- South Africa

- /

- Trade Distributors

- /

- JSE:MMP

Earnings Tell The Story For Marshall Monteagle PLC (JSE:MMP) As Its Stock Soars 27%

The Marshall Monteagle PLC (JSE:MMP) share price has done very well over the last month, posting an excellent gain of 27%. The last 30 days bring the annual gain to a very sharp 42%.

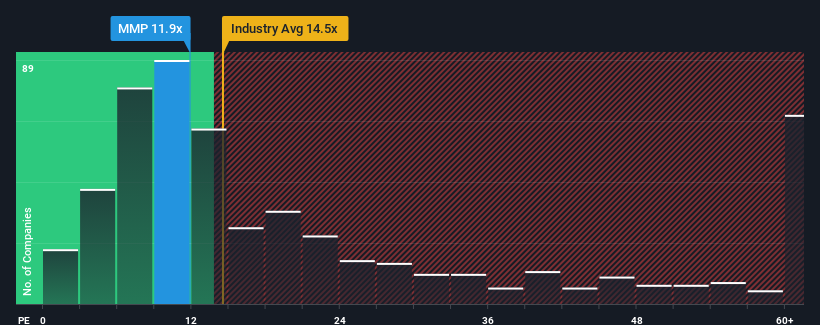

Even after such a large jump in price, it's still not a stretch to say that Marshall Monteagle's price-to-earnings (or "P/E") ratio of 11.9x right now seems quite "middle-of-the-road" compared to the market in South Africa, where the median P/E ratio is around 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Marshall Monteagle as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Marshall Monteagle

Is There Some Growth For Marshall Monteagle?

There's an inherent assumption that a company should be matching the market for P/E ratios like Marshall Monteagle's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 227%. The strong recent performance means it was also able to grow EPS by 75% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's about the same on an annualised basis.

With this information, we can see why Marshall Monteagle is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Its shares have lifted substantially and now Marshall Monteagle's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Marshall Monteagle maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Marshall Monteagle you should know about.

If these risks are making you reconsider your opinion on Marshall Monteagle, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:MMP

Marshall Monteagle

An investment holding company, engages in the import and distribution, and property holding businesses in the United Kingdom, South Africa, Europe, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives