely to change until there’s decent content, games or entertainment that offer a signficantly better experience than the existing options.

-

The second catalyst is likely to be the price of a headset.

- Meta’s Quest 2 is $300 and Apple’s Vision Pro is $3,500, both of which are out of reach for most people. As was the case with mobile phones and IoT devices, lower prices would likely result in more widespread adoption.

Investing in Gaming, AR and VR

There's a lot of overlap when it comes to companies operating in gaming, AR, VR and the metaverse.

As you’d expect, many of the same companies keep coming up across multiple technology trends. It’s no surprise to see that all the largest tech companies including Meta , Alphabet , Microsoft , Apple , and Nvidia have substantial exposure to these industries. When it comes to gaming, we can add Tencent to this list.

Besides these companies there are the well known game publishers and gaming hardware companies, including Sony , Nintendo , Electronic Arts , TakeTwo Interactive and Corsair . The Simply Wall St Top Video Game Stock Collection includes a few more examples.

When it comes to sports betting, the major players are DraftKings , Penn Entertainment and UK based Flutter Entertainment . There are a few listed Esports companies ( SKLZ , HUYA , GAME , etc), but they are significantly smaller and investors should exercise extreme caution .

The leading software used to create virtual worlds comes from companies like Roblox , Unity and Adobe .

Less well known companies include Immersion which develops haptic technology (which makes devices vibrate in various ways) and ANSYS, Inc. which provides simulation software. Another is Matterport which provides solutions to create digital replicas of physical spaces.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇺🇲 US consumer inflation rose slightly more than expected in August .

- CPI rose 0.6% in August, compared to 0.2% last month and estimates of 0.5% .

- Prices rose 3.7% in the last 12 months, up from 3.2% in the year to July.

- While the price index rose during the month, it was broadly in line with what economists expected, namely inflation stabilizing above the 3% level.

- Investors still expect the Fed to keep rates at the current level next week.

- 🇬🇧 UK GDP contracted by 0.5% in July , which was more than the expected 0.2% contraction.

- Manufacturing and industrial output fell the most, resulting in the economy erasing June’s gains.

- 🇬🇧 UK unemployment rose from 4.2% to 4.3% in August .

- However, wages rose more than expected and claimants rose less than expected.

- This is just one data point, but higher wages could make the Bank of England’s job more difficult, despite the stagnant economy.

And then, a few news items that we thought were worth noting…

- 🏰 Disney and Charter Communications ended their standoff over streaming bundles.

- Disney had pulled channels including ESPN from Charter’s cable service over a dispute on how Charter distributes its content, and how much Disney receives.

- Charter wanted to offer its customers cheaper bundles that excluded the premium packages like ESPN.

- The deal is a compromise allowing Charter to offer bundles with 19 channels instead of 27. It also allows Charter to become a distributor of Disney’s streaming services.

- Both companies are in a tough position. Cable companies are losing customers to streaming platforms, while Disney still earns $2.2 billion from Charter which it doesn't want to lose. Ben Thomson wrote a great analysis of the future of these relationships .

- 🇪🇺 The EU is considering imposing tariffs on imports of Chinese EVs that benefit from state subsidies, pending an investigation into the industry.

- The investigation targets EVs manufactured in China, which could also affect non-Chinese brands like Tesla .

- The commission has given itself 13 months to investigate the situation, so we can expect a year of rhetoric before anything happens.

Key Events During the Next Week

It’s Fed Funds week, with the US central bank’s monetary policy committee meeting to decide on their next move. The Fed Funds rate will be announced on Wednesday and is expected to remain at the current range of 5.25 to 5.5%.

In the UK the inflation rate will be published on Wednesday and the BOE’s interest rate decision will be announced on Thursday. UK retail sales are also due on Friday.

In Japan the inflation rate and interest rate decision will be released on Friday.

It’s mostly smaller companies still reporting in the US, but there are a few larger ones, including:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.