How to Invest Like the Best - Part 6: How to Monitor Your Stocks, and Discover New Investing Ideas

Key Takeaways:

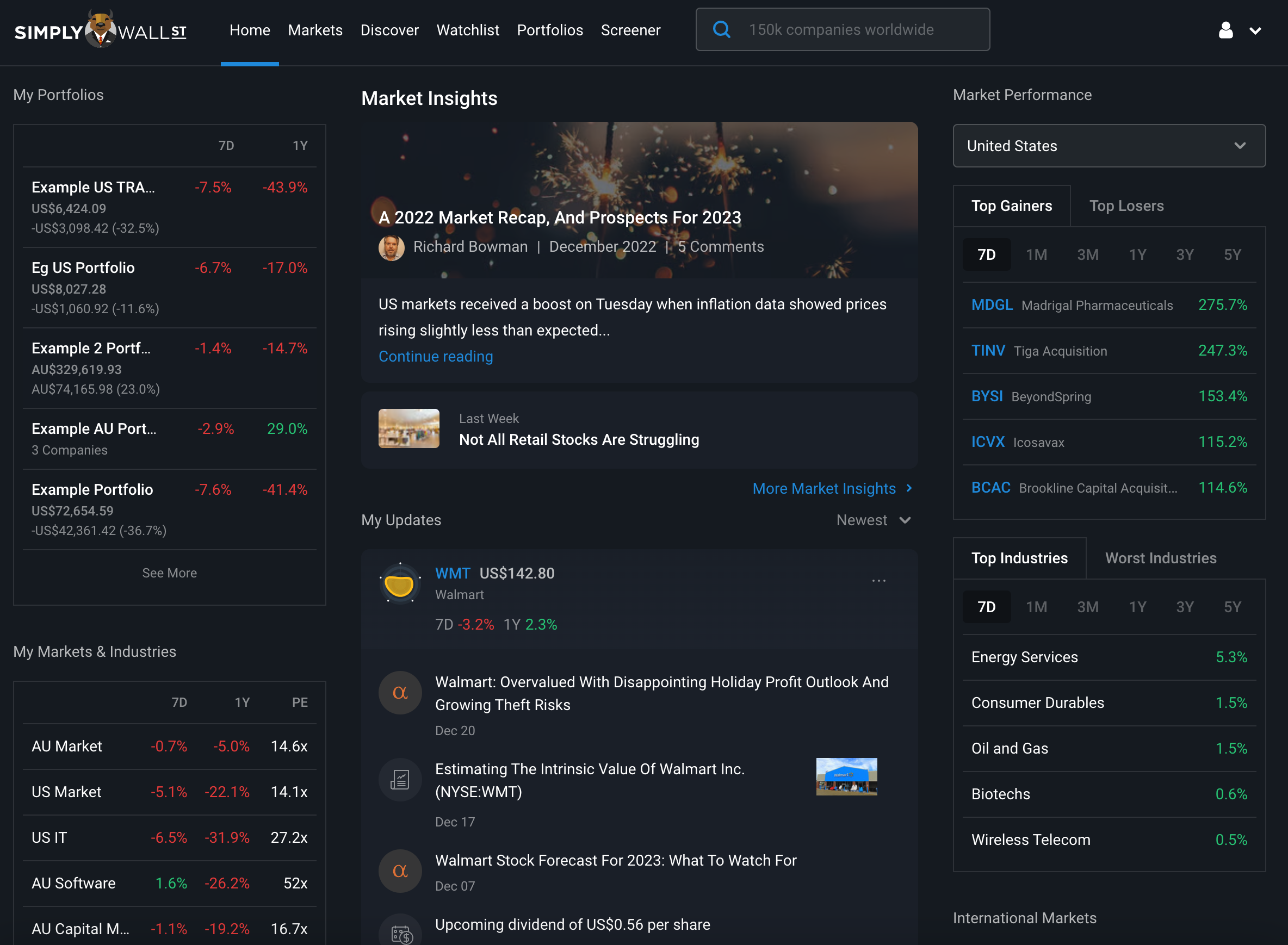

- Simply Wall St’s Dashboard , Watchlist , Portfolio tool and Important Update emails make monitoring your stocks a breeze.

- The Markets , Discover and Screener tools are great ways to find new stocks

- The repeat cycle of Narrative based investing is Discover, Research, Value, Decide, Monitor and Review.

Congratulations! You’ve made it to the final part of this Narrative Based Investing series! Now that you’ve finished Part 5, you’ve either bought a stock, or have a stock on your watchlist. There’s just 2 parts left to the Narrative Based Investing approach. They are:

- Monitoring your stocks

- Discover new investing ideas

This final part of the series will delve into both of these aspects, and will show you how Simply Wall St helps simplify these jobs considerably.

Let’s dive in!

How to Monitor Your Stocks

Once you’ve bought a stock, the key is to monitor its developments so that you can make sure your narrative unfolds largely as expected, until it either finishes playing out, or you decide to sell (for reasons we'll list below). Also, it’s important to monitor the stock in case you’re given appealing opportunities to buy more shares when it’s undervalued, or sell shares when they’re overvalued.

If the stock is on your watchlist, you need to monitor the stock to see if it ever becomes attractively priced enough to buy, and monitor its developments to regularly update your narrative around it.

These can usually be very time intensive tasks, but that’s where the Dashboard , Watchlist and Important Updates from Simply Wall St really help us streamline your process, and save you time.

Monitor your Dashboard and Watchlist

Your Dashboard is like your investment newsfeed. Any updates related to any stock in your portfolio or watchlist will be in this feed, and regularly returning here will allow you to keep your finger on the pulse of your investments.

These updates include everything from earnings reports insights, analysis of insider’s selling shares, and upcoming dividends, to important news events and articles providing in-depth analysis on the stock.

The key here is to look for any developments that potentially validate or invalidate your existing narrative . If you need help interpreting some of the events that come through, we’ve got a playlist of videos that will help you understand what insights you can learn from each event.

Playlist: Monitoring your Stocks: Important Updates and Events

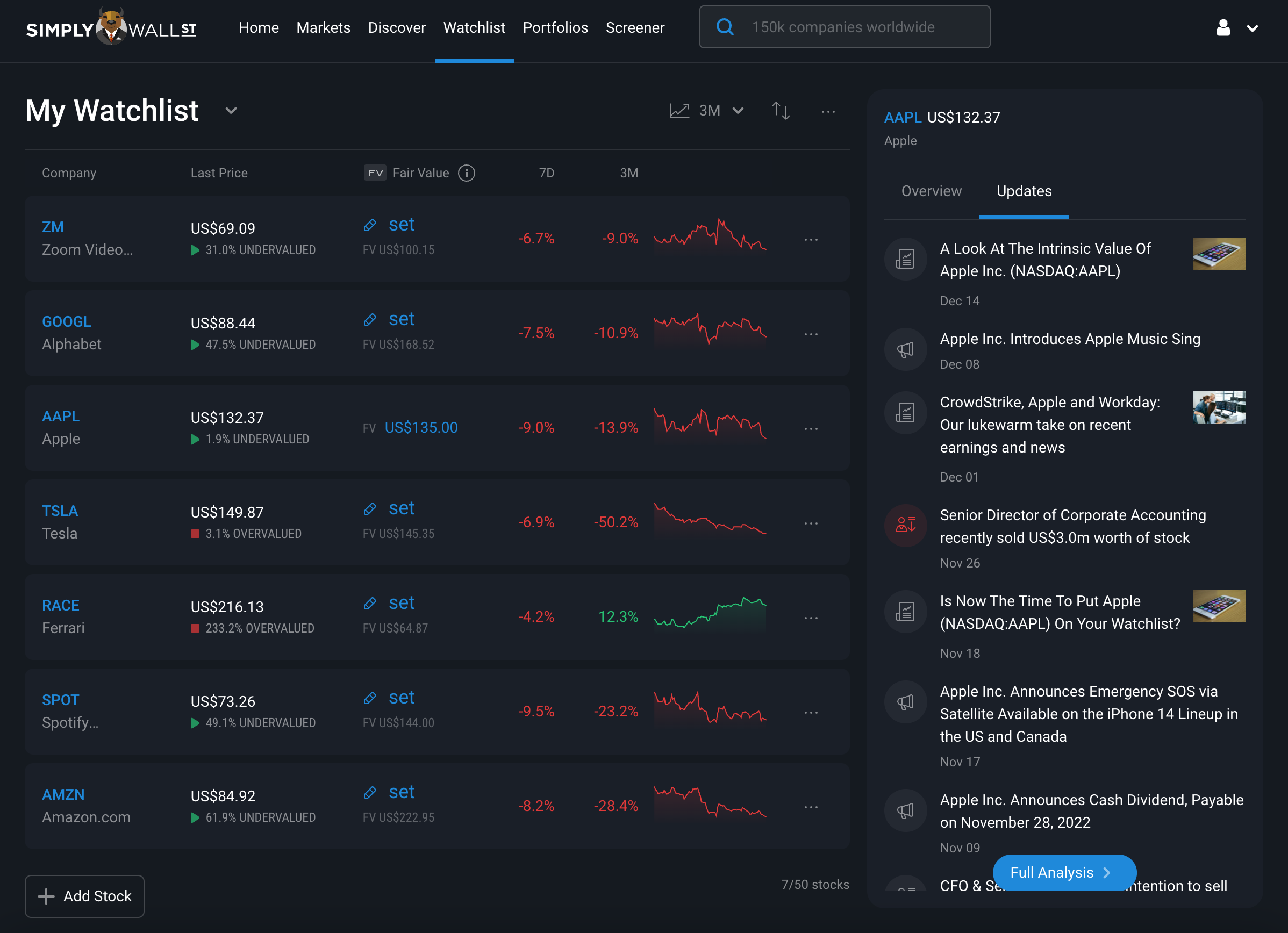

These updates will also appear on the right-hand side of your Watchlist, so that you can be up to date when reviewing stocks you're interested in.

These updates are also delivered via email to your inbox whenever they occur (check that you’ve got Important Updates ticked on under Notifications which is under the drop down menu in the top right hand side of the screen). These can be incredibly helpful in the sense that whenever the event occurs, you’re notified directly, without having to do the digging yourself, and some additional analysis is provided to add both context and insight to the event.

Knowing When to Sell a Stock

In cases when a negative development occurs that impacts your narrative, you need to re-assess the stock and see if your narrative is no longer valid, or your estimate of fair value is simply lowered. Similar to what we discussed in regards to knowing when to buy a stock in Part 5 , there are a few key questions to ask yourself before deciding to sell a stock:

- Has my narrative around this stock changed for the worse since I originally bought it?

- Do I no longer have conviction in a narrative around this stock?

- Is the stock overvalued against my estimate of fair value?

If you answer “Yes” to all three, that’s a relatively strong signal that it’s probably time to sell the stock. If you only answer “Yes” to the third question, that’s potentially a signal that you should sell given your holding that stock at a price that you think is above its fair value. If you only answered “Yes” to the second question, that’s potentially a sign that you should reduce your exposure to this holding, simply because you have less conviction in it, so it’s not a “confident bet” within your portfolio of bets.

The key here is we’re not using our emotions or other people's opinions to determine whether we should sell a stock or not. We’re being rational, methodical and reviewing our analysis. We’re only selling because either:

- The stock is overvalued (the market may be overvaluing the stock in your opinion), or

- We don’t have confidence in our forecasts (news and developments reduced our confidence in our original reason for owning the stock - it’s now too hard too hard to forecast), or

- Our new narrative no long justifies holding the stock (our new narrative incorporates the latest news and developments, and the stock is no longer appealing to own)

Similar to buying, there are many other reasons you might sell a stock, including portfolio management, opportunitiy cost, personal financial needs , etc., but these questions above cover selling stocks at a high level. We'll get into other reasons in a different piece.

So, now that we have a process and system in place for how we monitor our stocks and their respective narratives and valuations, we’re in a position to start looking for our next potential investment opportunity!

How to Discover New Investing Ideas

We’re basically back at the start of the Narrative Based Investing Cycle, where we are now going to try and find stocks within our Circle of Competence again! Now, if you already identified multiple stocks in Part 1 of this series and you haven’t looked into them yet, you can simply follow step 1-6 of this series for any stock that was added to your Watchlist in Part 1.

Then, once you’ve finished going through your list of stocks you have first hand experience with, you can start exploring for more stocks that may have not even been on your radar!

Exploring Industries and Markets for New Stocks

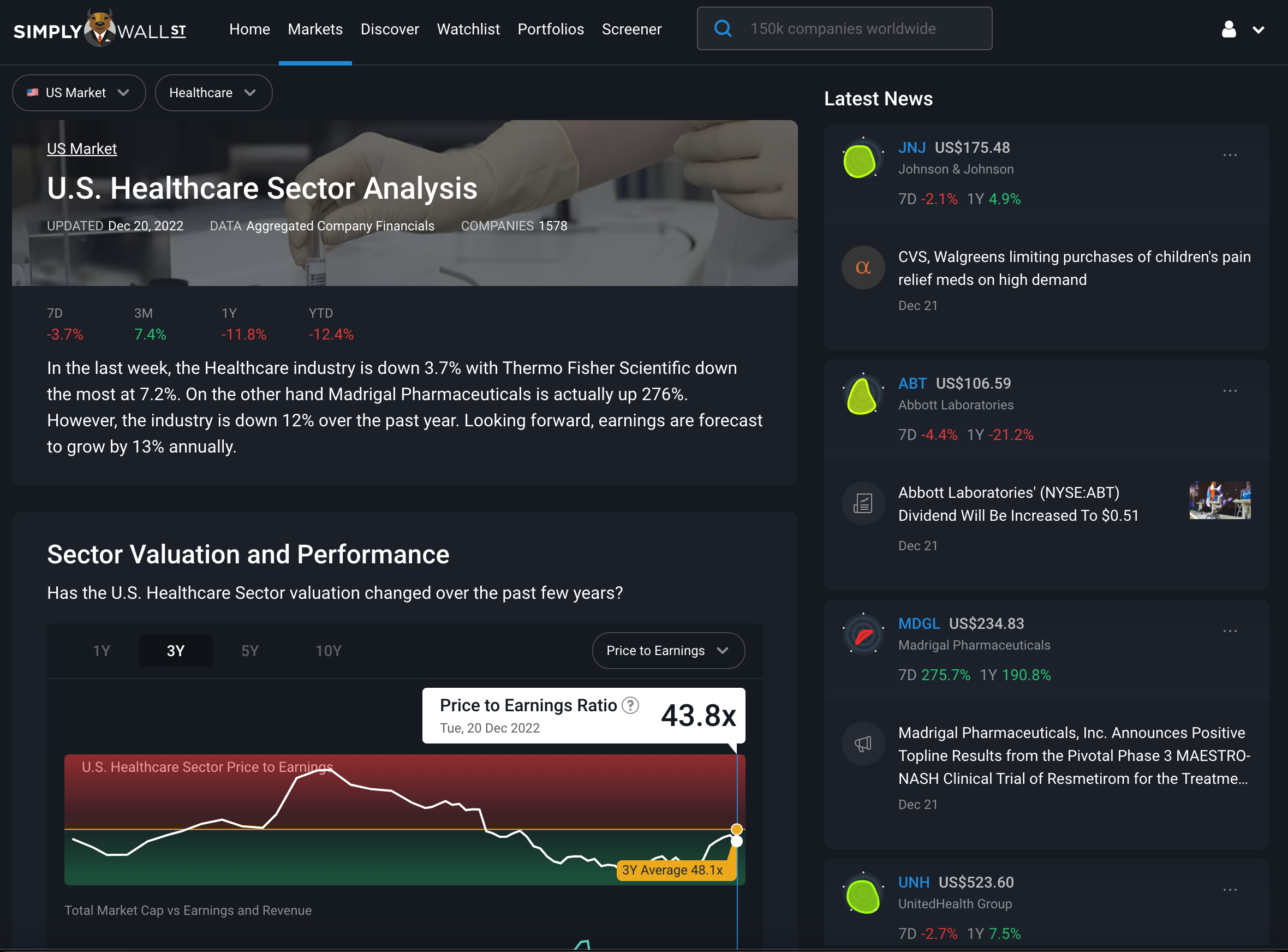

To cast your net wider, it can be great to start looking within industries and sectors that you understand. Let’s say you work in the Healthcare sector in the United States , given your firsthand experience, it can be great to start looking for stocks within that industry in your local market.

These Market and industry pages on Simply Wall St provide comprehensive analysis and useful insights on things like:

- Sector Valuation and Performance

- Industry Trends

- Sub-sector returns and valuations (showing risks and opportunities)

- Forecasted Growth

- Top Gainers and Losers

To get even more specific, if you work in say Life Sciences , or Pharma , or Healthtech , you can dive into those sub-sectors to see what other companies are in the space. Since you work in the field, you may be very familiar with how these business models work, and what makes them competitive. So it’s a great place to start looking for your next stock!

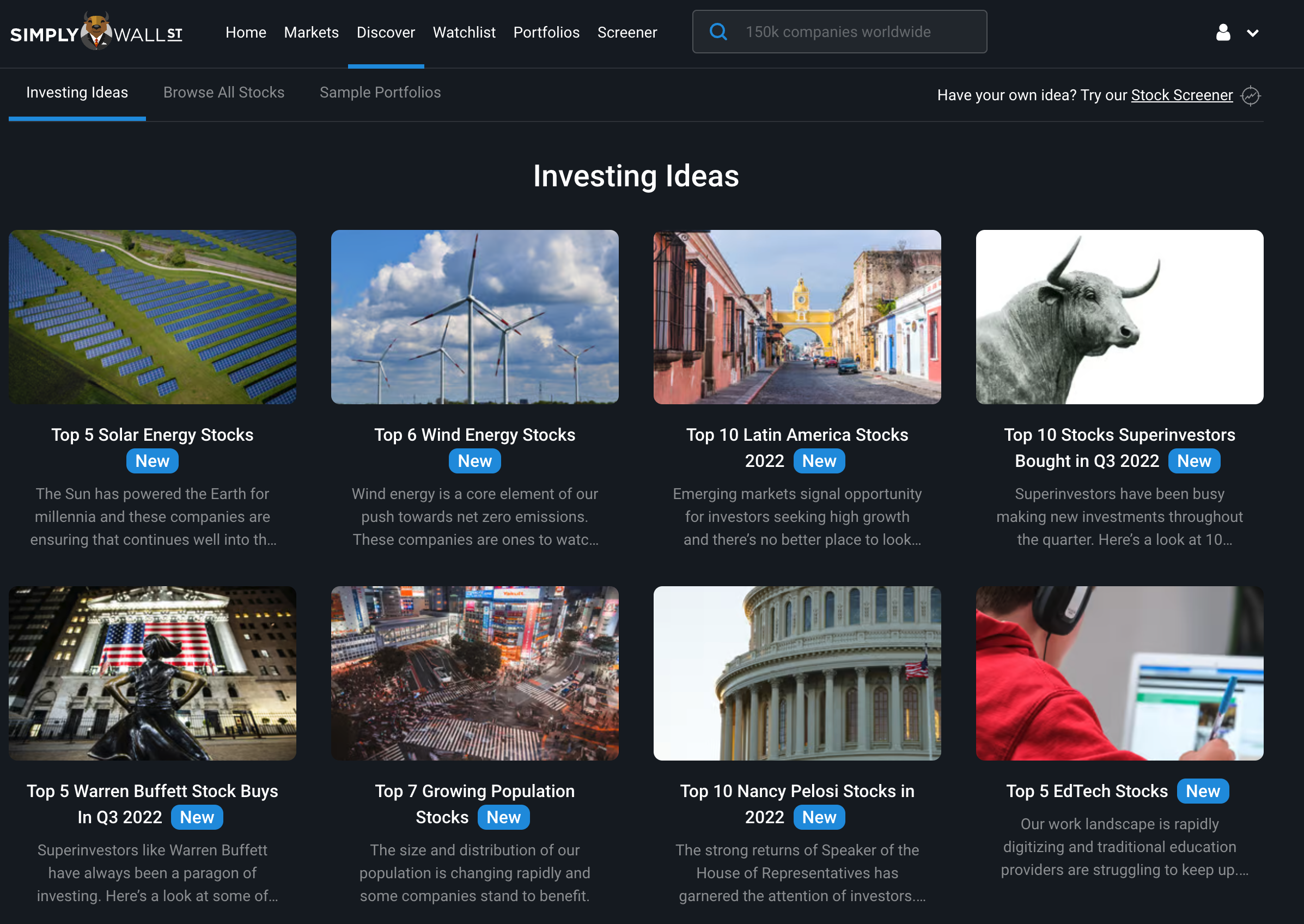

Exploring Investing Ideas

Maybe you’ve stumbled across a new investing theme that has arisen, say “The Transition to Renewable Energy”, and you think it’s a good investment opportunity. You’ve done some digging into it, got up to speed on how the industry works, and you’re keen to invest, but you’re not sure where to start.

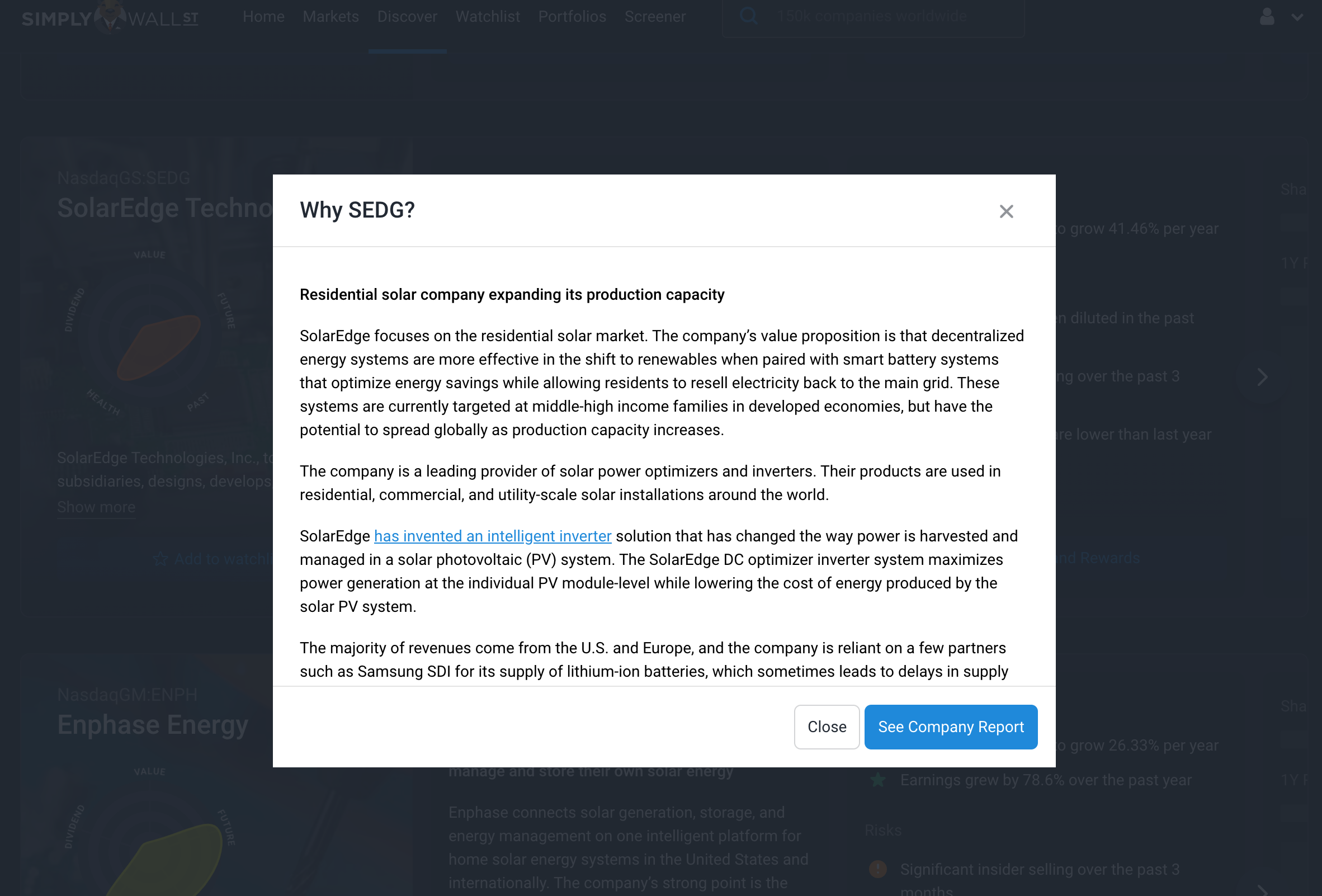

That’s where the Simply Wall St Discover section comes in. It provides a list of new investing ideas that outline the potential opportunities present within each theme.

Analysts curate a list of stocks that are set to benefit from each theme. They provide a high level overview of the narrative of the theme itself, and then explanations of why the stock was included in the list. If you’re up to speed on the industry and theme, this is a great next step to find a few specific stocks to look further into, where you can dive deeper on them like we have in this series.

Just remember, these aren't buy recommendations, they're simply indications of which stocks are set to benefit from each investment theme. It's up to you to follow the Narrative Based Investing process and decide for yourself if you want to own the stock.

Discovering Stocks with The Screener Tool

In addition to those two above methods, we have another tool - the Simply Wall St Stock Screener.

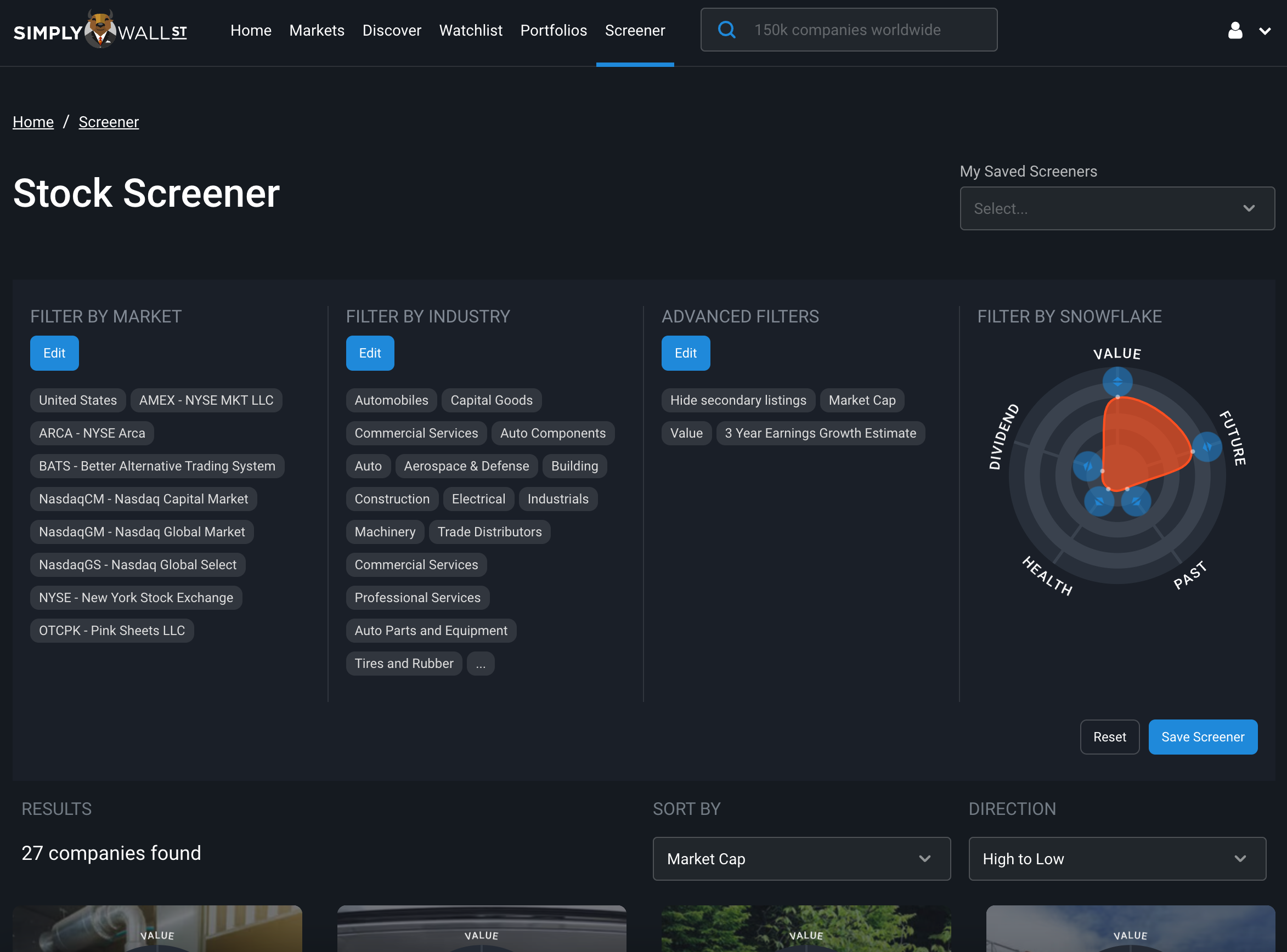

Here, you have the ability to filter for stocks using a wide array of criteria, from high level things like Market and Industry , to more specific criteria like Future growth rates , Discounts to Fair Value, Past performance metrics, and more.

You can even drag the snowflake into whatever shape you want. If you want to find companies that are potentially good value (4/6), and have good future prospects (4/6), you can do so like in the example below. For example, you can see below with the filters for Market, Industry and Advanced criteria, we’ve found 27 companies that meet those criteria.

Bringing it all together

So there you have it! Well done for getting through to the very end of our How to Invest Like the Best series. You’re hopefully now well versed in the process of Narrative Based Investing, where you know:

- How to identify your circle of competence, and stocks within it

- How to get to know the business model of a stock

- How to get to know a stocks strengths and weaknesses

- How to estimate the value a stock, and know the difference between price and value

- How to build a narrative around a stock, and know when to buy it

- How to monitor your stocks, know when to sell, and discover new investing ideas

To help you implement what you’ve learned in this series, we created an Investment Checklist! You can use this checklist when assessing any stock you’re interested in from here on out, to make sure you’re covering all important areas, and that you’re applying the principles you’ve learned to improve your investing process.

We’re very keen to hear your feedback on it, so feel free to leave your feedback at the link provided on the first page.

With the investing principles, mindset and methods you’ve learned from this series, you’re hopefully now confident enough to use this approach of Discover, Research, Value, Decide, Monitor and Review in your own investing journey.

Best of luck!

Lastly, since you've hopefully now finished the How to Invest like the Best series, we'd love to hear your feedback!

P.S. If you haven't read the full series, you can start at our HUB for How to Invest Like the Best.

Simply Wall St analyst Michael Paige holds a long position in AAPL. Simply Wall St has no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments. We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.