Quote of the Week : "Don't worry about the world coming to an end today. It is already tomorrow in Australia." - Charles M. Schulz

You might have seen a few of our market deep dives of some interesting markets across the globe.

Our insight articles on India and Mexico shone a light on two emerging markets that are well-positioned to benefit from global trends unfolding.

Today, we’ll be looking at the place that we at Simply Wall St call home, Australia !

For a country that is often seen as overrepresented in a lot of things - sport mainly - Australia has quite a subdued presence on the equity market stage. In terms of global equity markets, Australia is merely a drop in the ocean, coming in at only 1.5% of global market share .

But this doesn’t tell the full story of how interesting and unique the Australian economy is. So let’s dive in and begin unravelling what makes Australia’s market tick, what the risks are, and the global trends that Australia is benefitting from.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🇺🇸 US Imposes New Tariffs on Chinese Imports ( Reuters )

- Our take: The new tariffs on EVs, batteries, solar panels, semiconductors and numerous other products are as high as 100%. The usual take on tariffs is that they are ultimately paid for by consumers. In this case, it's actually the Chinese government that is paying by subsidizing exporters.

A 100% tariff might sound steep, but some analysts point out that it's not high enough to offset the effect of subsidies. We will now see how much China is prepared to spend (and can afford to spend) to keep its exports going.

👜 Burberry reports 34% drop in earnings as US and Asian consumers become price sensitive ( FT )

- Our take: Burberry’s revenue only fell 4% in the 12 months to March, but fell 12% in the last quarter. Q4 sales were down 17% in Asia and 12% in North America. In addition, the operating margin fell from 20% to 14% due to rising costs.

Companies like Burberry are regarded as luxury goods companies - but they aren’t as resilient as the really exclusive brands. With a broader customer base, they are more exposed to consumer sentiment as well as current fashion trends. Add rising costs to the mix and they are doing well to make a profit at all.

💳 Credit Card Delinquencies are on the rise ( Axios )

- Our take: Speaking of consumer weakness, this new data from the New York Fed showing an increasing number of credit card delinquencies aligns with our recent piece on how to invest around consumer weakness.

Since 68% of the US’s GDP comes from consumer spending, any weakness here can have an outsized impact on the broader economy. So, refer to our article above for how to hedge your portfolio against consumer weakness.

💻 Raspberry Pi looking at UK IPO ( Forbes )

- Our take: If this listing goes ahead it will give investors a new avenue for exposure to the IoT (internet of things) market. Raspberry Pi sells small, cheap computers which were initially popular amongst educators and hobbyists.

They are now being widely deployed to remotely control devices in industries ranging from agriculture to security, supply chain management, and even in space. The company's current shareholders include Arm Holdings and Sony and it was valued at US$560-million during the last funding round.

💰 Investors pull billions from thematic ETFs ( Bloomberg )

- Our take: Bloomberg’s reporting mirrors an article from Ark Invest on flows in Europe. ETFs that invest in clean energy, cybersecurity, EVs, digitization and infrastructure are all seeing large outflows. These themes were all popular 12 to 24 months ago, but have fallen out of favor. On the other hand, cash is predictably flowing to AI, robotics and automation ETFs.

This is a very familiar pattern with thematic funds: money flows in after a strong rally and out after the inevitable decline. This is another reminder to be careful investing in themes when they are ‘in fashion’.

🇨🇳 China issues US $138 billion in bonds to support the economy ( FT )

- Our take: These bonds were largely expected by the market, but investors weren’t sure on the details. They will have durations of 20-50 years and they began issuance in May 17th. The funds will likely be used to support the economy in areas where it’s struggling (real estate, etc) and boost domestic demand by helping consumer confidence. Chinese officials have said the bonds will: “ support the implementation of major national strategies as well as building security capabilities in key areas ”. So, interpret that as you will.

🇺🇸 US Inflation data was better than feared ( Reuters )

- Our Take: Investors were stoked to hear that inflation printed lower than expected (3.4% vs 3.5% expectations), so the market rallied on the news. The latest inflation print boosted investors’ hopes that The Federal Reserve might start its easing cycle this year. Considering the market has already rallied for the last 6 months largely on the idea of rate cuts this year, and they keep getting pushed further out, investors might need to adjust their expectations which could push the market lower.

🇦🇺 The Land Of Abundance

No discussion about Australia’s economy could be had without mentioning Australia’s resources sector. Australia’s resources are not just a cornerstone of the nation’s economy; they also play a significant role in global infrastructure.

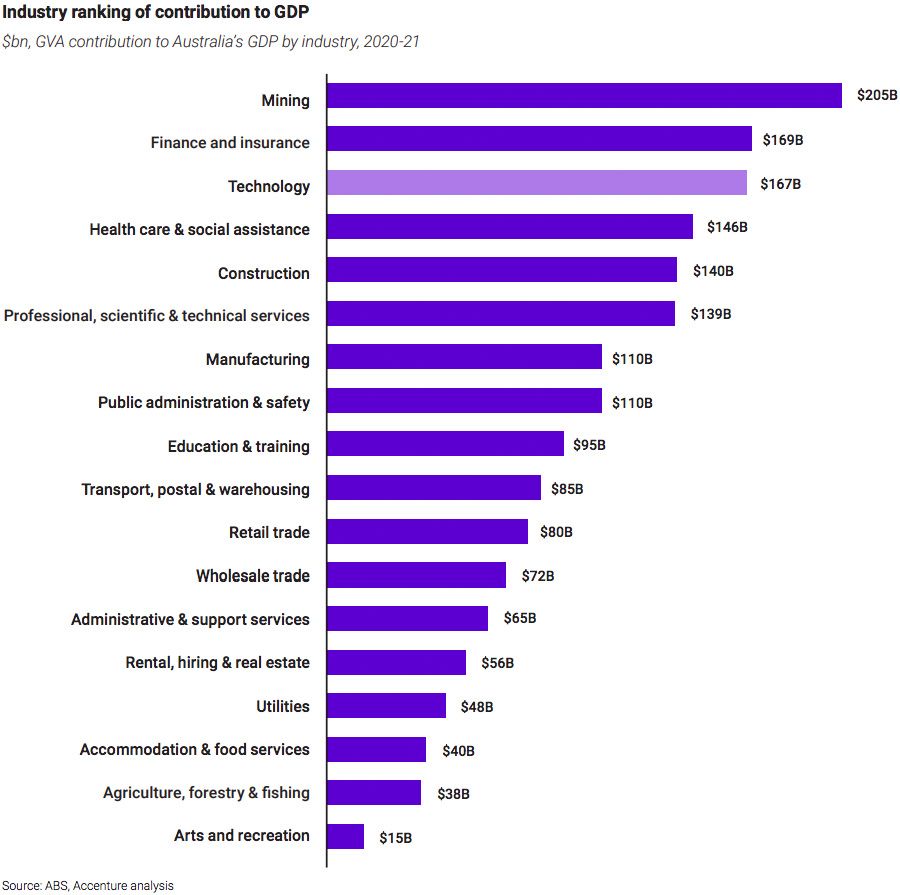

The mining and resource sector directly contributes approximately 14.3% to the nation’s GDP , the largest contribution, ahead of the Health & Education sectors at 12.8% and the Financial Services sector at 7.4%. The mining and resource operations are heavily concentrated in regions rich in natural resources, such as Western Australia and Queensland.

The country ranks as the world’s leading exporter of key commodities like iron ore - of which Australia accounts for 55.4% of global supply - and coal . Australia is also increasing exports of important rare earth elements and other minerals critical for modern technologies.

🔋 Fuelling The Global Energy Transition

As the world shifts towards renewable energy sources to meet Net-Zero targets in the fight against climate change, Australia's role in the global market becomes increasingly pivotal due to its vast reserves of key battery minerals.

Many of the minerals found in abundance in Australia’s earth are essential for battery production, which powers everything from electric vehicles to renewable energy storage solutions.

✨ If we keep tracking down the path set to meet 2050 emissions targets, we could expect the demand for these minerals to climb, underscoring Australia’s importance as a key supplier in the global supply chain for green technologies.

This would create opportunities for investors, foreign or domestic, to capitalize on the nation’s wealth of resources.

Australia holds a dominant position in the market for the three main battery metals:

-

🔋 Australia is the world’s largest supplier of lithium , producing some 46.9% of the world’s total supply.

- Although Chile has larger known reserves, issues with legislation, water scarcity and indigenous groups have prevented expansion to the levels of production we see in Australia.

-

🪙 Australia is the 5th largest nickel producer globally , accounting for roughly 6% of the global supply.

- There is even scope for greater levels of production, considering Australia’s reserves are the second most expansive in the world at 20.6% of the global reserve.

-

⚡ Australia is the 3rd largest producer of cobalt at 3.5% of the global supply.

- Although Australia lags significantly behind the Democratic Republic of the Congo in first, ethical concerns over the use of child labour in artisanal mines could see demand shift to countries with far greater worker protections.

✨ Australia could be an opportunity for global investors seeking exposure to resources like iron ore or battery metals, particularly as ESG concerns and sovereign risks may deter investment in other resource-rich regions like Africa or South America.

Uranium: Is Australia About To Have A Glow Up?

It’s not just battery metals that Australia has an abundance of; Australia also holds expansive reserves of natural gas and uranium. As touched on last week, the rising uranium price has piqued the interest of investors in Australia’s market.

Australia’s uranium reserves are the largest in the world, hosting as much as one-third of the world’s known uranium resources . However, Australia is only the fourth-largest producer of uranium.

Decades of aversion to mining uranium embroiled with post-Cold War fear has meant that Australia’s uranium mining industry is somewhat underdeveloped.

Australia’s export of uranium is limited to countries with whic h Australia has formed a bilateral nuclear cooperation agreement with; and the exports must explicitly be for peaceful non-explosive purposes.

However, the requirement for these agreements doesn’t seem to limit Australia’s export capacity, with agreements already struck with countries with significant nuclear arsenals like Russia, China, France and the United States. Enforcing that law might be a bit hard.

In addition, Japan - Australia’s second-largest trade partner - added uranium to its critical minerals list . While it’s not clear if Australia will dramatically increase its production of uranium to meet the rising demand, this is an indication that the opportunity is there for investment, since demand is rising.

✨ Globally, t he uranium tide seems to be turning in recent years. The UN Climate Change Council declared a need to triple global nuclear capacity to meet 2050 Net-Zero targets. So if the narrative globally continues to become more favourable to nuclear power, then the industry might enjoy more favourable political and societal conditions.

This all sounds great, but what’s the catch?

🌏 Is Australia Really An Investor’s Paradise?

Australia does have a lot going for it (we may be biased).

It does have a vast supply of critical mineral reserves, the magnitude and breadth of which are unrivalled globally. It has a largely stable and cooperative weather climate which lends itself to consistent project operation in the area, which not all resource countries can claim. Plus, it has a relatively stable political landscape with a legal framework familiar to investors in the United States and the United Kingdom.

So what’s the catch?

Well, like any country, there is always some level of sovereign risk, so let's take a look at some of the risks investors should be aware of.

⚠️🤝 The Risk Of Relying On One Big Trade Partner

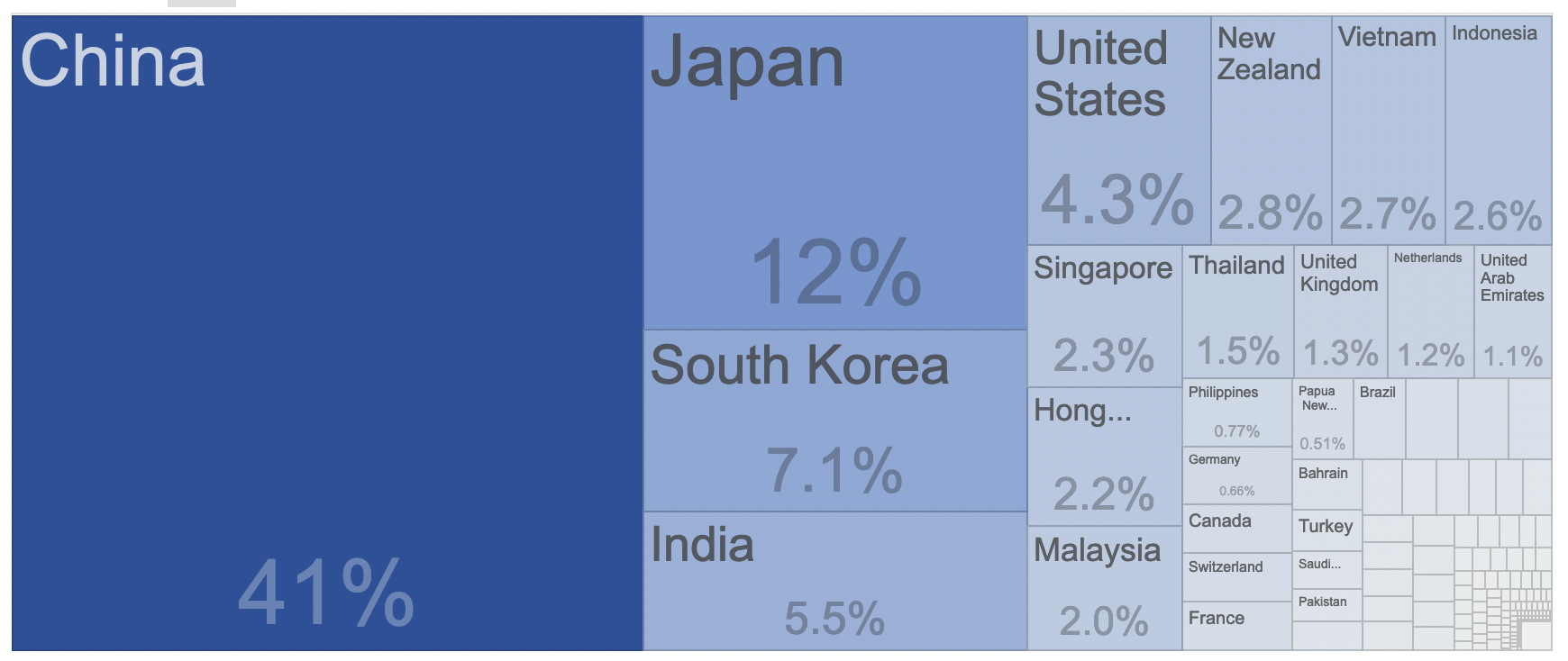

Australia's economic landscape is significantly influenced by its trade relationship with China, its largest trading partner.

In the 2022-23 fiscal year, two-way trade with China totalled AU$316.9 billion, with Australia’s goods and services exports to China encompassing almost two-thirds of that total! (AU$203.5 billion).

If you’ve made it this far, the makeup of these exports should come as no surprise!

Iron ore is far and away the largest export with China importing AU$104.8 billion worth, followed by natural gas with exports totalling AU$20.8 billion, closely followed by crude minerals at AU$19.8 billion.

While having such an expansive trade relationship is important, providing support to Australia’s mining sector, as well as other key segments like agriculture, and education, it does highlight a significant risk.

✨ The reliance on Chinese demand could upend Australia’s entire economy if the stability of the trade relationship was jeopardized.

Be it from political tensions or simply macroeconomic turmoil, a significant decline in demand for Australian exports from China could spell disaster if these industries are unable to redirect supply to other foreign trade partners.

While the relationship between China and Australia is currently ‘fair’, there have been moments recently where the relationship has been tested.

😬 A Not So Rosy Relationship

Despite the economic benefits, the relationship between Australia and China has been fraught with strategic and diplomatic tensions over recent years.

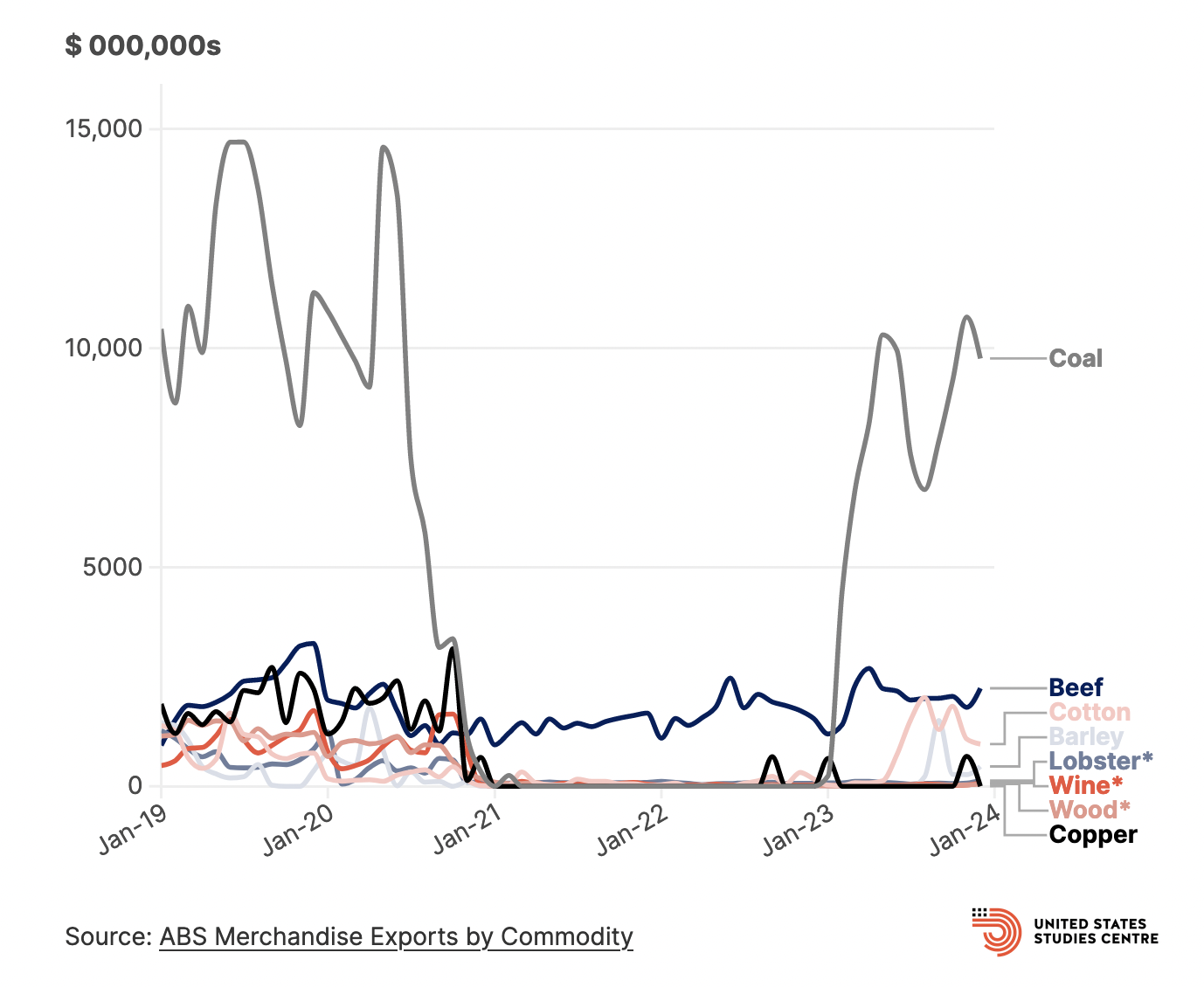

The issues range from cybersecurity concerns to trade tariffs and restrictions.

On the cyber front, the Australian Signals Directorate had pointed the finger at China over a spate of malicious attacks on Australian companies and infrastructure.

As for trade tariffs, following the pandemic, China placed a number of tariffs on Australian exports like wine, where tariffs were raised to 200% , and barley. Further biosecurity restrictions impacted Australia’s agricultural sector with several beef abottoirs sanctioned and timber exports blocked, in addition to bans on the export of coal, cotton and lobsters .

As a result of these trade restrictions, Australia’s exports of certain goods to China fell to nearly zero. The impact of the restrictions was economically significant, as Australia’s exports to China fell from 33% of Australia’s total export market to 27.6% in 2022.

As of late though, t he relationship has achieved some form of stability.

The last of the trade restrictions between China and Australia was lifted in March 2024 as China abolished the tariffs placed on Australian wine exports .

While the relaxation of these restrictions can be read as an improving trade relationship between the two countries, it could also be argued that the futility of the restrictions meant they were no longer necessary.

This is because the heavy tariffs did little to hurt Australia’s overall exports, as the goods were simply redirected to other markets . What could have originally been seen as political retribution ended up as merely a slight inconvenience.

This is encouraging from a risk mitigation point of view, and shows that should the relationship sour, Australia could soften the blow by benefiting from the global trends of “ friend-shoring ” for its exported goods.

When assessing the inherent risk of investing in Australia, it’s not just Australia’s relationship with China that has to be monitored.

China's trade relationships with other countries can also have a significant bearing on the Australian economy.

As stated at the beginning of this Market Insight, the US imposed tariffs on exports of Chinese EVs, batteries, solar panels and semiconductors as a reaction to the Chinese government heavily subsidizing these industries.

While there’s no direct impact, if China stops subsidizing these industries and demand for Chinese products falls due to the higher prices that’ll inevitably be passed on to consumers, then the demand for the raw materials mined in Australia could also fall.

🧑💻 A Blossoming Tech Landscape

There’s much more to Australia than what can be dug out of the ground.

In fact, Australia is undergoing somewhat of a tech boom, which has spurred rapid growth in employment and investment.

The tech landscape in Australia was previously considered quite underdeveloped, but following the increase in digital adoption throughout the COVID-19 pandemic, things have begun to change.

Employment within Australia’s tech industry has been hot, with the number of tech jobs rising three times faster than the rest of the economy , and the industry has now become a fundamental pillar of the Australian economy.

What was once a drop in the ocean has now become the third-largest contributor to Australia’s economy, adding AU$167 billion when you account for both the direct and indirect contributions to GDP.

The growth has been exponential as well, with the sector’s contribution to Australia’s GDP increasing 79% since 2016 , growing four times faster than any other industry.

While this growth has been phenomenal, there’s still plenty of opportunity for it to keep growing, as the direct impact of the tech sector on Australia’s economy is still relatively small.

If we only assess direct contribution, the tech sector accounts for 3.8% of Australian GDP, far lower than what we see in other developed economies like the US (10.2%), UK (8.1%), and Canada (6.8%).

There have been numerous tech success stories originating from Australia, and the hopes are that an education and business environment conducive to growing the technology sector encourages a transformation of Australia into a tech hub akin to Silicon Valley.

For a closer look at some of these success stories, here are some of the big names in tech that have started in Australia (and New Zealand!).

From the publicly traded:

- Atlassian

- Xero 🇳🇿

- Afterpay, which was acquired by Block

- WiseTech Global

- Computershare

- REA

To the privately listed ones you may have heard of:

- Canva

- Airwallex

- Stake

- VGW

💡 The Insight: Investing In Australia Is A Lesson In Global Politics and Economics

Australia’s unique economy comes with its own unique challenges. Its dependence on a heavily cyclical industry that interacts with a volatile trading partner means that there are distinct periods of boom and bust.

While the severity of this largely depends on the sector you’re investing in, it’s still incredibly useful to carry forward the same knowledge irrespective of if the industry is heavily correlated with exports, e.g. Mining, Agriculture, Education or if its focus is more domestic like the Financials, Health or Construction.

Here are some tips if you’re considering investing in Australia (or any country where there’s a heavy reliance on exporting to foreign partners!):

- 👀 Keep a close eye on geopolitical relations

- US relations with key Australian trade partners can have an unexpected domino effect, which could hurt or be a boon to the Australian economy. It’s important to be aware of any trade restrictions or agreements that could materially alter the demand for the goods and services Australia provides.

- 🚢 Understand who the key trade partners are

- An overwhelming majority of Australian exports make their way to Asia, but this seems to be changing over the last few years as more exports make their way to the Americas to try and reduce reliance on a single region. Be sure to remain aware of which countries have close ties with Australia and the factors that could impact the demand for Australian goods and services, be that political or economic.

- 🔍 Find patterns or correlations in the demand for goods and services

- Generally, a downturn in Chinese property development negatively impacts Australian iron ore exports. Likewise, tension and war in other regions have elevated the demand for Australia’s agricultural exports. There are often links like this that can be made that can help you understand when periods of boom or bust are likely.

- 🌏 Look for global opportunities

- Australia is typically considered less risky than global competitors in Africa & South America. Instability and uncertainty in those regions could see investors shift to Australia to meet shortfalls in supply due to its relatively more stable political environment.

- 🌅 Seek new horizons

- Australia’s economy is heavily focused on mining, education and financials, but don’t ignore opportunities that are arising in its blossoming tech landscape.

For those who are interested, here are some of the sectors that define Australia’s economy and some of the major players in those respective industries:

⛏️ Mining & Resources

🏦 Financials

🏥 Healthcare

🛒 Retail & Consumer Services

Key Events During the Next Week

Tuesday

- 🇨🇦 Canada’s inflation rate will be published, with economists expecting 2.8%, down from 2.9%.

Wednesday

-

🇯🇵 Japan’s balance of trade data will be published. The most recent surplus was ¥366.5B.

-

🇬🇧 UK inflation data is due to be released. The annual rate is currently 3.2%.

-

🇺🇸 The minutes from the last FOMC meeting will provide more detail on the committee’s stance on inflation and interest rates.

Friday

- 🇯🇵 Japan’s inflation rate (currently 2.7%) is due to be published.

- 🇬🇧 UK retail sales are forecast to be up 0.3% for the year to April, up from 0% in March.

- 🇺🇸 US durable good orders are expected to be just 0.3% higher month-on-month, down from 2.6% in March.

This week’s big event will no doubt be Nvidia’s earnings report on Wednesday. Elsewhere, earnings reports are due from retailers and cloud software providers, amongst others.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.