- South Africa

- /

- Food and Staples Retail

- /

- JSE:BID

The Price Is Right For Bid Corporation Limited (JSE:BID)

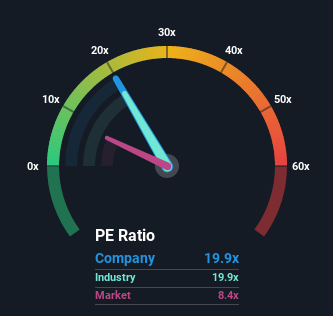

Bid Corporation Limited's (JSE:BID) price-to-earnings (or "P/E") ratio of 19.9x might make it look like a strong sell right now compared to the market in South Africa, where around half of the companies have P/E ratios below 8x and even P/E's below 5x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Bid has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Our analysis indicates that BID is potentially overvalued!

Is There Enough Growth For Bid?

In order to justify its P/E ratio, Bid would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 56% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 15% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 8.2% per year, which is noticeably less attractive.

In light of this, it's understandable that Bid's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Bid's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Bid's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Bid with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Bid, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bid might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:BID

Bid

Engages in the provision of foodservice solutions in Australasia, New Zealand, the United Kingdom, Europe, Africa, South America, Asia, the Middle East, and internationally.

Flawless balance sheet with proven track record.