Pressure On The Global Housing Market Builds

Reviewed by Bailey Pemberton, Michael Paige

What Happened in The Market Last Week?

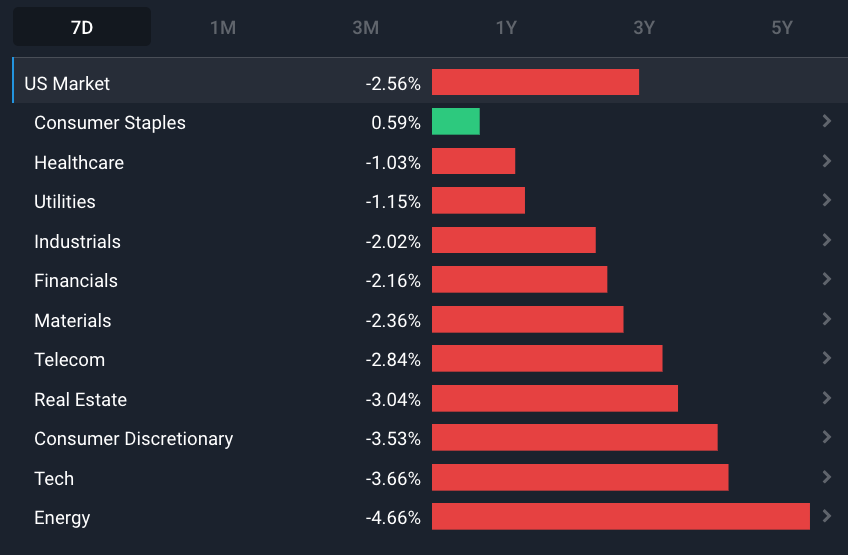

Rising bond yields finally caught up with equity markets last week. On Tuesday the S&P 500 had its worst day this year, falling 2%. Most sectors traded lower, but as risk appetite disappeared investors sought safety in the defensive sectors. US Consumer Staples stocks were up and Healthcare stocks were down marginally, but held up better than other sectors.

One surprise was US Tech growth stocks, many of which traded higher after a few good earnings reports. US Energy stocks had another bad week after the oil price fell below $75.

Some of the developments we have been watching over the last week include:

- Home sales around the world are still falling, although there were some signs of improvement in January.

- The Bank of Japan will soon have a new governor, and he has some big challenges ahead.

The Global Housing Market Slowdown Continues

Headlines around the world are pointing to depressed housing markets, though there have been some signs that things are stabilizing. The state of the housing market is a double edged sword - home prices are still too high to be affordable, while homeowners don't want prices to fall.

Sentiment Is Improving In The US

US existing home sales fell for the 12th consecutive month in January, although the decline of 0.7% was lower than previous months. Housing starts and building permits also fell in January, despite low inventory. House prices in many parts of the country are still rising, though they have fallen in cities that saw the largest increases in 2021. For many people, home prices are still unaffordable and rising interest rates continue to add insult to injury.

When we turn to expert commentary, there were some signs of improvement. Goldman Sachs reduced its estimate of how much house prices will decline and Zillow said it expects house prices to rise slightly by year end. Homebuilder sentiment also improved in January which could be a sign of an inflection point.

The News Is Less Encouraging Elsewhere

In the UK house prices have fallen the most since 2009 as measured by the The Royal Institution of Chartered Surveyors (RICS) house price balance. Mortgage approvals have also fallen to the lowest level since May 2020. This is due to rising mortgage rates which mean home loans are affordable for fewer people as the criteria to qualify for a mortgage becomes stricter.

Australia has seen home prices fall, but the market has now sized up as sellers are holding out for a recovery. This could result in another drop in prices if conditions remain tight, and sellers become forced sellers.

In Canada, home sales in January were down 37% year-on-year , and with bond yields rising again that number could fall further. Home prices have also fallen and are expected to fall further. Despite lower prices and sales activity, Canada has imposed a two year ban on foreigners buying houses . The ban is aimed at making houses more affordable.

💡 The Insight: The Same Cause But A Different Outcome

The cause of the slowdown in home sales around the world is the same. Home prices became unaffordable when rates were at historical lows because it was cheap to secure debt funding, a lot of upward pressure on prices. When the interest rates began to rise, the cost of taking out a loan became far greater and so new mortgage volume fell dramatically. But the outcomes could be quite different.

Around the world, people have access to very different types of mortgages. Some have fixed rates, some have variable rates, and some switch from fixed to variable after a certain number of years. When mortgage rates rise, homeowners paying a fixed rate aren’t affected - unless they want to buy a new house. So while homeowners may not be forced to sell up, the market grinds to a halt.

For homeowners paying a variable rate, their monthly payments might become unaffordable forcing them to sell. The downfall of selling at this point is that they have to sell at a price that’s affordable to buyers given higher rates, so house prices inevitably have to fall. Budgets for homeowners paying off variable rate mortgages also get squeezed which impacts consumer spending.

The term of the average fixed rate mortgage also affects the outcome of rising mortgage rates. In the US, 30 year mortgages are popular, but in many countries fixed rate mortgages are limited to five years. That means that people who took out these mortgages 4-5 years ago will now be faced with paying a dramatically higher mortgage repayment when their fixed rate expires, leading to more homeowners having to refinance at higher rates, or sell.

For Short or Medium-Term Investors (< 5 years)

Most countries are facing a major slowdown in housing sales due to high home prices and mortgage rates. The knock on effects will vary depending on the types of mortgages. This report goes into more detail on the most common types of mortgages in each country.

For Long-Term Investors (5+ years)

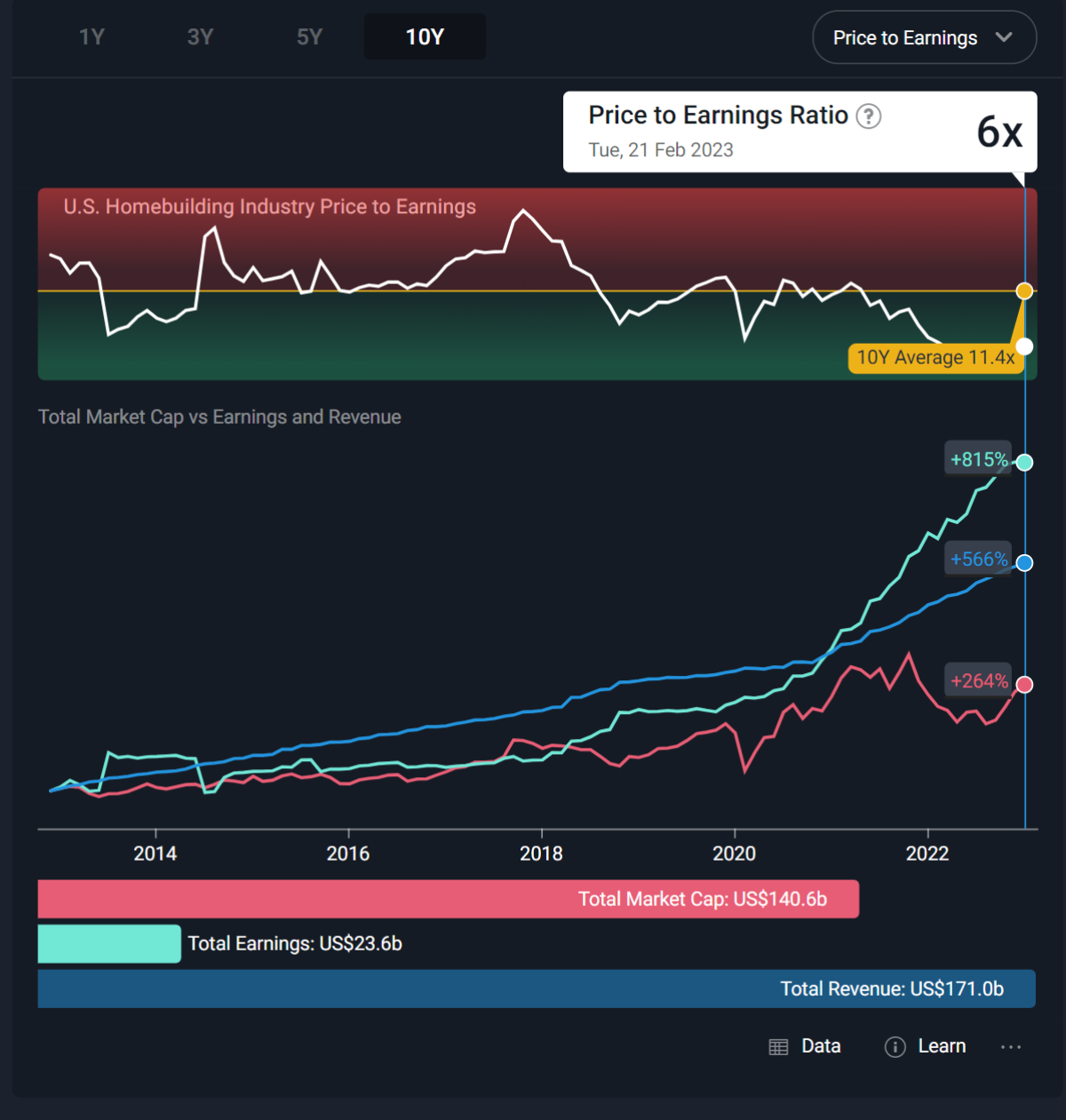

The homebuilding industry is very cyclical and closely correlated to the housing market. But ongoing demand and shortages act as a tailwind for the industry and these companies.

The US homebuilders are trading on a very low price-to-earnings ratio compared to historical earnings - although that’s somewhat misleading as earnings are expected to fall significantly this year. However, the slowdown in activity and its effect on earnings could eventually create an opportunity for long term investors.

Japan’s Economic Challenges

The Bank of Japan (BOJ) will have a new Governor in April when Kazuo Ueda takes the helm. He will have an incredibly tough job tackling inflation without raising rates which many believe will be an impossible task. At the same time, Japan’s economic recovery since the pandemic has been slow.

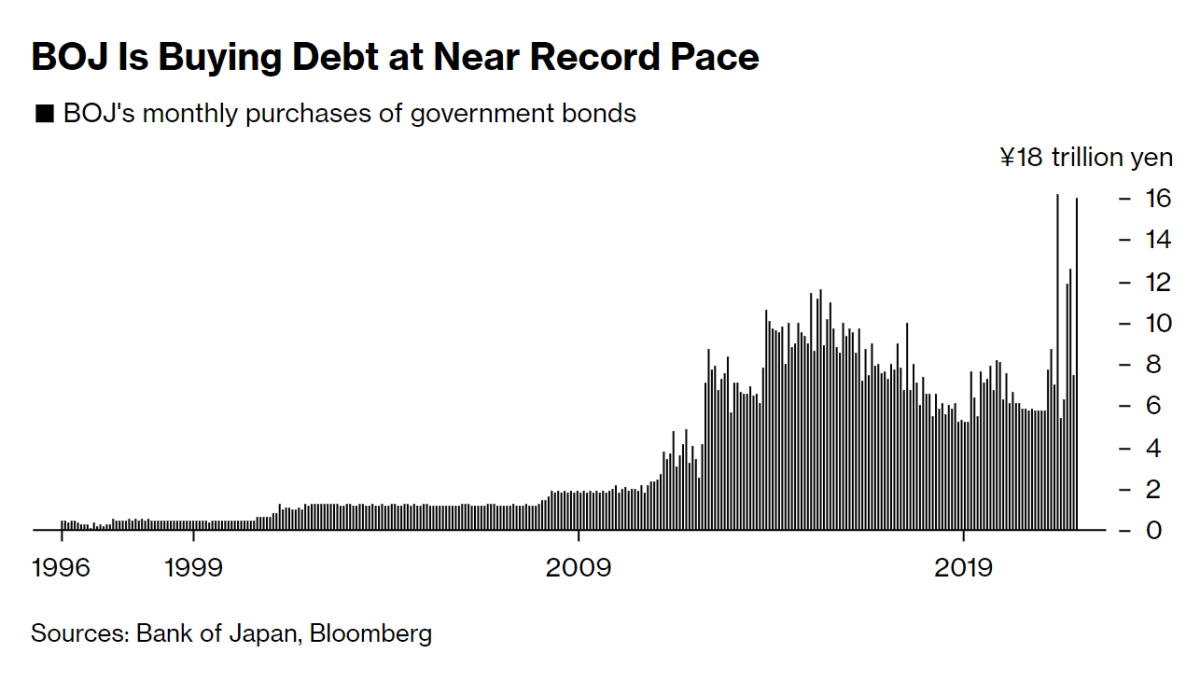

Japan’s government debt is an astonishing 260% of GDP. While that would be alarming in almost all cases, it’s only been manageable because Japan’s interest rates have been close to (and now below) zero for the last two decades.

With higher rates, that debt would not be sustainable. It’s also important to note that Japan’s economic growth is also very low, which means growing its way out of that debt is unlikely.

The End Of Yield Curve Control?

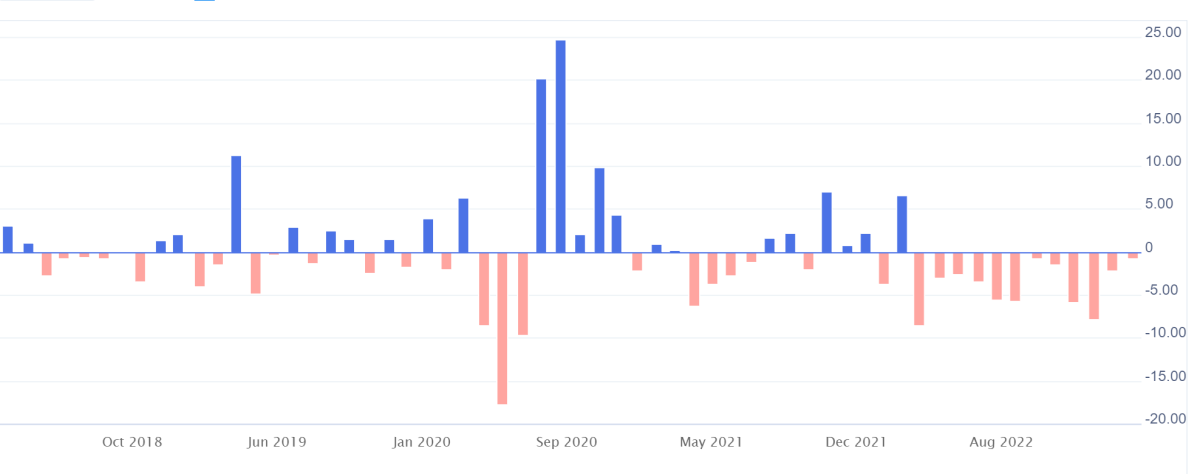

In 2016 the BOJ pivoted from quantitative easing to yield curve control. This policy was used to prevent deflation and encourage short term borrowing. Unlike similar policy tools, YCC targets specific rate bands along the yield curve, and the BOJ steps in to buy bonds when the band is breached.

But this policy also appears unsustainable. To intervene in the market the BOJ has built up a balance sheet equivalent to 135% of GDP . Many believe the bank will soon have to abandon the policy.

This will be Ueda’s challenge. Some are concerned because he studied under Stanley Fischer, as did Ben Bernanke who launched the massive quantitative easing program in the US. Former Treasury Secretary, Lawrence Summers, even called Ueda Japan’s Ben Bernanke . It’s not that he’s expected to do the same thing, but that he’s regarded as decisive and may surprise the market with his strategy.

BlackRock’s research team downgraded Japanese equities and thinks a policy change is both likely and inevitable and could lead to reduced risk appetite and higher global yields .

💡 The Insight: Japan’s Economy Doesn’t Operate In Isolation

In 2010 China’s GDP overtook Japan and it's now more than four times the size of Japan’s economy. But Japan is still the third largest economy in the world and it has a significant place in the global financial system. One of the effects of the BOJ’s policies is that it has flooded the world with liquidity.

If the policies that created this situation are reversed, it could have profound effects on the global financial system.

What this means for investors

In December, the BOJ shocked global markets when it unexpectedly widened its target range for 10-year bond yields. At the time risk appetite was beginning to return to markets, but the effect was still felt by bond and equity markets elsewhere.

Even if you don’t have direct exposure to Japanese investments, it's important to be aware that a major policy shift in Japan could have a major effect on liquidity and risk appetite around the world.

Key Events During the Next Week

There’s very little notable data out in the next week. US durable goods orders will be released on Monday. On Wednesday Australia’s GDP growth rate and China’s manufacturing data are out, and then on Thursday inflation and employment data in Europe will be closely watched.

Earnings season is starting to wind down, but there are still plenty of important companies reporting. They include:

- Berkshire Hathaway ( NYSE: BRK.B )

- Occidental Petroleum ( NYSE:OXY )

- Zoom Video ( Nasdaq: ZM )

- Target ( NYSE: TGT )

- Nio Inc ( NYSE:NIO )

- Dollar Tree ( Nasdaq: DLTR )

- Snowflake ( NYSE: SNOW )

- Salesforce ( NYSE: CRM )

- Okta ( Nasdaq: OKTA )

- Costco ( NYSE: COST )

- Broadcom ( Nasdaq: AVGO )

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.