What Happened in the Market This Week?

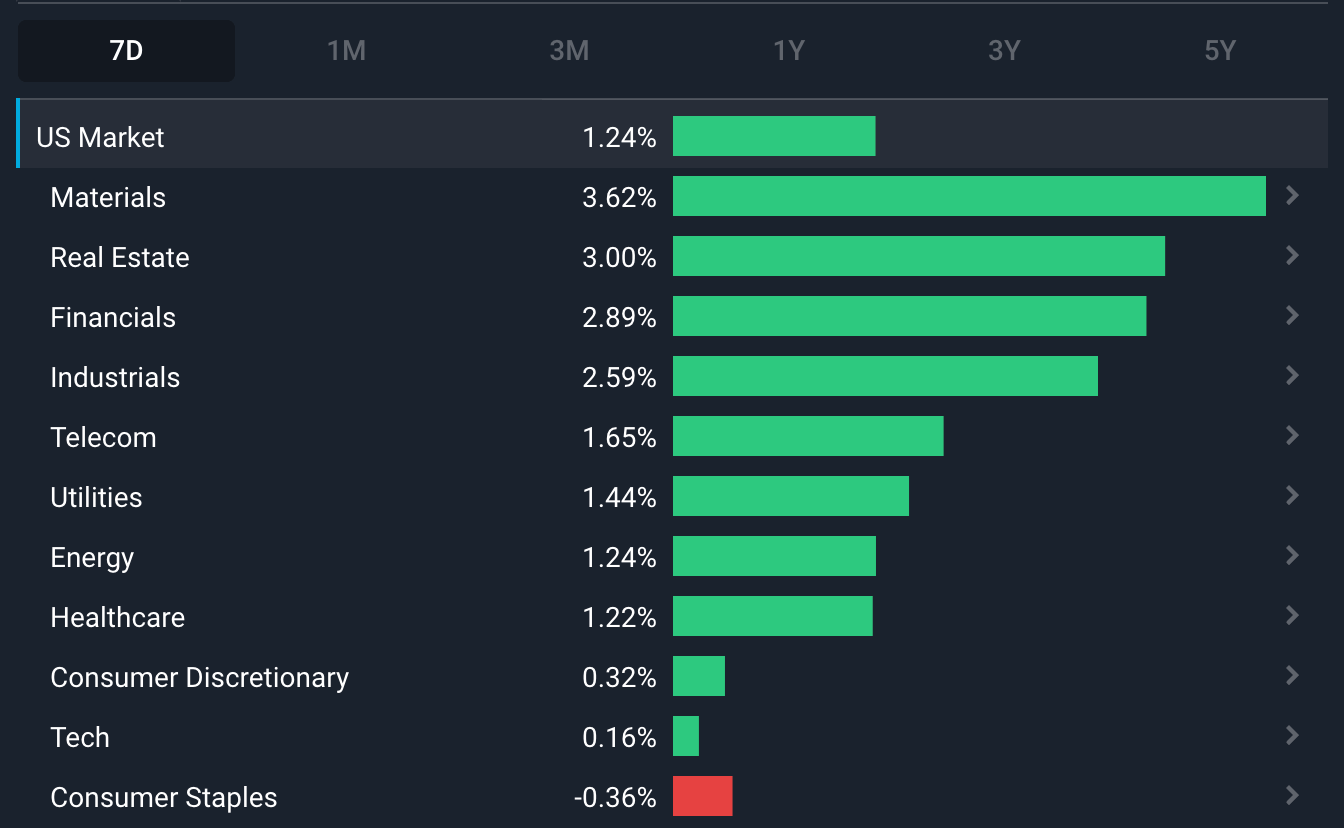

Equity markets continued to edge higher, and received a boost when the U.S. inflation rate declined more than expected. Financials and Real Estate stocks began to outperform after the inflation data was released, while Tech stocks, which have outperformed over the last few weeks, began to lag. Energy stocks also fell as the price of crude oil remained in the low $90-range throughout the week.

Q2 Earnings Season continues, with Walt Disney (NYSE:DIS), Sysco (NYSE:SYY), SoftBank (TSE:9434) and several others releasing their reports this week. This was the 3rd week of Q2 Earnings Season, and we had created an Earnings Calendar each week, which you can find in the last three Market Insights.

U.S. Sector 7D Performance - 12th Aug 2022 - Simply Wall St

Some of the developments we have been watching over this week include:

-

Europe and the U.K. are facing a bleak economic outlook with record high inflation and falling growth rates.

-

U.S. inflation and expectations for future inflation are finally beginning to cool after recent declines in commodity prices.

Europe and the U.K. face a Bleak Economic Outlook

In the previous weeks, we’ve talked mainly about the U.S. Fed’s rate hike, how U.S. inflation is at a 40-year high, and how the U.S. is in a technical recession.

Europe and the U.K., similar to the U.S., are facing a long list of headaches. Eurozone GDP growth forecasts are falling, and the U.K. is forecast to be in a recession by the end of the year. At the same time, the European Central Bank and the Bank of England have been forced to raise interest rates at the fastest pace in a decade to bring record high inflation down. In addition, the war in Ukraine continues while the continent faces a drought and heat waves.

Is the U.K. in a Recession?

As we mentioned in last week's Market Insight, exactly what constitutes a recession depends who you ask. In the U.K.'s case, The Bank of England thinks the economy will enter a recession in the fourth quarter, while The National Institute of Economic and Social Research believes that the country is already in a recession.

Regardless of the precise definition, the combination of sub 1% growth, inflation above 8%, and rising interest rates isn’t a good combination. The U.K.’s next Prime Minister will have a tough job and the two contenders for the job have differing opinions on how to approach it. Rishi Sunak wants to prioritize inflation, while Liz Truss is proposing tax cuts to stimulate growth. We’ll get some more clarity on the 5th of September, once the Conservative Party MPs have voted for their preferred candidate on the 2nd.

How is Inflation in Europe?

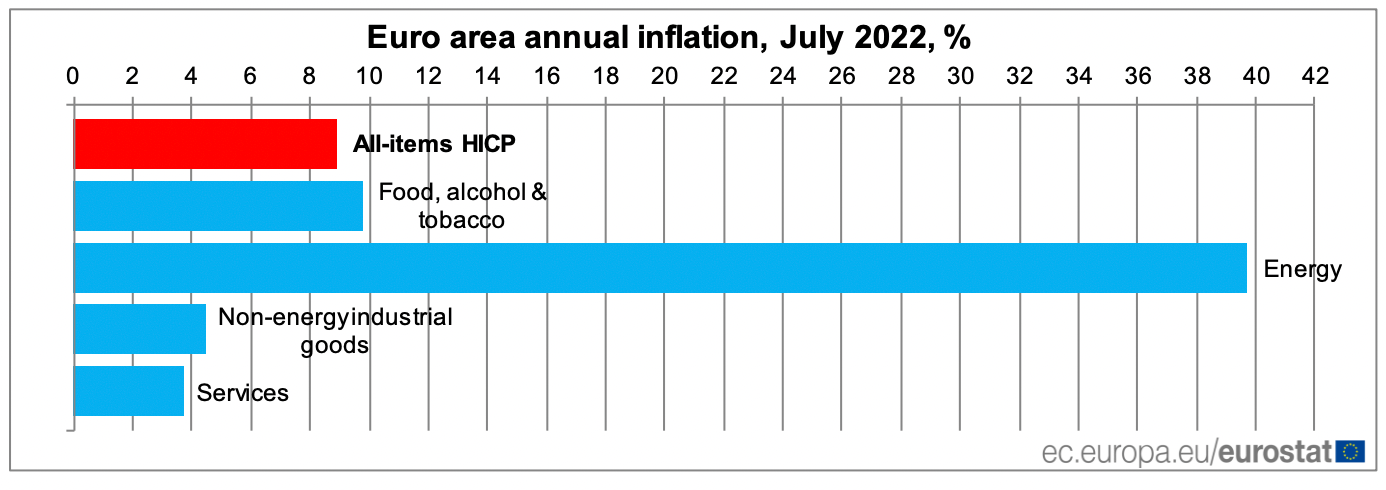

Euro area July inflation forecasts - Image Credit: Eurostat

Annual inflation in the European Union jumped to 9.6% in the year to June, while it reached 8.6% for the countries that use the Euro. The war in Ukraine cut off some energy and food supplies, which added to the supply chain problems that started during the pandemic.

The war also impacted the economy, so the central bank was reluctant to raise interest rates. This meant that when rates started rising in the U.S., the USD dollar became relatively more attractive, and ultimately led to the Euro falling to parity with the USD Dollar for the first time in 20 years. This has added fuel to the inflation fire, as imports have become even more expensive.

To make matters worse, due to the heatwave and drought the Rhine river is so low that it's now impassable for some cargo boats carrying coal and gas. And, on top of this, Germany faces the prospect of Russia cutting off its gas supplies.

The Insight: The Outlook for Europe and the UK Economies

Europe’s economic outlook is bleak, but that doesn’t mean there aren’t opportunities in Europe’s stock markets. Many of the largest companies in Europe and the U.K. such as Unilever (LSE:ULVR) and LVMH Moët Hennessy (ENXTPA:MC) are multinationals that earn revenue around the world, so they aren’t entirely exposed to Europe’s economy. Exporters such as AstraZeneca (LSE:AZN) also benefit from the weaker currency as their products become cheaper for importers outside of Europe.

The stocks that are at risk are those that are exposed to local consumer markets, energy prices, and other imports. Recall that high inflation reduces a consumer’s purchasing power, which in turn affects company profits, while energy prices are volatile and uncertain due to the war.

👉 Make sure you know how these factors relate to the revenue and expenses of the companies you are invested in - some companies may be able to win on both sides of this equation, while others sadly lose on both sides.

Economic uncertainty in the Eurozone may see increased demand for the USD as international investors look to the U.S. for stability.

We have investment ideas above for the best stocks for when USD rises.

U.S. Inflation Finally Begins to Cool After 40-Year High

The U.S. inflation rate came in better than economists expected - but it seems investors were already anticipating a lower number. The consumer price index (CPI) - which we wrote about previously explaining how it relates to inflation - rose 8.5% the year to July, compared to consensus forecasts of 9.1% as it was in June. Core CPI, which excludes food and energy, rose 5.9% versus estimates of 6.1%. So basically prices are still rising, but at a lower rate than initially expected.

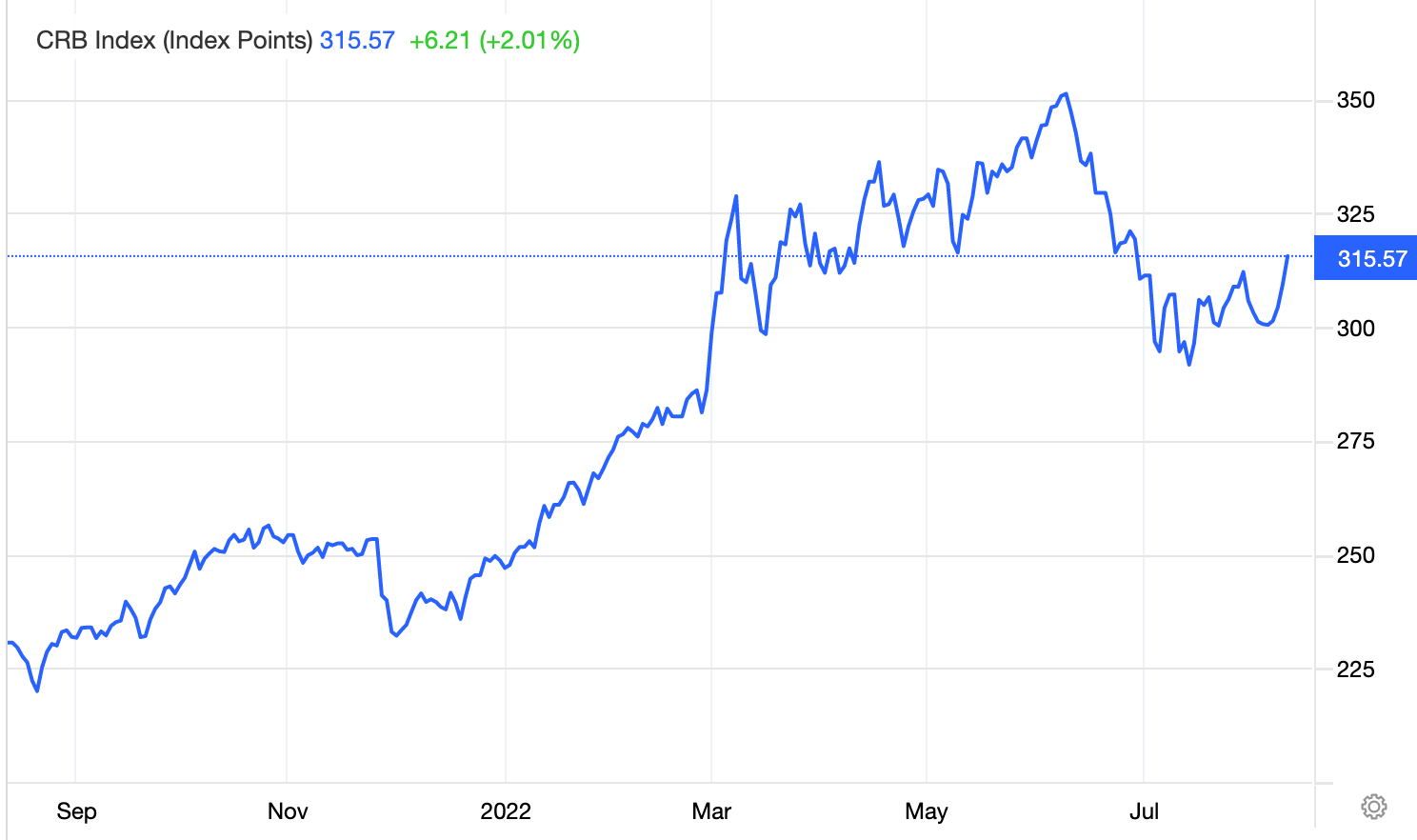

CRB index of Commodity prices YTD - Image Credit: tradingeconomics.com

The slowdown in inflation isn’t entirely surprising given the decline in commodity prices over the last two months. Since early June, the price of Crude Oil has fallen more than 22%, while the CRB index (Commodity Research Bureau) of commodity prices is down nearly 10%.

Earlier last week, a survey also showed that consumers were already expecting inflation to slow dramatically. This ties in with the expectations of the bond market, where yields on U.S. 10-year treasuries have fallen from 3.48% to 2.74%.

Ever wondered why stocks go up sometimes after bad news? Or the other way around?

You may have noticed that two weeks ago when the U.S. GDP confirmed the U.S. was in a technical recession, equity markets rallied. And then, when stronger than expected employment data was released on the 5th of August, markets sold off. Why was that?

This is due to the fact that the market is now almost entirely focused on inflation and interest rates. Weak economic data implies that demand, and therefore prices, should be falling. Positive economic data, like the better than expected jobs report, suggests the economy may be growing faster than anticipated, which means inflation might stay higher for longer.

If the central banks see data that proves the economy is still strong (labor market, etc), and inflation is still high, they won’t hesitate to keep raising rates until it starts cooling. However, if there’s evidence that the economy is weakening, and inflation is cooling, they might decide to take their foot off the pedal and raise rates less aggressively, or stop altogether.

Essentially the former means higher expected interest rates and therefore lower justifiable valuations on stocks, and the latter means lower interest rates and therefore higher justifiable valuations on stocks. We have some examples in the next section.

Why have growth stocks been outperforming recently despite the recession?

When you buy a share of a growth company, you’re often paying 30 (or a lot more) times its current earnings (i.e. a P/E ratio of 30+). This is because growth stocks are priced with its growth potential included - you are paying for profits that may only materialize 5 to 10 years into the future.

When interest rates rise, the present value of those future profits are worth less, so the business is worth less. But, when expectations for future interest rates fall, the opposite applies.

(You can see a practical example of how an interest rate is used to calculate the fair value of stock in Simply Wall St’s company analysis model.)

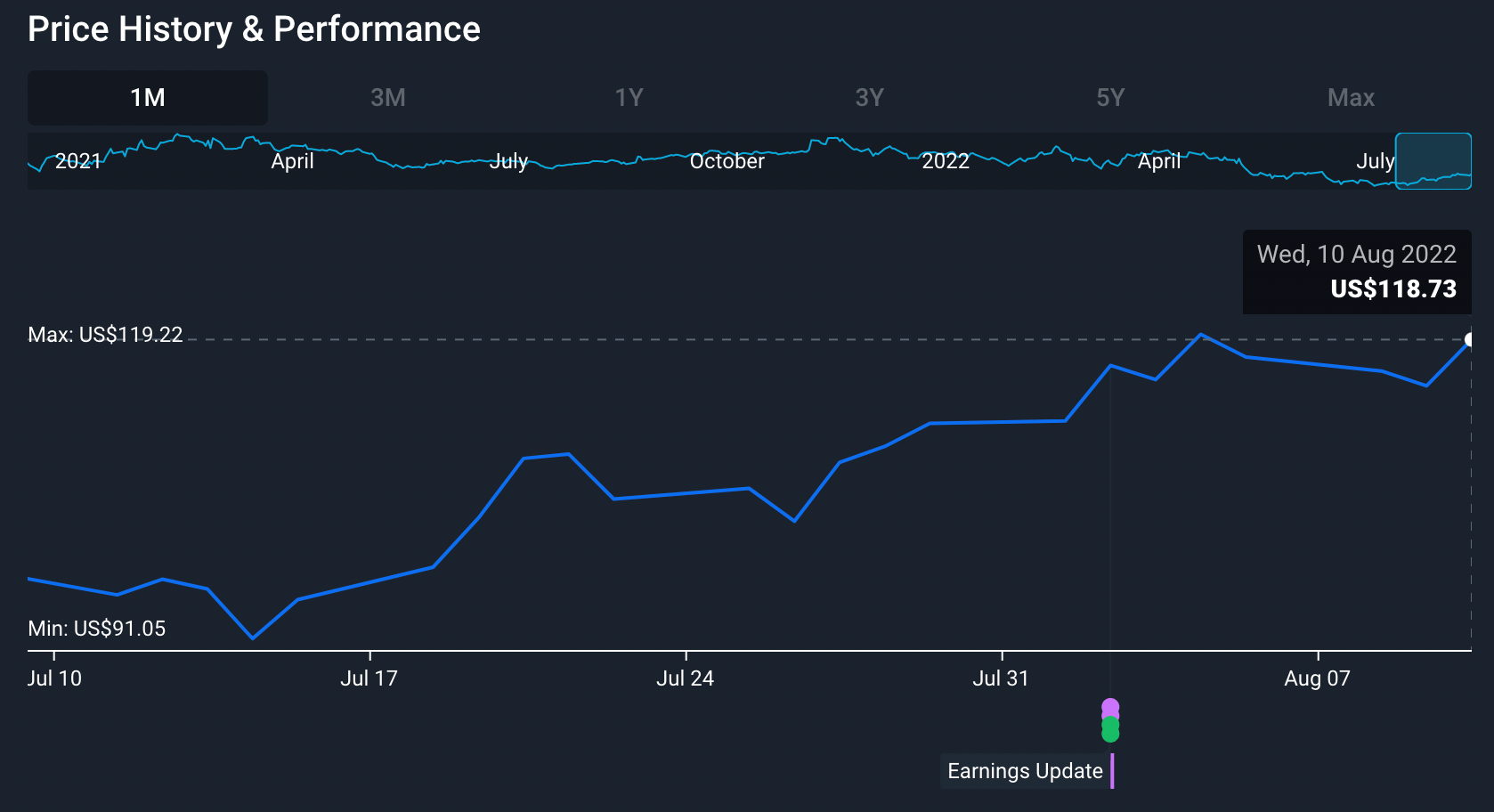

Since the weaker economic data has been released, the market has been expecting lower interest rates than before (e.g. 3-4% instead of 5-6%), so growth stocks which were heavily sold off, have been outperforming. Hence, this explains why we’ve seen those relatively high growth stocks like AirBnB (NASDAQ:ABNB), Coinbase (NASDAQ:COIN) and The Trade Desk (NASDAQ:TTD) all up 20% to 60% over the last month.

Airbnb's (Nasdaq:ABNB) 1-Month Share Price Chart on Simply Wall St's Company Analysis Page

The Insight: Does this mean growth stocks are the way to go?

While better than expected inflation data is great news for growth investors, this could turn out to be a case of ‘buy the rumor, sell the fact’. The market has been betting on CPI being better than expected for the last few weeks, and now that we’ve got it, there could be some profit-taking in the short term.

👉 Inflation may have peaked, but it will take more than one single metric to confirm it. The key is likely to be commodity prices, and whether or not they rebound, which could occur due to a multitude of factors.

Rather than trying to predict if we're at peak inflation or not, investors should consider utilising a few timeless strategies to navigate the uncertainty. These include the likes of dollar-cost averaging and diversification, which we mentioned in last week's update.

Key Events Next Week

This week, the U.K. will hear about the latest inflation and employment rates, after last week's GDP data. Remember, we mentioned above that positive economic news such as a high employment rate may mean that the economy is better than expected - which means that inflation may stay higher for longer.

In the U.S., we have housing data on Tuesday and Thursday, and the FOMC’s meeting minutes and retail sales data on Wednesday. We had previously written above how some analysts are concerned of a 2008-like housing crash, so this week's housing data will be important.

The other notable economic releases will be Australia’s unemployment rate and Japan’s second quarter GDP growth rate.

Meanwhile, Q2 Earnings Season continues, as outlined below.

🗓 Earnings Season Calendar (Aug 15 - Aug 19, 2022)

Mon 15 Aug

BHP Billiton (BHP) • Henkel (XTRA:HEN3)

Tue 16 Aug

Walmart (WMT) • Home Depot (HD) • Agilent Technologies (A) • China Telecom (SEHK:728)

Wed 17 Aug

Tencent (SEHK:700) • Cisco (CSCO) • Lowe's Companies (LOW) • CSL (CSL)

Thur 18 Aug

Estee Lauder (EL) • Transurban (TCL) • Xero (XRO)

Fri 19 Aug

China Merchant's Bank (SHSE:600036) • Xiaomi (SEHK:1810) • Cochlear (COH)

Was this article helpful? Register for free with Simply Wall St to receive our weekly market insights straight to your inbox!

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.