- United States

- /

- Electric Utilities

- /

- NYSE:POR

How Higher Quarterly Earnings and Sales at Portland General Electric (POR) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Portland General Electric announced its third quarter and nine-month 2025 financial results, reporting third quarter revenue of US$952 million and net income of US$103 million, both higher than the same period last year, with nine-month net income slightly below the prior year.

- The company delivered improved quarterly earnings per share despite modest year-to-date income softness, highlighting quarterly operational gains amid longer-term growth pressures.

- We’ll now consider how the company’s higher quarterly sales and net income might influence its investment outlook and long-term prospects.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Portland General Electric Investment Narrative Recap

To be comfortable holding Portland General Electric stock, investors typically need to believe in the utility's ability to generate steady revenue from the core Oregon market, adapt to evolving electrification trends, and maintain constructive regulatory relationships. The recent rise in quarterly revenue and net income is encouraging, but it does not materially alter the biggest near-term catalyst, robust demand growth from industrial and data center customers, or the ongoing risk that distributed energy resources could gradually erode centralized grid reliance and long-term revenue growth.

Among recent announcements, the August completion of three large-scale battery storage systems stands out. This operational milestone supports PGE’s key growth catalyst by enabling the company to serve rising demand more reliably and aligns with regulatory and customer expectations for cleaner, more flexible energy solutions, which could play a growing role amid incremental near-term gains in revenue.

By contrast, investors should also be mindful of regulatory and clean energy cost pressures, as...

Read the full narrative on Portland General Electric (it's free!)

Portland General Electric’s outlook anticipates $4.0 billion in revenue and $479.0 million in earnings by 2028. This is based on a 4.7% annual revenue growth rate and a $185 million earnings increase from current earnings of $294.0 million.

Uncover how Portland General Electric's forecasts yield a $47.83 fair value, in line with its current price.

Exploring Other Perspectives

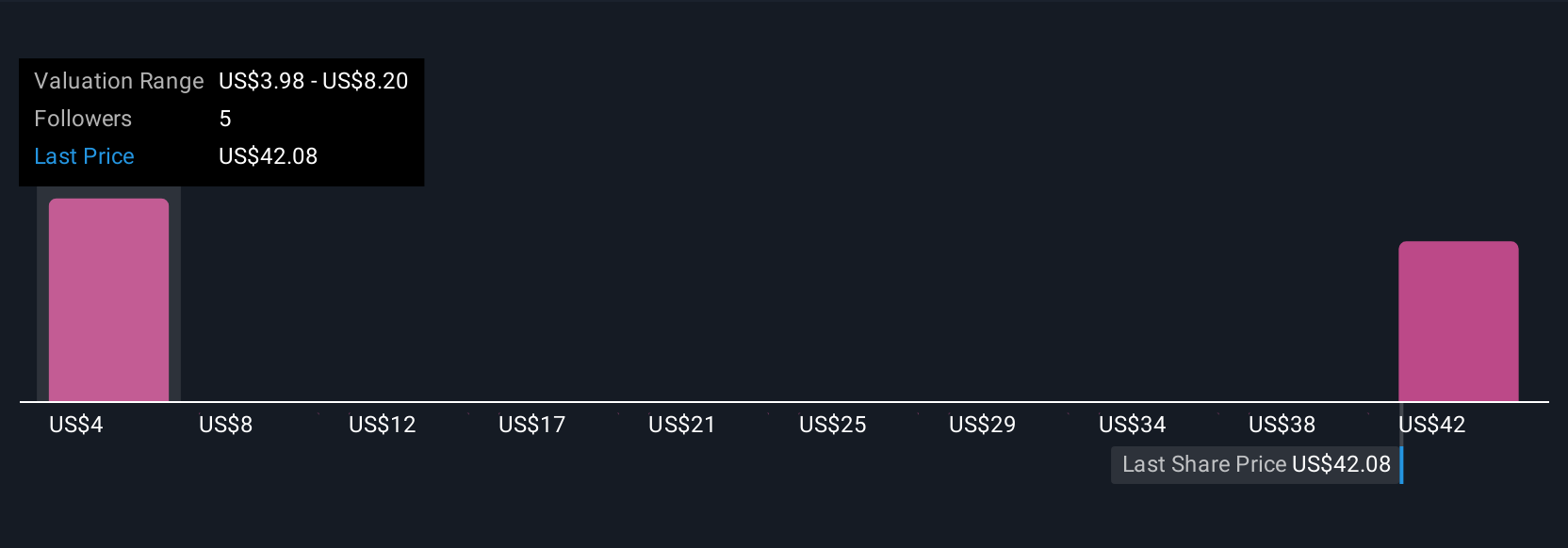

Simply Wall St Community members’ fair value estimates for PGE stock span from US$3.88 to US$54.07 across 3 views. These widely different outlooks arrive as utilities face ongoing challenges from distributed energy resources, meaning your assessment of long-term revenue risk could differ meaningfully from the consensus.

Explore 3 other fair value estimates on Portland General Electric - why the stock might be worth as much as 11% more than the current price!

Build Your Own Portland General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Portland General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Portland General Electric's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives