- United States

- /

- Gas Utilities

- /

- NYSE:SPH

Suburban Propane Partners (SPH): Assessing Valuation as Investors Reconsider Growth and Risk

Reviewed by Simply Wall St

Suburban Propane Partners (SPH) has drawn renewed attention from investors, with shares showing a mix of gains and pullbacks over the past month. While recent movement highlights shifting sentiment, the company’s long-term track record remains a key consideration.

See our latest analysis for Suburban Propane Partners.

The latest share price moves from Suburban Propane Partners reflect investors reassessing both growth prospects and risk, with momentum building thanks to a resilient 3.5% year-to-date gain and an impressive 61% total return over five years. Short-term dips have not derailed the longer-term upward trend, highlighting continued confidence among shareholders.

If you are thinking about what else could offer strong returns, now is the time to broaden your search and see what is possible with fast growing stocks with high insider ownership

With solid historical returns and a share price now above analyst targets, the question for investors is clear: is Suburban Propane Partners trading below its true value, or has the market already accounted for all its growth potential?

Most Popular Narrative: 7.6% Overvalued

With Suburban Propane Partners trading at $18.29, above the widely followed fair value estimate of $17.00, market optimism may be stretching further than analyst consensus suggests. The current price reflects hopeful expectations for future transformation and earnings, yet the most influential narrative dives deeper into the business forces at play.

Growth strategies center on expanding renewable fuel capacity and leveraging regulatory incentives, positioning the company to benefit from cleaner energy trends and higher-margin opportunities. Market share and earnings stability are reinforced by targeted acquisitions, operational improvements, and enduring demand for core propane services in rural and off-grid areas.

Curious what’s fueling that extra premium over fair value? Bold operational upgrades, lucrative new markets, and regulatory tailwinds are just the start. Dive into the narrative to uncover the surprising quantitative leaps analysts are counting on, and what could flip this story on its head.

Result: Fair Value of $17.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it's worth noting that unpredictable weather-driven propane demand and ongoing cost inflation could challenge these optimistic growth projections for Suburban Propane Partners.

Find out about the key risks to this Suburban Propane Partners narrative.

Another View: Discounted Cash Flow Model Suggests Upside

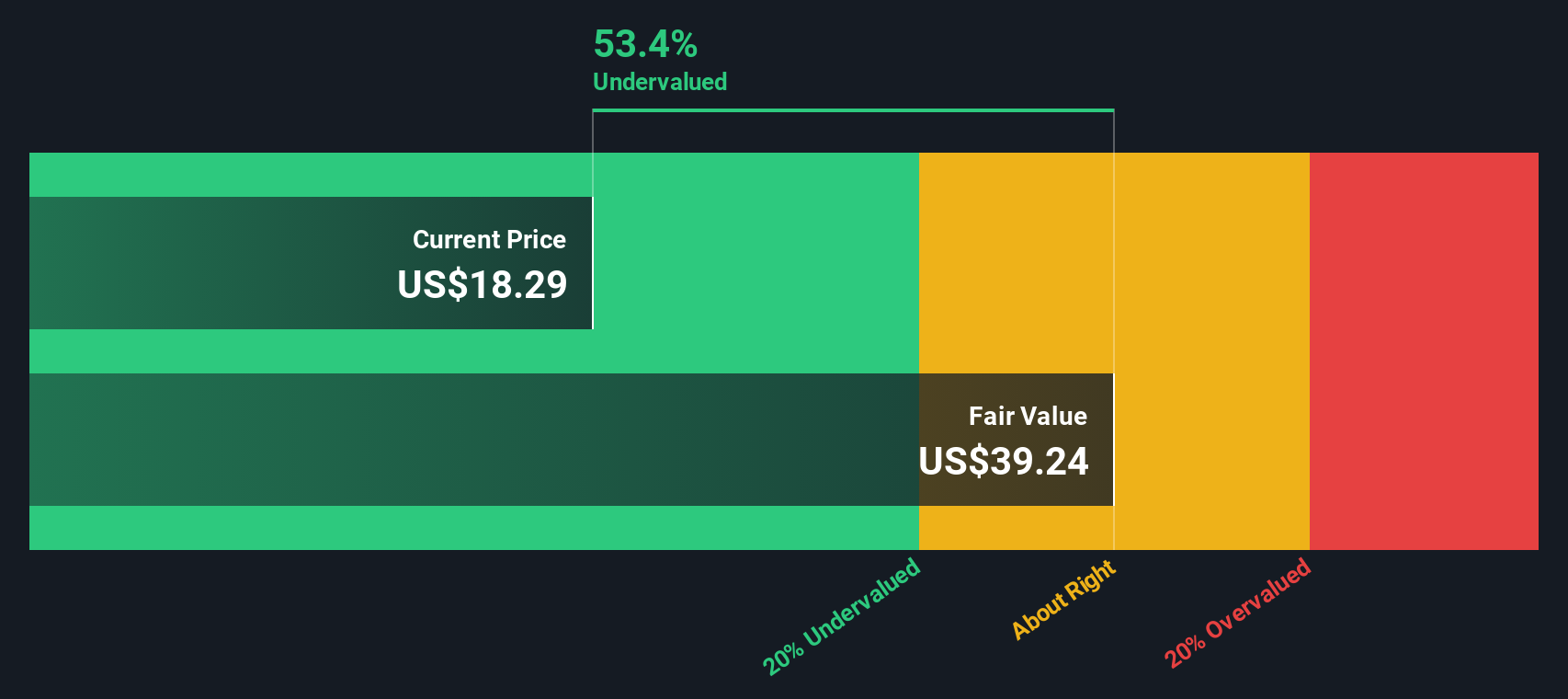

While analyst consensus based on market multiples hints at Suburban Propane Partners being overvalued, our DCF model arrives at a dramatically different conclusion. The calculation puts fair value at $39.24, which suggests shares could be trading at over 50% below their intrinsic value. Can this much upside really be justified, or is it just a disconnect between methodology and the real outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Suburban Propane Partners Narrative

If you want a fresh angle or believe your perspective could reveal something new, it only takes a few minutes to build your own view of Suburban Propane Partners. Do it your way

A great starting point for your Suburban Propane Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by seeking out unique opportunities before the crowd catches on. Give yourself an edge by using these screeners that can help you spot tomorrow’s winners today.

- Uncover high yields and consistent income by checking out these 16 dividend stocks with yields > 3%, offering attractive returns above 3%.

- Accelerate your growth strategy with these 24 AI penny stocks, fueling advancements in automation, machine learning, and next-generation software solutions.

- Capitalize on disruptive tech trends by targeting these 82 cryptocurrency and blockchain stocks, pushing boundaries in digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPH

Suburban Propane Partners

Through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, fuel oil, and refined fuels in the United States.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives