- South Africa

- /

- Specialty Stores

- /

- JSE:PPH

Would Shareholders Who Purchased Pepkor Holdings' (JSE:SRR) Stock Year Be Happy With The Share price Today?

While it may not be enough for some shareholders, we think it is good to see the Pepkor Holdings Limited (JSE:SRR) share price up 24% in a single quarter. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 26% in a year, falling short of the returns you could get by investing in an index fund.

See our latest analysis for Pepkor Holdings

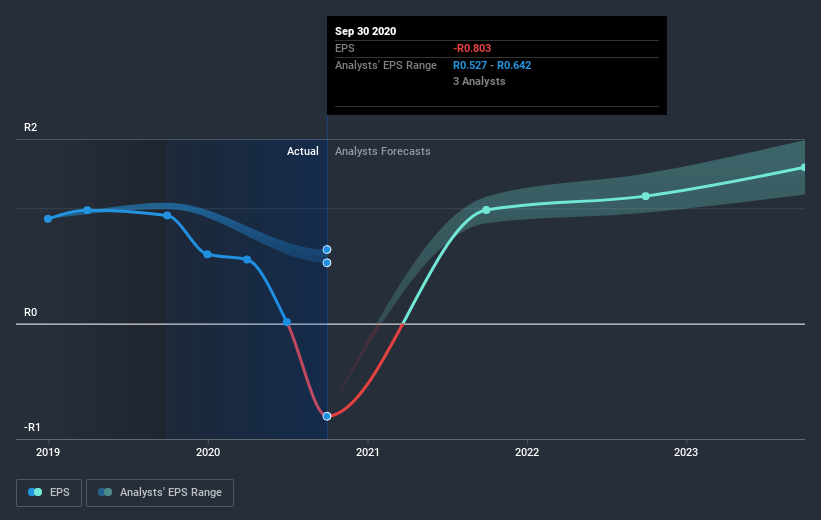

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Pepkor Holdings saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. We hope for shareholders' sake that the company becomes profitable again soon.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Pepkor Holdings' key metrics by checking this interactive graph of Pepkor Holdings's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Pepkor Holdings shares, which performed worse than the market, costing holders 25%. The market shed around 1.0%, no doubt weighing on the stock price. Shareholders have lost 4% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Pepkor Holdings you should be aware of.

Of course Pepkor Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ZA exchanges.

When trading Pepkor Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:PPH

Pepkor Holdings

Operates as a retailer focusing on discount, value, and specialized goods in Angola, Botswana, Brazil, Eewatini, Lesotho, Mozambique, Malawi, Namibia, South Africa, and Zambia.

Flawless balance sheet with reasonable growth potential.